You may be curious to know the types of questions we ask while pondering over whether to begin our KiwiSaver HealthCheck or not. To be more transparent, and to take away some concerns you may have, we would like to give you a rundown of the details we ask you and why we ask them.

By completing the form, we aim to make you feel confident in your investment, to maximise your KiwiSaver and have it be one less thing to worry about. We have inserted snippets of the questions to show you how easy it is!

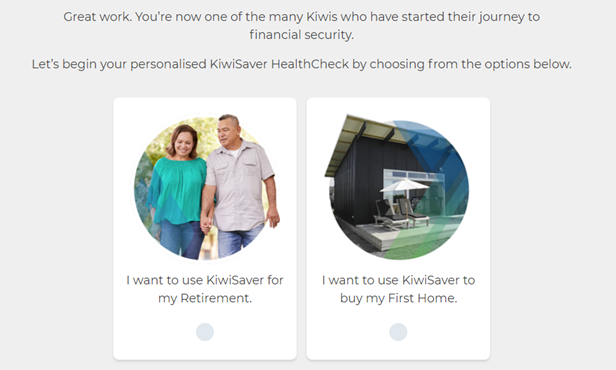

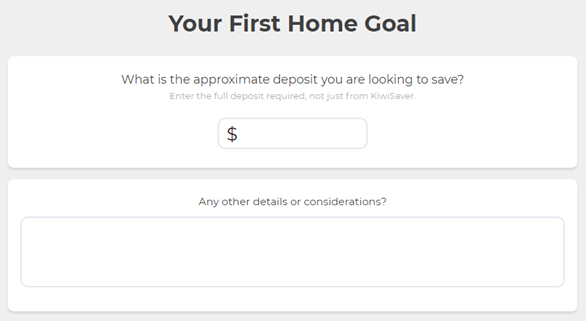

What are your KiwiSaver goals?

Firstly and most importantly, we like to find out what your goal is, be it how much you plan on spending in retirement or saving for a first home deposit. It’s helpful for us, and also you, to have a rough idea of what exactly you are intending to do with your KiwiSaver account. The amount is also seen as a target and will determine the rate of return you might need in order to get there.

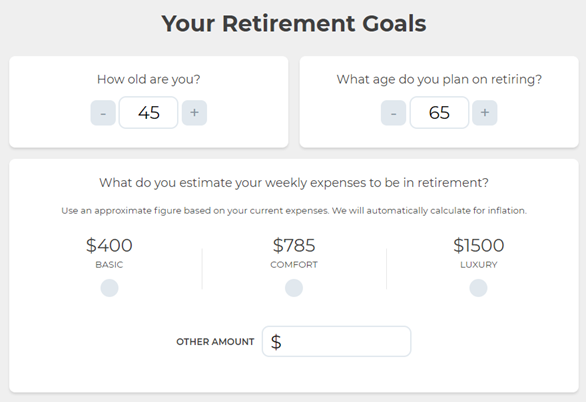

How long until you plan on withdrawing?

Additionally, we ask the dreaded ‘how old are you?’ question and, for a retirement goal, at what age you’re looking to retire. This gives us an idea of how long your investment horizon is and, therefore, what your volatility capacity is. The shorter the investment horizon, the less likely you are able to withstand volatility in the market.

For a first home buyer, your volatility capacity is based on how long it will be until you reach your deposit goal. Let’s say, according to our calculations, you will be able to reach your goal within 2 years, this will mean your time horizon is also 2 years.

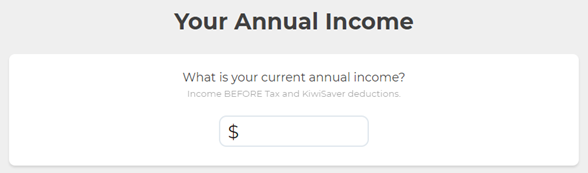

What is your annual income?

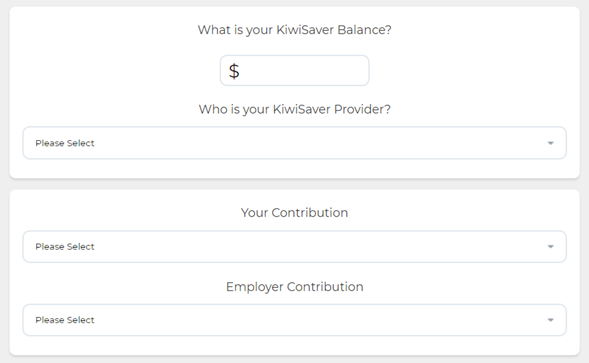

Your income is another important factor needed to find the required return. It determines what your KiwiSaver contributions will be based on the two percentages you have, at some point, chosen to deduct. One percentage is what you yourself contribute and the other what your employer contributes.

