KiwiSaver Comparison - Compare KiwiSavers

The table below aims to provider a quick KiwiSaver providers comparison based on key features, fund types and available, and a KiwiSaver fee comparison. You can use this as a tool to understand all the different solutions and analyse your options. While it can be overwhelming to compare KiwiSavers, the key takeaway is to seek professional advice if you are unsure about it all.

| KiwiSaver Comparison | Average Management Fee | Fund Types | Number of Funds | Key Features |

| AE (Always Ethical) | 3.33% | Balanced | 1 | Ethical investments, transparency |

| AMP Wealth | 1.13% | Conservative, Defensive, Balanced, Growth, Aggressive | 20 | Customised funds & strong track record |

| Anglican Financial Care | 1.15% | Conservative, Balanced, Growth | 3 | Faith-based ethical investing |

| ANZ | 0.64% | Conservative, Defensive, Balanced, Growth, Aggressive | 7 | Variety, recognition, strong historical |

| ASB | 0.55% | Conservative, Defensive, Balanced, Growth, Aggressive | 6 | Trusted, recognition, variety, low fees |

| BNZ | 0.37% | Conservative, Defensive, Balanced, Growth, Aggressive | 8 | Trusted, recognition, variety, low fees |

| Booster | 1.04% | Conservative, Defensive, Balanced, Growth, Aggressive | 14 | Strong performer, growth focused |

| BT Funds Management (Westpac) | 0.47% | Conservative, Defensive, Balanced, Growth, Aggressive | 8 | Reliable banking, strong local expertise |

| Civic Financial Services (SuperEasy) | 0.32% | Conservative, Balanced, Growth, Aggressive | 4 | Low fees, local government owned |

| Consilium NZ (KiwiWrap) | 0.75% | Conservative, Defensive, Balanced, Growth, Aggressive | 30+ | Personalised investing, goal focused |

| Craigs Investment Parterns | 1.35% | Conservative, Defensive, Balanced, Growth, Aggressive | 30+ | Personalised investing, goal focused |

| Fisher Funds | 0.80% | Conservative, Defensive, Balanced, Growth, Aggressive | 7 | Variety, financial guidance, customise |

| FundRock NZ (InvestNow) | 0.68% | Conservative, Defensive, Balanced, Growth, Aggressive | 40+ | Variety, customisation, transparency |

| Generate | 0.82% | Conservative, Defensive, Balanced, Growth, Aggressive | 9 | Strong performer, transparency, support |

| Kernel Wealth | 0.35% | Defensive, Balanced, Aggresive | 3 | Low fees, innovative solutions, customise |

| Koura Wealth | 0.86% | Conservative, Defensive, Balanced, Growth, Aggressive | 10 | Ethical, strong performer |

| Medical Funds Management (MAS) | 0.62% | Conservative, Defensive, Balanced, Growth, Aggressive | 7 | Variety, tailored, ethical solutions |

| Mercer NZ | 0.62% | Conservative, Defensive, Balanced, Growth, Aggressive | 7 | Tailored advice, diverse, long-term growth |

| Milford Funds | 0.72% | Conservative, Defensive, Balanced, Growth, Aggressive | 6 | Strong performer, transparency, growth |

| New Zealand Funds | 1.39% | Defensive, Balanced, Growth, Aggressive | 4 | Ethical, sustainable growth |

| Nikko Asset Management (GoalsGetter) | 0.95% | Conservative, Defensive, Balanced, Growth, Aggressive | 18 | Variety, long-term focus |

| Pathfinder | 1.12% | Conservative, Balanced, Growth | 4 | Goal-oriented fund selection, ethical |

| SBS Wealth | 0.82% | Conservative, Defensive, Balanced, Growth, Aggressive | 9 | Local knowledge & support, flexible |

| Sharesies | 0.97% | Conservative, Balanced, Growth, Aggressive | 8+ | User-friendly, accessible, customise |

| Simplicity | 0.24% | Conservative, Defensive, Balanced, Growth, Aggressive | 6 | Low fees, accessible, transparent |

| Smartshares (SuperLife) | 0.60% | Conservative, Defensive, Balanced, Growth, Aggressive | 30+ | Variety, accessible, simplified |

| Summer | 0.70% | Conservative, Defensive, Balanced, Growth, Aggressive | 10 | Active management, modest fees |

Note: The following information is only meant to serve as a general KiwiSaver comparison overview. The data may have changed since the time of writing. For the most up-to-date KiwiSaver providers comparison and the best choice for you, complete our HealthCheck below. Alternatively, you can check the latest fees and funds on offer at each providers’ website directly.

