KiwiSaver News - National Capital in the news

Want to learn more about us?

Access our range of articles for further insights on our achievements.

We also keep you up to date with general KiwiSaver news and the best performing KiwiSaver funds.

National Capital is the first online financial advice service to give people personalised advice on which KiwiSaver provider and fund they should be in.

It is one of only four companies in New Zealand so far to receive a digital financial advice exemption from the Financial Markets Authority which has been issuing the exemptions since February 2018.

National Capital will use computer algorithms to decide what type of fund a person should be in based on information they give about assets and liabilities like their mortgage or other loans, tolerance for risk and volatility and select the best provider for them.

National Capital, the trailblazing financial advisory firm specialising in KiwiSaver and investment advice, proudly clinched the prestigious “Mover and Shaker 2023” title at the Booster KiwiSaver Awards 2023 in Wellington, New Zealand, on November 3.

This recognition is a testament to National Capital’s dedication towards empowering Kiwis to achieve a financially secure retirement and their significant contributions to the KiwiSaver industry.

National Capital’s commitment to providing free personalised KiwiSaver advice has been pivotal in its mission to empower one million Kiwis to secure their financial futures.

National Capital, a leading KiwiSaver advice company, has been named a finalist in the NZ Hi-Tech Awards 2023. The company is the only financial services company in its category, competing with some of the top high-tech companies in New Zealand.

The NZ Hi-Tech Awards is one of the most prestigious competitions in the tech industry, recognising the outstanding achievements of New Zealand’s high-tech companies and individuals. This achievement recognises National Capital’s commitment to innovation, excellence, and the use of technology to enhance customer satisfaction.

November 20, 2023

Retirement can feel so far away that it’s easy to ignore – you tell yourself you’ll get around to it soon.

Then there’s a panic on at the finish line when you realise you’ve run out of time to make the easy changes that could have saved you tens of thousands of dollars.

The good news is that it can be quite easy to make a few tweaks to your KiwiSaver, then sit back and reap the rewards.

National Capital’s latest research reveals that neglecting KiwiSaver could result in a loss of $88,000.

November 20, 2023

A new report has revealed the staggering amount of money Kiwis could be missing out on at retirement by making a simple KiwiSaver mistake.

The mistake could be so costly, people could be missing out on the equivalent of a Mercedes Benz.

National Capital, a KiwiSaver advisory firm and watchdog published a report on Monday covering the third quarter of this year.

December 12, 2023

New Zealand is witnessing a notable increase in KiwiSaver fund withdrawals, with October 2023 experiencing a doubling compared to the same month in 2022, reaching $21.5 million.

Financial advisor Clive Fernandes notes that the surge, now exceeding a thousand monthly applications, raises concerns, particularly as it is driven not only by employment changes but also by financial strains induced by factors such as rising interest rates.

In this article, Clive Fernandes outlines the essential factors individuals should consider when thinking about early KiwiSaver withdrawals

November 20, 2023

Kiwisaver advisors are urging New Zealanders to care about where they put their retirement funds.

National Capital’s latest Value for Money report finds the difference between top and bottom-performing funds can be as much as 2.55 percent, or $88,000 by the time of retirement.

Director and KiwiSaver advisor Clive Fernandes says it’s import for Kiwis to consider several key factors before they determine where their retirement funds go.

“You’ve got to take into consideration past performance- but also look at things like fees, capability, the stability of these companies, the processes they undertake to make a decision.”

May 28, 2023

Clive Fernandes, Founder & Director of National Capital joined the show to chat about KiwiSaver and ask the listeners what their intentions are with the account: First Home, Retirement, or Hardship?

May 21, 2023

We hear about the amount of money we’ll need in retirement and for many people it seems like a long way from reality.

The KiwiSaver advisory firm National Capital has released its first KiwiSaver Value for Money Report. Managing director Clive Fernandes joins us.

May 16, 2023

Financial advisers National Capital say management disruption in the past six months means financial advisers need to remain alert in the coming quarters.

National Capital rated KiwiSaver funds against six pillars; performance after fees, assessment of the value provided for fees, fund management capability, provider stability, portfolio composition and processes, and ethical investing.

