We hear a lot about how different KiwiSaver funds are performing, who is the best, who is the worst. There is also a lot of chatter in the media about fees and the effect that it can have on your KiwiSaver balance at retirement. However, among all the noise there is one factor that has the single biggest impact on your KiwiSaver balance at retirement – it’s your contribution rate.

It’s the one thing that you have in your control and can use to ensure that your retirement is secure. Now, the easy answer to the question ‘How much do I need to contribute’ would be ‘as much as you can’. But that’s not very helpful.

As living functioning human beings, we need to balance our current financial needs and wants, with those of our future self. Contributing more now can result in depriving yourself of the opportunities that life brings ( visiting loved ones, spending less time at work, eating good food etc). Ending up with a lump sum at retirement which is way more than you need is not the answer.

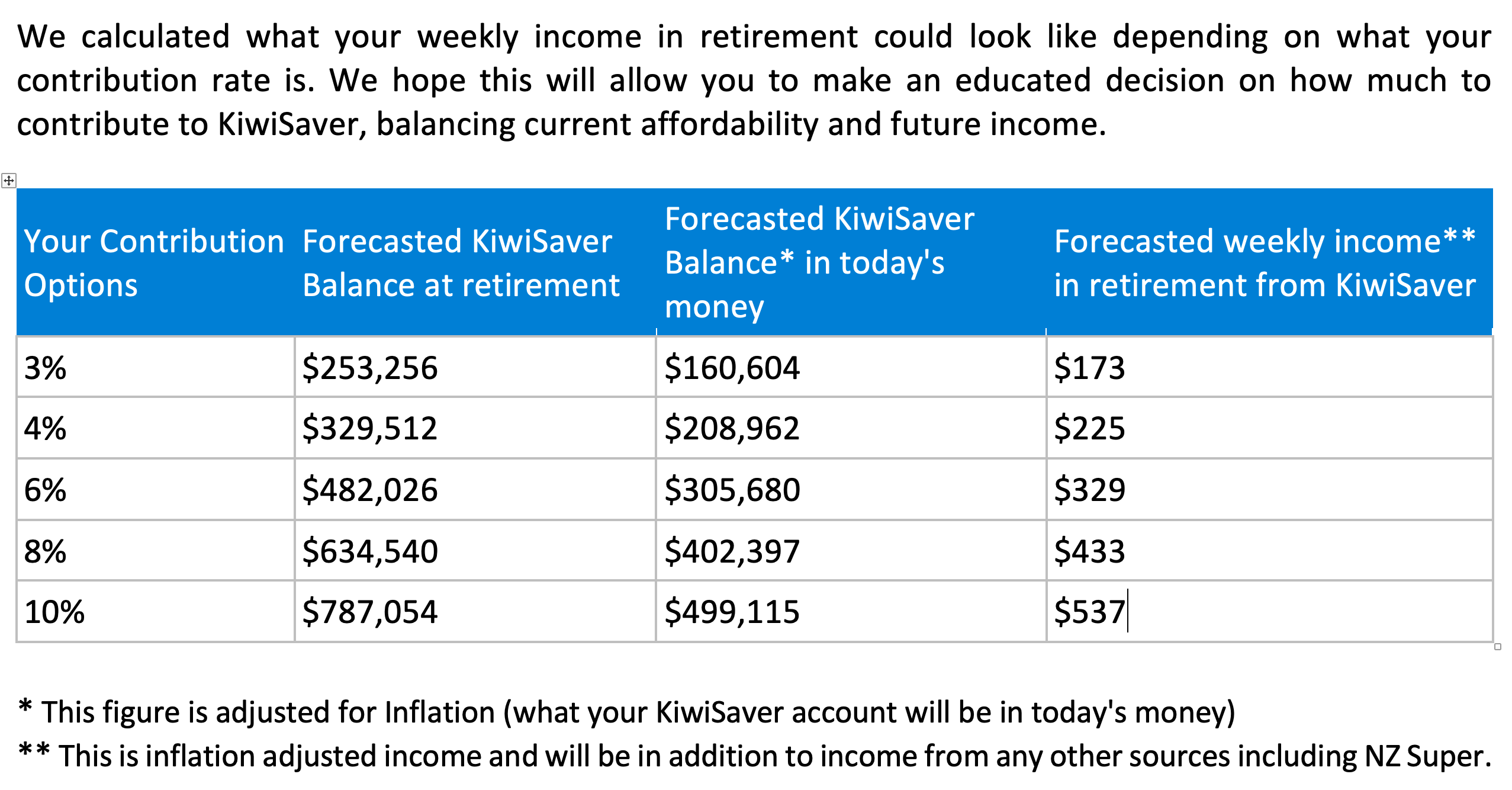

Alternatively, the bigger risk is where you will save ‘as much as you can’ and still not be able to achieve your retirement goals. We don’t want that to happen either. That’s why it’s important for us to know exactly what we need to contribute. At National Capital, we calculate and present the expected lump sums for a whole range of scenarios ( Starting from a 3% contribution to a 10%) so our clients can know what to expect and use that information to make an educated decision on what the correct contribution rate for them should be.

So how do we do the calculation?

We need to take a few factors into consideration

- Your current KiwiSaver balance

- Your employer contribution rate

- The years remaining for your retirement

- The type of fund you are investing in

We need to know the type of KiwiSaver fund you are investing in before we can calculate the effects of different contribution rates on your final KiwiSaver lump sum. Read our earlier post on calculating the rate of return you need and matching that to a KiwiSaver fund to get an idea of how to find that out.

Once we have all the above information, we use our smart software to quickly calculate (within a matter of milliseconds) all the different possibilities for where your KiwiSaver balance will end up depending on different contributions. We also take into consideration the government contributions you can expect to get every year depending on the amount on the total amount of annual contributions at the different contribution rates.

You could also do these calculations yourself by using a spreadsheet (Ask us for one if you are keen).

In our KiwiSaver recommendation that we send to clients, the final output looks something like this…

Hey, what’s that Forecasted weekly income column?!

The forecasted weekly income gives you an estimate of the income you can draw from your KiwiSaver each week at different contribution levels. This is additional to your NZ Superannuation pension. Depending on lifestyle, the average weekly expenses in retirement is between $600 (no frills) to $1400 (luxurious). As you can see, contributing a higher percentage of your income before you retire could be the difference between living at the minimum vs in luxury during your retirement.