All There Is To Know - Compare KiwiSavers

There are more than 27 providers in New Zealand with numerous funds among them. This choice is good for us as investors as it promotes competition but can also lead to confusion during a KiwiSaver comparison. Many providers talk about how their funds have had the best performance in some time frame or the other, almost every provider has won some sort of award and most of them talk about ethical investing. KiwiSaver fee comparison may also play a role in your decision. So how do we choose? We can compare KiwiSavers based on performance on specific metrics which will be discussed below.

- Top Performers

- Traps To Avoid

- Comparison factor 1 - KiwiSaver Fee Comparison

- Comparison factor 2 -Active OR Passive - Which Is Better?

- Comparison factor 3 - Evaluation of Ethical Funds

- Comparison factor 4 - Bank KiwiSaver Scheme vs NZ Owned

- Comparison factor 5 - Asset Allocation

- Comparison factor 6 - Investment Processes

- Comparison Factor 7 - Who are the people managing your money?

- Comparison factor 8 - Your own personal requirements

- Employer Chosen Scheme

- Employment Restricted Schemes

- List of Providers

Note: The following information is general information and is not personalised advice. If you want personalised advice , please submit the KiwiSaver HealthCheck.

Top Performers - KiwiSaver Comparison

Best Performing KiwiSaver Funds

*Past performance is not necessarily indicative of future performance.

*All returns are per annum after fees and tax (28% PIR) as of the quarter ended 31st August 2025.

*Source: National Capital Research

What is the best KiwiSaver fund for you?

We’re here to help find the best KiwiSaver fund for you. Our team are financial advisers specialising in KiwiSaver & Investment research. We provide free KiwiSaver advice, with the goal of empowering Kiwis to become financially secure.

By taking a few minutes of your time to complete our KiwiSaver HealthCheck questionnaire, you will receive an instant recommendation tailored specifically to your goals and beliefs.

Our system combines the latest figures and technology to provide the most suited recommendations. Nonetheless, whether you take us up on the advice, is completely up to you.

How To Compare KiwiSavers Based On Performance

As demonstrated in the latest data above, while one provider might be the top performer in a Growth Fund, another one may have the top performing Balanced Fund.

There are many different types of funds, so it’s important to first determine which type of fund is most appropriate for you during a KiwiSaver providers comparison.

Once you’ve determined the type (or types) of fund to invest in, you can move to the KiwiSaver providers comparison stage. While past performance may not necessarily be an indicator of future returns, it’s useful to recognise both the serial underperformers and outperformers.

Again, while evaluating their performance, it is important to compare apples to apples. Comparing the performance of a Conservative Fund with 20% growth assets to a Growth Fund with more than 75% growth assets could lead to a very biased picture.

We don’t think so. The last 12 months of performance is meaningless in most cases because it’s too short-term a time frame for a proper KiwiSaver comparison. You need a long enough time frame to ensure that your comparison of past returns is relevant and useful.

In the list above, we have taken the last 5 years’ performance of each provider into consideration. Investing is a long-term solution, and it’s important we evaluate performance in the same vein. The 5-year performance metric gives us a much better idea of the performance of the fund, by filtering out short-term volatility. Therefore, the 5 year period is a good timeframe to run a KiwiSaver providers comparison.

Traps To Avoid – KiwiSaver Comparison

Investors should not go and constantly scour for the best performer, often switching when they see what they believe is the “next best thing”. And there are a lot of reasons why.