Fernandes says on management capability if there is a broad amount of personnel change for a provider plays a role in the amount of points National Capital allocates for its stability pillar. “A provider with a lot of movement will have a slight negative impact on the overall rating.”

May 15, 2023

KiwiSaver advisory firm National Capital launched its first KiwiSaver Value for Money Report, which indicated people needed to save more and put more of their money into growth assets. National Capital managing director Clive Fernandes said the average contribution rate of 4.3 percent of a salary, compared with an optimum rate of 6.3 percent.

The company said about 69 percent of KiwiSaver funds should be invested in growth assets, compared with the current average of 56 percent across all savers.

“The difference in an expected return for a conservative fund and a growth fund is a few percentage points,” Fernandes said. “Now while this might not seem a lot, compounded over the lifetime of your typical KiwiSaver, who is about 40 years old, that’s another 25 years of investing to go, and can result in tens of thousands of dollars.”

May 15, 2023

The average worker contributing money from their salaries into KiwiSaver needs to save another 2% of their gross salary in order to achieve a comfortable retirement, a new report says.

The report from KiwiSaver advice business National Capital also says the average KiwiSaver needs to substantially increase the amount they have invested in shares.

“They [KiwiSavers] are not giving it enough thought. There’s a lot of DIY going on. This is our retirement investment. This is our retirement we are talking about,” he said. “Kiwis are not investing their KiwiSaver money in the best way that suits their life stage,” Fernandes said.

Over the investing lifetimes of the current crop of KiwiSavers, this would result in billions of potential investment returns lost.

June 23, 2023

Digital financial adviser National Capital has hit $100 million in KiwiSaver funds under advice.

National Capital founder Clive Fernandes says with the KiwiSaver total approaching the $100 billion mark, a huge proportion of New Zealanders are still not getting any advice on their KiwiSaver accounts.

Fernandes says National Capital now has close to 2000 clients, with an average account balance of $50,000. Over the past two years there has been growth in six figure balances and, in the demographic approaching retirement age, $1 million accounts.

“There is no way one company can advise on all of this. We should be working together to build a knowledge base and offerings to do a better job.”

Sound investment accrues healthy post-retirement benefits

February 26, 2022

Modern Kiwis are facing the risk of not having enough to live the lifestyle they want in retirement. A large number of people have told the Commission For Financial Capability (CFFC) researchers that the New Zealand Super will not be sufficient for their livelihood after retirement.

In this article, Clive Fernandes, director of National Capital, explores ways to set up a comfortable retirement free from financial stress or anxiety.

“I recommend a financial plan and investing in KiwiSaver and other sources that can provide them with the additional income needed for a comfortable retirement lifestyle.”

August 22, 2022

Auckland-based KiwiSaver advisory firm National Capital has won a FinTech award, named “Most Innovative Financial Advisory Firm 2022 – New Zealand” by Wealth and Finance magazine.

The FinTech awards were launched six years ago by Wealth and Finance magazine to recognise firms that are working to redefine finance and banking for the modern age and the ever-changing modern consumer.

With multiple components required to succeed in finances, people can often be left unsure of their next move. National Capital aims to constantly innovate how they offer their services, improving their KiwiSaver comparisons or helping Kiwis refine their knowledge on all things relating to different KiwiSaver funds.

Me and My Money: Clive Fernandes, National Capital Director

While Auckland remains in alert level 4 lockdown until at least September 13 (the rest of New Zealand in alert level 3, Northland from Thursday night), Fernandes reminds KiwiSaver members not to panic-switch.

The alert level changes are affecting many Kiwis’ incomes, but others are earning the same and spending a lot less. Other than saving for a rainy day, a post-lockdown splurge or future travel, Fernandes suggests they could think of their ‘future selves’ and put a little extra into KiwiSaver.

Once an impatient investor, Fernandes says his biggest financial mistake was looking at how to invest a specific dollar amount, rather than his long-term goals.

October 1, 2021

It’s hard to escape the news that house prices are rising and buying a first home in NZ is increasingly difficult.

National Capital’s mission is to help a million Kiwis become financially secure by offering unbiased KiwiSaver advice, which includes helping them along their first home buying journey, an increasingly challenging one.