You can even add your partner’s details if you’re feeling kind enough to let them in on your secret.

How well do your tolerate volatility?

From here are the volatility tolerance questions. We ask you 5 simple multiple-choice questions to get an idea about how comfortable you are with volatility in the market and, hence, your KiwiSaver account. This indicates whether you are OK with greater ups and downs, you prefer a balanced approach or are perhaps in need of a safe and steady investment. This is an important factor because when your investment aligns with your tolerance levels, you are more likely to stay the course.

What’s most important to you?

Even though all the funds we recommend have gone through a rigorous selection process, we like to know what is most important to you when you invest. As this is likely to be a long term commitment, it is important for you to feel confident with it and know you’re getting exactly what you want out of it. For this reason, we ask what you’d like to prioritise out of getting the lowest fees, being with a big bank, investing Kiwi-owned, getting high returns, ESG investing or whether you are happy with any option.

What’s your current situation?

Of course, in addition to the contribution rates, we need to know what your current balance is and which provider and fund you invest in. The balance is a starting point for the returns required calculation and your current situation is used when comparing it with our recommended strategy.

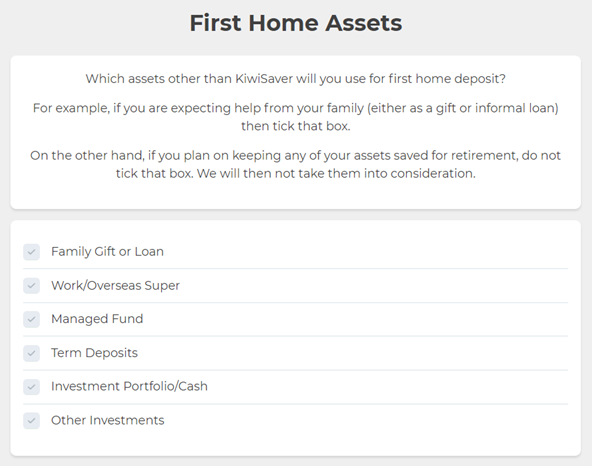

Have you got any assets or loans?

Finally, any assets and liabilities you may have are also taken into consideration. It is possible you have decided to build wealth outside of KiwiSaver or perhaps there’s a loan to pay off that may reduce your final balance. We believe that in knowing these, the fund we recommended will be more appropriate and get you closer to where you want to be.

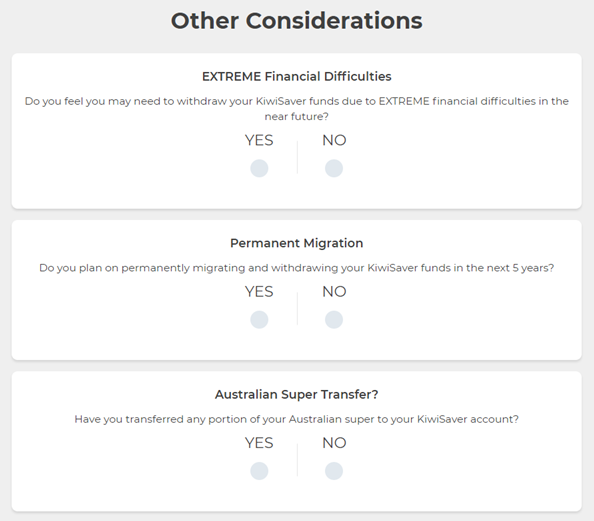

Final questions

There are a few final questions that are important in determining the advice we give. If you’re a first home buyer and you’ve moved your Australian Super over, we will need to slightly change our calculations, as this cannot be used for the deposit. If you plan to withdraw for financial difficulty, a first home or migration, we may once again need to adjust the advice to assist you better with your next steps.

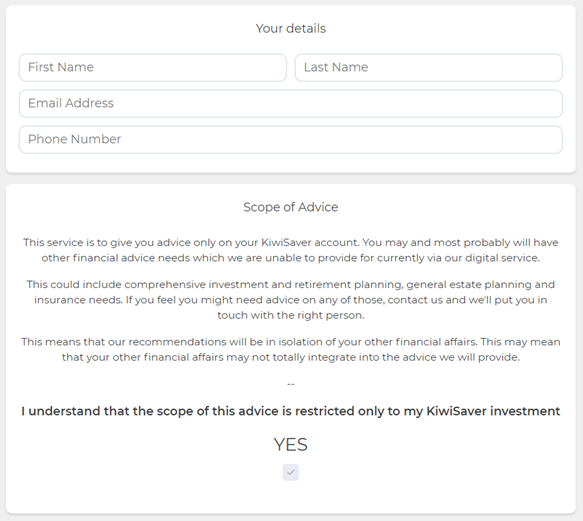

Lastly, we’ll ask you for a name and contact information so we can discuss with you your personalised KiwiSaver plan.