Just because a fund is doing well right now, does not mean it is best for you. During KiwiSaver comparison, one should take into account factors such as your personal volatility capacity, how long it will be until you need the money and your other assets.

But here’s the kicker. The thing is that even if investors find the ‘top performer’ for a period of time, they can still lose out on returns.

The reason for this is because investors succumb to different investing mistakes that bring down their return levels significantly.

So to illustrate this idea, let us show you an example.

Peter Lynch is considered by some to be one of the best investors on Planet Earth. He is known for many things – for example, for writing the book “One Up on Wall Street”, which sold over one million copies.

But the thing he is probably most well known for is for being the fund manager of Magellan from 1977-1990.

During this time, the average annual return for the Magellan fund was 29.2 percent. The S&P 500 during this time only returned around 14 or 15 percent, with dividends reinvested.

Investors saw this large overperformance by Lynch, so decided to invest with Magellan to capitalise on this. As a result, the fund grew from $18 million in assets under management to $14 billion in assets under management.

Here’s the thing though. Despite investors actually finding a great performer, the average investor in the Magellan fund actually lost money.

And no, your eyes are not fooling you. The average investor actually did lose money.

The reason why this occurred is that not all investors bought and held the Magellan fund from 1977-1990. Instead, investors succumbed to mistakes that decreased their return.

So even when investors can find good investments, why do their performance results mimic poor performing funds?

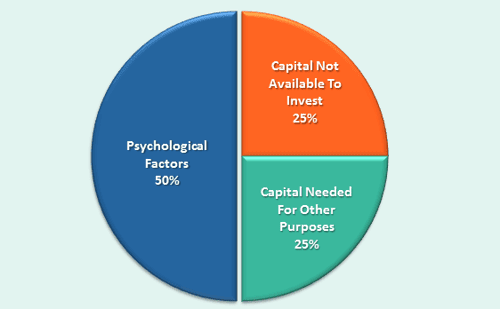

According to a Dalbar study, three main reasons exist for this.

Investors are not perfect. We are humans, and because of this, we are biased. Behavioural biases are a big reason for average investors not outperforming the market. The Magellan investors kept buying into the fund after a period of very good returns and sold if the fund decreased in value. So basically they kept buying high and selling low. They lost money because they were chasing short-term returns. All they needed to do was stay invested long-term.

In other words, investors themselves get in the way of earning larger returns. In fact, we get so much in the way that in the 2017 Dalbar’s Investor Returns study, the average investor made 2.89% less every year than the market index!

This generally occurs because of a lack of financial planning. When investing in a fund, one should make sure that they:

- Have enough money to invest in that fund

- Will not need to use their investment money in the case of a financial emergency

In a recession, for example, people may get laid off or be in some financial difficulty. And it’s during these times that the share market can drop.

If an investor is in financial difficulty and has not got a large enough emergency fund, they might choose to use the money they were investing instead.

However, when people do this, they may end up selling their shares when the market has dropped (i.e. “selling low”). This is against investor logic which says we should “buy low and sell high”.

Due to this, the investor may miss out on the gains from any future rebound that the share market has.

Don’t make the mistake Magellan investors made, by only looking at performance and jumping into a fund just based on your ‘research’ of its past performance. Researching funds and using a returns KiwiSaver comparison to compare returns in the market is a good step. But you need to do much more.

- At National Capital, we help our clients plan their KiwiSaver comparison correctly. We do this by determining their Volatility Capacity, Volatility Tolerance and the actual Returns Required to fulfil their goals.

- We research the funds we are recommending to make sure they are managed well. Our research covers:

- Culture of the company running the fund. Are they focusing on the investor or only growing the business?

- Volatility dependent performance: How is the performance compared not only to other funds, but how much risk is the fund taking to achieve that performance.

- KiwiSaver Fee Comparison: Are the fees reasonable and how do they compare to similar funds?

- Portfolio: What is the asset split, which countries are the funds invested in. How much of the funds are invested in New Zealand, and what are the liquid assets that the fund has?