It’s important KiwiSaver members are in the right fund when looking to buy their first home, as many found during the stock market fall at the beginning of the pandemic. KiwiSaver funds should match member’s goals and risk tolerance, and provide certainty for those looking to purchase a home in the near future.

KiwiSaver advisor calls for auto-increase option after study shows just over one third of Kiwis would choose it

November 9, 2021

If KiwiSaver members were given the option to have their contributions increase automatically over time, it would help them save more money, a KiwiSaver advice provider says.

Clive Fernandes, head of KiwiSaver advice service National Capital, said given the growing retirement savings gap, and survey results showing an auto-increase option would be supported, he’s proposing it be considered by the Government.

“Any scheme that increases savings among younger Kiwis can only positively contribute to their retirement,” Fernandes added.

November 9, 2021

It has been an excellent year for KiwiSaver investors. Over the past 12 months, many KiwiSaver funds have demonstrated substantial annual returns exceeding their long-term averages.

As of October 15, 2021, there were 27 KiwiSaver providers, with about $81.6 billion of New Zealanders’ money invested. Within these, 27 KiwiSaver providers are 305 different funds, with a wide range of investment options to choose from.

We have had a look at the returns of a bank KiwiSaver provider, ANZ, as well as Milford, a New Zealand-owned company provider to analyse how they have performed.

New climate-focused KiwiSaver scheme allows Kiwis to invest money where it makes a difference

A new KiwiSaver scheme aims to give Kiwis the option to avoid environmentally risky investments and instead put their money into areas where it can make a difference.

Clive Fernandes, director of KiwiSaver advice provider National Capital, told Newshub PathFinder is an example of a KiwiSaver provider proven to have used ethical investment principles over time.

“Our research into them shows that they have put their money where their mouth is, and that has been validated recently when they were awarded the Best Ethical KiwiSaver Provider and Best New Ethical Fund at the Mindful Money Ethical and Impact Investment awards,” Fernandes said.

More people turning to KiwiSaver for hardship - and to buy first home

Financial pressures, including lockdowns and job losses have led to a 43 percent rise in KiwiSaver members withdrawing funds for financial hardship. And an 18.8 percent rise in first-home withdrawals shows more Kiwis are turning to KiwiSaver to help them save for a first home.

Although value can be subjective, checking value for money is important. Clive Fernandes, director of KiwiSaver advice provider National Capital, said “members paying higher fees for actively managed funds should make sure that’s what they’re getting.”

Fernandes also said, “research has shown that individuals who received KiwiSaver financial advice earned an average of 4 percent higher returns.”

Members could look at their KiwiSaver provider’s net returns after fees, and compare it to competitors.

Strong support for compulsory KiwiSaver, increase to contribution rates - research

Current Financial Services Council data shows there are around three million KiwiSaver members, with $82.2 billion invested in KiwiSaver funds. But National Capital founder Clive Fernandes said collectively, there needs to be somewhere between 4.5 and 8 times that amount.

Telling people they have to save more might not be enough, he said. Most people who are savers are already doing so.

“We’ve got a looming retirement issue, so a compulsory KiwiSaver will most likely happen,” Fernandes said.

Once people are in the habit of saving, see it grow, and get “into the headspace” where they enjoy putting money aside, contributions can be increased at a comfortable pace, he said.

He also suggests people get advice to set a goal for how much they need to save for retirement – and create a path to reach it.

23 February, 2021

“Applying early is recommended – it can take up to 10 working days to process an application for most providers – some may take up to 15 working days.”

In this article, Clive Fernandes, director of National Capital, answers some questions on KiwiSaver’s first home application process and expected delays that goes with it.

“Before doing anything else, a first-home buyer will need to confirm their eligibility with their provider, then request a withdrawal form.”

“As part of the application, members are asked to provide a statutory declaration proving they intend to live in the home for at least six months..”

9 January, 2021

“2021 only comes around once. But the benefits from being financially secure last for a lifetime.”

In this post, Clive Fernandes, director of National Capital, urges people to make 2021 their year of financial peace of mind. He points out the benefits of being financially secure and goes over what can happen to those that do not have financial peace of mind.

“In early 2020 (before the pandemic), a Finder Survey found that one in three New Zealanders were living paycheque to paycheque. And according to this research, 15% of Kiwis could live off their savings for less than a week.”