- People: Who are the people running the fund and how long have they been in that role. Do they have the experience and skills required to manage the fund, and does their remuneration align them with the interests of the investors?

- Investment Processes: What are the governance processes of the fund, what is their brokerage execution policy and how much portfolio turnover do they have?

Using all this information we then recommend the appropriate fund for our clients.

Nothing. Our advice is absolutely free of charge to you. There are two reasons for this:

- We get paid our fees by the providers, similar to how the Mortgage Adviser is paid by the banks. This covers our costs. We work with multiple providers so that we can choose the best fund for you.

- Our mission is to help Kiwis become financially secure. Our company was formed on the three Māori principles of pūataata (transparency), tikanga (the correct way) and taurikura (prosperity), and we believe by helping Kiwis achieve financial security via KiwiSaver comparison and avice, we can best achieve our mission

If you would like us to create a plan tailored to you, and select the appropriate fund based on that plan, please submit our HealthCheck using the button below to start the process. Our KiwiSaver comparison and advice process is 100% online so you can do it from the comforts of your own home. If you would prefer to talk to us on the phone or video, we are happy to do that too.

You can do your own research using the 8 KiwiSaver comparison factors listed below. These are not in order of importance.

Many people start and stop their research based on a fund’s past returns. However, this should not be the most important factor in choosing a fund let alone the only factor. It is crucial to be aware that at different times, different funds come out on top. Just because a fund performed well in the last quarter or year, it doesn’t mean it will continue to be the best.

In saying this, you may use past returns as a guide for finding the serial under or overperformers. In this case, you may find it difficult to invest in a fund that has underperformed for the past 10 years or feel more at ease with one who is a serial overperformer. This could help you feel more confident in your provider and reduce the risk of changing funds during some volatility.

Comparison Factor 1 - KiwiSaver Fee Comparison

KiwiSaver fee comparison is an important consideration. By law, providers have to ensure their fees are “reasonable” but there is still quite a difference between fees for similar funds among providers.

It’s important to understand what your fees are paying for however. You don’t just go to the cheapest lawyer or doctor you can find, and in a similar way – rather than simply deciding based on fees, look deeper.

An actively managed fund will normally have higher fees than a passive one. This accounts for the extra work and research a manager of an actively managed fund has to perform. The expectation is that this extra work and research will lead to greater investment returns, but that is not always the case.

Additionally, a fund with more Growth Assets will normally have a higher fee than one with more Income Assets. The rationale behind this is it again takes more work and research to select Growth Assets because of the higher risk and volatility.

KiwiSaver fees are normally broken up into two parts.

- Percentage Management Fee: In most cases, this is presented as a percentage of your balance. This way your fee increases incrementally along with your balance, which helps keep things fair. Management Fees range from 0.3% to 2% in most cases. The variance in this figure is primarily due to the different types of funds.

- Fixed Membership Fee: In addition to the Management fee, some providers also charge an Annual Membership or Administration Fee. Membership fees range from $0 to $60 a year, and on average $32.

Providers can change their fees over time, so it’s a good idea to keep monitoring your fee structure.

No. KiwiSaver fee comparison is only a small component when considering your choices. There have been studies performed that show other non-fee factors can contribute up to 7 times more wealth than lower fees. If you’re keen on a long read, a link to the study is here.

Ultimately what should be important to you is the net returns. This is the return you get after fees and taxes. Most comparison sites and providers list the funds’ net returns after fees.

KiwiSaver Comparison Factor 2 - Active OR Passive - Which is better?

What's the difference?

Active funds are ones where their fund managers take a hands-on approach to investing. These fund managers generally look at a variety of investments and try to pick out the best ones.

In contrast, passive funds have fund managers that are more hands-off. Generally, these fund managers will instead invest in dozens or hundreds of investments and choose not to guess which investments might do best.

It is important to know this distinction as you compare KiwiSavers in general.

In reality, there really isn’t such a thing as a 100 percent passive fund.

Even passively managed funds require some active decision making. Take, for example, a fund that invests in the NZX 50 and nothing else. Someone has to actively make the decision to invest in the NZX 50, as opposed to the ASX 200 for example.

There has been an ongoing debate in the last decade about whether active funds are better than passive funds.

Some may argue that passive funds are better than active funds because some studies that show on average in the past, active funds do not outperform the index after fees. However, using averages can be very misleading during your KiwiSaver providers comparison journey.

Averages are skewed to the downside by index huggers. An index hugger is an actively managed fund that performs similarly to a passively managed index fund. This may be because these fund managers are not as actively investing as you may think.

An index hugger that invests in New Zealand companies, for example, may mimic the NZX 50 in its returns. So as a result, people investing in these funds are paying more in fees to have their investment be actively managed, only for their investment to act as the index. That is partially why a KiwiSaver fee comparison should also be part of your process.

However, averages do not matter to an investor. It doesn’t matter if some active fund managers can’t beat the market. All an investor needs to do is find a few active fund managers that can do so. And at National Capital, we believe that’s possible because skilled fund managers do exist.

We believe that skilled fund managers show that the market is not efficient. With a little bit of hard work and some correct processes, it is possible to beat the market. Additionally, some expertise in a particular industry or investment area will help someone beat the market. We can help find the right fit in your Kiwisaver comparison journey.

If you’re still unsure whether you’d prefer investing in an active or passive fund, you don’t even have to make a choice. Your portfolio could be a blend of active and passive managers. In fact, a well diversified portfolio could contain both.

With all of this though, there’s one thing to keep in mind.

What matters most to the final returns you get from your investments is what your asset allocation is and how you react to volatility in the market. And it’s these factors that matter more when you compare KiwiSavers.

Read More: Active vs Passive KiwiSaver funds – which is better?

KiwiSaver Comparison Factor 3 - Evaluation of Ethical Funds

Now that we have discussed performance, KiwiSaver fee comparison, returns and services, is that all? Not really! But this part is optional and quite personal when it comes to KiwiSaver comparison criteria.

It is your right to know how your funds are invested and whether those investments are made in a socially responsible manner. As a result, along with the traditional investment funds, Kiwis now have the opportunity to choose a fund that matches their ethical preferences through a sustainable fund scheme which is in line with the United Nations Principles for Responsible Investment framework.

While the specific ethical and sustainable funds may differ depending on the provider, these funds are based on environmental, social and governance (ESG) factors. They normally exclude investing in specific industries that are at odds with strong public policies, involved with any unethical activities directly or indirectly. Some examples are:

- Fossil fuels

- Nuclear power production

- Whaling

- Military weapons manufacturing

- Civilian firearms production

- Tobacco production

- Alcohol production

- Gambling operations

- Adult entertainment

- Genetically modified organisms

Some providers follow an accessing criterion which includes in-depth company analysis to identify how well they follow social governance factors, their investment principals and investment decisions. You need to ensure that your provider is guided by a Responsible Investment framework in terms of where to invest. For some people, this point may weigh heavy in their choice during their KiwiSaver providers comparison.

Read More: Digging deeper to find out if your KiwiSaver fund is truly ethical

KiwiSaver Comparison Factor 4 - Bank vs NZ Owned

What's the difference?

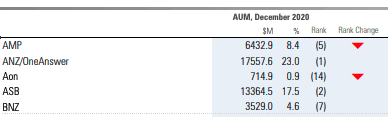

It may be self-explanatory, but a bank KiwiSaver solution is one that is run by a bank. Be that ASB, ANZ, BNZ or Kiwibank. Banks are currently dominating the KiwiSaver industry holding the greatest amount of investors money. The convenience of having your retirement savings integrated with your banking has something to do with it. Being called KiwiSaver you’d presume that it is run by Kiwis, however, four of our five major banks are actually Australian. ASB, ANZ, BNZ and Westpac are all Australian-owned and hold a great deal of our KiwiSaver money. If you care whether your savings are being managed by an NZ owned entity, this is an important topic when you compare KiwiSavers.