“Many Kiwis experienced financial hardship during the Covid-19 lockdowns, exposing their already fragile financial situation. As a result, many of us should take this pandemic as a reminder that we must prepare for the next unexpected event.”

9 November, 2020

KiwiSaver fees might appear low at first but can add up over time, especially on longer-term investments such as KiwiSaver.

InvestNow offers investment into at least 140 managed funds from over 20 fund managers. With their no-advice direct investment model, they are offering no administration fees or transaction fees for members.

There are many benefits to this, including having more control, choice, and flexibility over our KiwiSaver investments, but ‘Do It Yourself’ (DIY) investing also comes with its disadvantages or risks. While DIY helps reduce fees, making wrong decisions there could result in much lower KiwiSaver balances.

Using InvestNow DIY KiwiSaver scheme means that savers need to make some complex investment decisions on both asset allocation and from which managers can choose. This is something that is done by professionals for them in other KiwiSaver schemes.

9 October, 2020

Many Indians wonder if we should be investing our savings in New Zealand in a vehicle such as KiwiSaver or sending it back to India.

Money in your bank account in India could earn much higher interest than the money sitting in your bank account in New Zealand, at least right now.

With a salary of $70,000, your employer could contribute $2100 (before tax) to your KiwiSaver account every year. On top of this, there is a government contribution to boost your savings, where the government will add 50 cents for every dollar you invest in KiwiSaver up to $521.43 per year.

Consider your long-term plans, such as the age you are planning to retire and how much you want to save. An important consideration will be whether you plan on living in New Zealand after your retirement or would you be moving back to India?

A bit of time and resources spent to ensure you are investing in the correct way now, will bring rich dividends to you in the future.

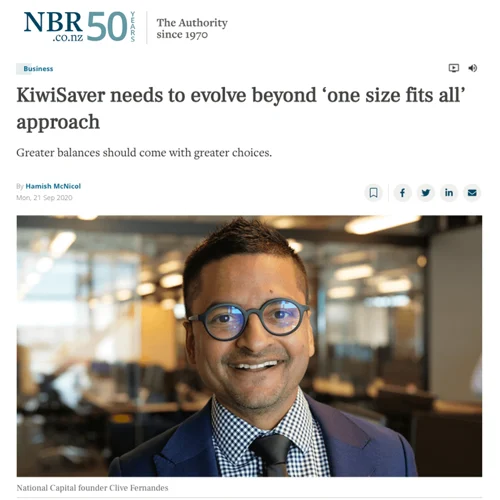

21 September, 2020

There’s a rule of thumb that when somebody’s savings get to around the price of a new car, they both begin to take notice of it and care about where it is being invested. And so it goes for KiwiSaver.

Online managed funds platform InvestNow would next month launch a build-your-own KiwiSaver scheme where customers could choose form 28 funds. The service would not be adviser-led, however.

National Capital was the country’s first online financial advice service which provided personalised advice on KiwiSaver investments, founded in 2018. It has since advised on $100 million of KiwiSaver savings.

“There are over three million KiwiSavers and about 1800 AFAs, the majority of who won’t work with someone with less than $1m” Fernandes said. “Technology allows for personalised advice where previously it was too expensive”.

1 September, 2020

Experts are urging Kiwis to exhaust all other avenues before dipping into their KiwiSaver funds to deal with financial hardship brought on by Covid.

The advice comes as the number of financial hardship withdrawal applications, and the amounts being withdrawn, begin to rise as Kiwis feel the effects of the pandemic.

The advice for Kiwis to try and leave their KiwiSaver alone comes in the wake of a controversial election policy proposal from the National Party, which encouraged those with an idea for a new business to dip into their KiwiSaver to help fund their start-up.

National Capital founder and director Clive Fernandes said taking KiwiSaver funds to start a small business during an economic recession was a “terrible idea”.

“We already have a problem, that even with KiwiSaver, a large proportion of Kiwis will not have enough money to retire on. Encouraging them to withdraw even more from their KiwiSaver accounts will only exacerbate the problem,” Fernandes said.

The Financial Markets Authority just-published it’s ‘value for money’ report which showed there wasn’t a correlation between investment style and fees.

Since there has been much talk about value for KiwiSaver, there has been a slow upward trend in fees.

However, the single-minded focus on fees could dumb-down KiwiSaver, according to Clive Fernandes, founder of robo-advice firm National Capital.

However, the single-minded focus on fees could dumb-down KiwiSaver, according to Clive Fernandes, founder of robo-advice firm National Capital.

“There’s a much bigger problem in KiwiSaver than whether members are in active or passive funds,” Fernandes said. “Just having advice to move from a conservative to a balanced fund, for example, could lead to much better outcomes for members than whether they paid a few basis points more or less in fees.”

An Auckland based financial advisory firm is offering free advice on KiwiSaver, especially to lower income groups and people who are largely unaware of its benefits and use.

National Capital, established in 2018, uses computer algorithms to determine the type of KiwiSaver Fund that would be the best suitable to people depending on their specific circumstances.

An IT professional with experience in development websites, Mr Fernandes moved to New Zealand in 2010 and wanted appropriate financial advice to launch his career here.

“I tried to get financial advice and there was a big difference between the advice for the wealthy and for the rest of us. I was motivated to establish National Capital to fill the gap,” he said.

Fees charged by KiwiSaver providers may not reflect how actively they manage their investment funds, a new study has found.

Across 26 public KiwiSaver providers, two-thirds said they were “mainly active”. But the results showed varying degrees of how active they were.

“Based solely on activeness and fees charged, there are a small number of providers that appear to be poor value for money relative to other providers,” says FMA director of regulation Liam Mason.

Clive Fernandes, director of KiwiSaver advice provider National Capital, said the focus should be on advice, not fees. As the impact of COVID-19 was unpredictable, even the most active fund managers couldn’t have picked the extent of the market drop.

“Clients with access to advice ended up making better decisions and should have better retirement outcomes than those who did not,” Fernandes said.

24 August, 2020

The Government is working through the process of appointing default providers for the next term.

Being a default scheme is understood to give providers a reputational boost, but it comes with increased scrutiny and regulatory restrictions, particularly on the fees that can be charged.

Clive Fernandes, an AFA who specialises in digital advice, says the review of default provider settings ahead of the appointment process had focused on the wrong thing.

“Now that most Kiwis are already signed up to KiwiSaver and new signup numbers each year are lower, the ‘default scheme’ idea is no longer required.

“Instead, people should be given access to personalised advice right as they are signing up. We should be encouraging new entrants to make an active choice to best set them up for their future and specific goals. This would help to solve a lot of issues and would be in the best interests of members vs providers,” he said.

21 August, 2020

At the time of signing up for KiwiSaver, Kiwis are placed into one of nine low-risk default funds. Auto-enrolling members into default funds was a good idea when the goal was to onboard millions into KiwiSaver quickly, but it’s not needed anymore.

National Capital director Clive Fernandes said default fund providers were not making the effort to educate customers after they had been automatically placed in a fund.

“The best way to fix the problem is to make sure people don’t go into default funds in the first place. Give them advice at the time they are signing up … at the time when they are most likely to be engaged with their KiwiSaver.”

Fernandes said generally new sign ups would be younger people getting their first job, who would be happy with free digital advice.

Listen to the interview on Radio NZ

20 August, 2020

MBIE and the Treasury are reviewing default provider settings as approximately 715,000 New Zealanders remain in default KiwiSaver funds.

Clive Fernandes says the approach being to review the default scheme isn’t the right area of focus.

“The KiwiSaver default scheme concept was required when three million Kiwis needed to be onboarded as KiwiSaver members in a short period of time,”

“However the situation has now changed significantly. Now that most Kiwis are already signed up to KiwiSaver and new signup numbers each year are lower, the ‘default scheme’ idea is no longer required.”

“Instead, people should be given access to personalised advice right as they are signing up. We should be encouraging new entrants to make an active choice to best set them up for their future and specific goals. This would help to solve a lot of issues and would be in the best interests of members vs providers”.

14 August, 2020

National Capital was the first financial advisory firm in New Zealand to be awarded a digital advice exemption (robo advice license) by the Financial Markets Authority; allowing National Capital to create a hybrid system where computers assist the authorised financial advisers to create and implement recommendations for the best result.