We then have New Zealand-owned ones that are not run by a bank. Some of them are not-for-profit, some actively managed and some are niche, offered only to certain people such as the NZ Defence Force Scheme.

Many people may see banks as being safer and a less risky place to put your money. However, this isn’t really the case. All providers are licensed by the Financial Markets Authority (FMA). This means that they must all comply with all obligations detailed in the Financial Conducts Act 2013 and the KiwiSaver Act 2006.

In addition to this, providers don’t actually hold your money. In fact, your money is held by a third-party in something called a trust. For you, this means that, even if they went bankrupt, your provider wouldn’t use your money to pay off their debt.

Both bank-owned and NZ business owned have things to offer you as an investor. For a bank, this may be that, in some cases, they offer lower fees. This could be because, with lots of members, they are able to spread the costs of managing your investment more widely than smaller providers. Thus, a positive note for banks during a KiwiSaver fee comparison.

A reason that a number of Kiwis invest with bank-owned providers may be because they register to their own bank’s scheme. This is often quite convenient and offers a level of comfort to people as it may feel as though you are just opening another type of savings account.

Although low fees, convenience and comfort all sound great, it is definitely not a reason to immediately go and invest with your local bank.

NZ-owned schemes are becoming increasingly popular. Firstly, and potentially being something of importance to you, it is great to know that any profits are going straight into Kiwis’ hands. In comparison, you cannot be certain of this when you register to a bank scheme as the profits may well be going overseas.

Also worth mentioning is that most consumers don’t actually trust their banks a whole lot. Consumer NZ discovered that only 48% of consumers believe banks are trustworthy with only 38% agreeing they have their best interests at heart.

Even though we have provided this KiwiSaver comparison for you, it is something that we believe you should ask yourself. It is not necessarily a question of bank or non-bank but rather which specific fund is right for you?

Read More: Should I be in a Bank KiwiSaver scheme or an NZ owned KiwiSaver scheme?

KiwiSaver Comparison Factor 5 - Asset Allocation

What is asset allocation?

Asset allocation describes how your money is distributed towards different investments. More specifically, asset allocation describes what type of investments your money is being put towards.

It is important to be aware of the different types of assets your scheme invests into during your KiwiSaver providers comparison. So, below is a breakdown of these three different types of assets:

- Growth assets include highly volatile, but high-return investments. These include shares, property and infrastructure.

- Income assets include assets such as corporate bonds and government bonds. They are considered less volatile investments compared to growth assets. However, they are not considered as safe as cash and cash equivalent assets.

- Cash and cash equivalent assets are the least volatile type of asset, but give the least amount of returns. These include investments like floating rate notes and term deposits.

Asset allocation varies greatly between funds. While there are guidelines, there is no single specific allocation for each fund class.

Therefore, during a KiwiSaver providers comparison, it is important not to pick a fund simply because of its name. Despite many funds having similar names, they all have their significant differences.

KiwiSaver Comparison Factor 6 – Investment Processes

This is a very important factor when you compare KiwiSavers and decided whom to invest your hard-earned money with. The differences between funds can be seen in the way providers invest money.

Each provider will have their own unique methods they use to invest your money. This is because different providers hold different philosophies and beliefs. It is very worthwhile looking into how your provider chooses to invest your money as it may affect the final outcome for your balance.

We would ‘run out of space’ if we covered all 30+ of them below. So instead, we will compare KiwiSavers and contrast just three. This will show the wide range of methods that they can use to invest your funds.

The great thing about National Capital is that if you want more information about a specific provider, you can view the list at the bottom of this page to see the research we have gathered on each of them.

To demonstrate the variety of the investment processes, here are the three providers we will discuss:

- Milford Asset Management

- JUNO, and

- Simplicity

Milford

Let’s start with Milford. They are active managers which means they buy and sell investments with the aim of beating the market. This approach allows them to take advantage of opportunities whilst minimising downside risks. When deciding which investments to make, they assess the economic backdrop, the valuation of different assets, and the potential futures of the companies themselves.