“By merging the best of human Authorised Financial Advisers, but maximising the benefits and automation in key areas by using smart technology and AI, we are able to offer more Kiwis personalised advice at no cost to them,” said Clive.

“At National Capital we believe technology is the key to democratise financial advice, however we understand there is no substitute for human perspective, especially when making key financial decisions.”

“Being able to have the unbiased power of technology combined with the human-to-human interaction means we are able to provide our clients with the utmost service.”

29 July, 2020

On Wednesday, the National Party announced a new policy that would allow people who lost their job after March 1 to use $20,000 of their KiwiSaver savings to start a new business.

KiwiSaver advice provider National Capital called the idea of using KiwiSaver “terrible.”

“The primary reason for small businesses failing is undercapitalisation. And here we have a policy which is encouraging someone who is unemployed to start a business using $20,000 from their retirement savings. It’s a recipe for disaster,” director Clive Fernandes said.

KiwiSaver was intended as a retirement savings scheme and there was already an issue of people not have enough money to live on when they got there.

“Encouraging them to withdraw even more from their KiwiSaver accounts will only exacerbate the problem,” Fernandes added.

Listen to the interview on NewsTalk

29 July, 2020

New Zealand’s KiwiSaver sector has panned a proposal from National to allow unemployed people to tap into their accounts to start a business.

The scheme would give people a $1,000 voucher to get advice from a chartered accountant or “registered financial adviser” to talk about their ideas, put together a viable business plan and set up on a system such as Xero.

At that point they would then be eligible to withdraw up to $20,000 from their KiwiSaver account to get the business off the ground.

Adviser Clive Fernandes said it was a terrible idea – he said $20,000 would not be sufficient to get a business off the ground and most people would end up worse off than they started. “It’s a recipe for failure.”

“I support the concept of encouraging people to start a business but I don’t think this is the way to go about it.”

22 July, 2020

Withdrawing KiwiSaver funds on the basis of financial hardship compromises retirement and should only be considered as a last resort, a financial expert says.

COVID-19 has put an increasing number of Kiwis under financial strain. In May 2020, 1690 members withdrew savings totalling $13 million. As COVID-19 has caused share prices to fall and KiwiSaver balances to drop, withdrawing funds locks in those losses.

“For example, if a 50-year-old woman earning $60,000 a year were to withdraw $20,000 from her KiwiSaver [account], at 65 her total balance would be 25 percent less than if she had not touched it at all,” director Clive Fernandes said.

“While retirement may feel like a lifetime away, it requires its own savings strategy and KiwiSaver is the best opportunity to ensure you can retire comfortably,” Fernandes added.

17 July, 2020

A survey by National Capital indicates that two thirds of respondents aged between 45 and 54 thought they’d be in a better financial position than they are currently, while almost half were worried about the future.

However, only 20% of those surveyed see retirement saving as a priority and fewer than 1 in 7 are getting financial advice.

“We are going to reach a stage in which there are going to be a bunch of people retiring who just cannot afford to. The later these Kiwis leave sorting out their KiwiSaver, the worse it’s going to be. As with any investment, the sooner you make the right steps to put that investment in place, because of compounding interest etc, the larger the difference is going to be” says Clive.

15 July, 2020

Research by National Capital has revealed that three out of four (71%) Kiwis are unsure how much money they will need to retire when the time comes.

The survey of more than 1,000 respondents (aged 18 – 65+) was designed to uncover attitudes and behaviours towards KiwiSaver, retirement planning, personal goals and financial security after discovering only 1 in 3 New Zealanders felt financially secure.

“KiwiSaver could and should be playing a more significant role in helping people retire with more, yet the research shows it is not being maximised,” said Clive.

Further highlighting the issue, over 37% of respondents said planning for retirement is not a priority because they are simply “too busy dealing with the now, to worry about (my) retirement”, with Clive explaining that greater priority needs to be given to retirement, so it becomes a more equal split.

10 July, 2020

According to National Capital’s survey of 1000 New Zealanders, more Kiwi’s are worried about losing weight than having enough money for retirement.

The survey showed that 67 per cent of Kiwi women aged 18 to 65 said weight loss was their top goal for the next six months. Only 28 per cent of them had planning for retirement as a priority.

And 57 per cent of men surveyed said weight loss was also their main goal, with only 19 per cent having retirement planning at the top of their to-do list.

National Capital founder Clive Fernandes said it was concerning that Kiwis were unprepared for retirement, when evidence shows that they aspire to achieve a better standard of living in retirement than can be supported by superannuation.

23 June, 2020

National Capital, a financial advice firm providing digital KiwiSaver advice, has announced the appointment of James McKelvie as head of advice logic.

McKelvie will play a crucial role in the design and delivery of personalised KiwiSaver advice to Kiwis. His role will focus on developing the financial strategy underlying the KiwiSaver advice provided, refining and improving the advice logic to ensure better retirement outcomes.

McKelvie said, “National Capital has identified a way to bridge the advice gap between New Zealanders and their KiwiSaver accounts. I look forward to working with Clive and the team to develop advice logic that can be digitised to deliver personalised advice on a large scale.

22 May, 2020

When Covid-19 hit, fuelled by declining KiwiSaver balances, misinformation and a lack of advice, an estimated 50,000 Kiwis panicked and moved KiwiSaver funds, with most moving into a more conservative fund under the guise that they would be minimising further losses. The longer these members stay out of Growth/Balanced funds, the bigger the potential loss.”

“These figures show those KiwiSaver members who had greater access to advice were less inclined to switch, suggesting the value of advice – quite literally – particularly in a time of uncertainty,” Clive said.

“We need to ensure that Kiwis end up better off in the long run. Just aiming to have the lowest fees to attract new clients is not in the long term interest of KiwiSaver members. The Industry, FMA and the Government need to take the ‘value of advice’ into consideration; and not just have a myopic focus on fees,” Clive said.

22 May, 2020

Financial adviser Clive Fernandes crunched data from quarterly KiwiSaver fund updates, and found panic-switching, and withdrawals, by around 50,000 savers was most intense at banks’ KiwiSaver schemes, and less pronounced at KiwiSaver providers like Milford whose savers were more likely to have had financial advice.

Fernandes estimated the panic-selling could cost those who succumbed to it a collective $3.5b in lost retirement savings, after markets staged a recovery.

Fernandes, who owned the National Capital online KiwiSaver advice business, said about 50,000 people with money in KiwiSaver growth and balanced funds switched into cash and conservative funds in March prompted by drops in global sharemarkets prompted by the spreading economic impact of Covid-19.

24 April, 2020

National Capital, a financial advice firm providing digital KiwiSaver advice, has announced the appointment of David Anamosa as investment research lead.

Clive Fernandes, authorised financial adviser and director of National Capital, said: “In this role David will be instrumental in helping National Capital refine our advice model which uses principles of behavioural finance and good investment research to empower New Zealanders to get better outcomes from their KiwiSaver investments.

“David’s expertise will allow us to bolster the support National Capital can provide its clients and help people do the most with their money throughout their lives. Already we cover more than 100 KiwiSaver funds in our research and with David’s help, this will only increase, allowing National Capital to cover as many funds and providers as possible.

August, 2019

Most New Zealanders are not saving enough to have a comfortable retirement.

Behavioural economists from Victoria University, with the support of a group of financial advisers have published a report as part of a submission to the Retirement Commissioner’s 2019 Review of Retirement Income Policies, encouraging the government to implement changes to make it easier to implement this plan here.

Clive Fernandes, one of the four financial advisers pushing for changes, says, “Simply telling Kiwis they need to save more is not enough. The government needs to encourage behavioural nudges which have shown to help people save more, almost unconsciously.

10 February, 2019

National Capital earned the right to offer robo-advice services via an exemption issued at the end of January, 2019.

In a just-published note, the regulator says: “The FMA is satisfied that National Capital has the capability and competency to provide personalised services to retail clients through a digital advice facility, and that its directors and senior managers are of good character.”

On his LinkedIn page, Fernandes says the National Capital robo-advice system would help clients find “which KiwiSaver fund works best for them to achieve their goals, based on their situation”.

“With the focus on an ‘accountable algorithm’ and good client outcomes, this service will not only help Kiwis get the advice they need but do that in an ethical manner,” the posting says.