Milford starts their process with “negative screening” which excludes certain investments. From there, they do economic and investment analysis followed by an investment forum meeting whereby the research is presented and discussed by portfolio managers. Finally, a decision is made as to which investments to buy and sell.

JUNO

Next, we have JUNO which is also actively managed. They aim to buy assets when they’re considered low and to sell when they’re high. They also try to minimise unnecessary volatility and draw-downs while still seeking returns.

JUNO has four key stages of their investment process:

- Identify

- Research

- Construct, and

- Review

The ‘identify’ stage involves looking for assets that possess certain characteristics. The research stage requires talking to well-informed people in the market as well as the management teams of companies they invest in. In the research stage, JUNO looks at qualities such as what their financial futures may look like or their performance compared with similar companies.

The construct stage is self-explanatory and is where they build the portfolio. And review is the final stage which states that they will continuously reevaluate their investments and adjust accordingly.

Simplicity

Finally, Simplicity differs from the other two providers as it is passively managed. They do not actively choose individual investments and therefore, their investment process is quite different.

Simplicity invests in a wide range of assets and types of assets in order to diversify the portfolio where your money is invested. With the presumption of efficient markets, they believe that index funds are the way to go and may even decrease fees for investors. Vanguard is one of the largest providers of index funds and is where Simplicity invests a substantial amount of money.

As you can see, each manager has their own investment strategy. It’s beneficial for you to understand how your money is being invested in order to feel confident in the long term.

KiwiSaver Comparison Factor 7 – Who are the people managing your money?

The people

With over 7 billion people on Earth, each unique, there is bound to be variety in the people managing your money too. Every fund manager brings their own set of talents, experiences, and expertise into the equation. This is why it could be a good idea to look into the people in charge of your investment when you compare KiwiSavers.

There is another thing that is also important to note. You may think the employees at your chosen scheme are the ones who do most of the work choosing your investments and allocating your money. This, however, is sometimes not the case.

To explain what we mean, let’s look at companies that hire their own portfolio managers versus schemes that use external managers.

Some will let you know clearly who their portfolio managers are by listing the portfolio managers on their website.

Portfolio managers are hired for their expertise to help manage your money. They do a variety of activities such as research and analysis to do exactly this.

Examples of companies that list their portfolio managers on their websites are:

Take for example the first one, Milford Asset Management. Milford manages their funds actively, so to help with this, they have hired some portfolio managers.

Others use external fund managers or underlying investment managers to take care of your money. This means that some other organisation or company is given the task of managing your money. They will choose where to invest it, and how they think it is best to invest it.

For example, as of when this was published, BNZ had three underlying investment managers (source) they used to manage their client’s funds. These managers were:

- Harbour Asset Management Limited

- Threadneedle Asset Management Limited

- State Street Global Advisors, Australia, Limited

Now one may ask, “Why would a provider give my money to someone else to invest?”

The reason is that different schemes have different ideologies and beliefs. As a result, some of them will choose to give the underlying investment management decisions to someone else because they believe it is best to use external experts rather than do everything in-house.

Simplicity invests a lot via DWS Asset Management because they believe that investors will gain higher returns in the long run by using low-fee index funds (source).

KiwiSaver Comparison Factor 8 - Your own personal requirements

During the KiwiSaver providers comparison process, it’s important to keep external factors in mind too.

A lot of times, people may do something less suited for them because they are listening to generalised advice. Generalised advice makes a lot of assumptions. The problem with that is that these assumptions may not apply to you.

While generalised advice can be good, it is best to get advice for your specific situation instead. So here are two different personal factors someone should keep in mind when you compare KiwiSavers.

1. Other investments outside KiwiSaver

Here’s an example when general advice may not be right for someone.

Older people (e.g. in their 60’s or above) generally get told that their KiwiSaver money should be in a fund with fewer growth assets. This means that their fund will be less volatile, but they may miss out on some potential future returns.

Now what if someone had let’s say $400,000 in term deposits that they could use for retirement before touching their KiwiSaver savings? And what if also, this person was currently receiving NZ Superannuation, and would only spend $45,000 a year on their expenses?

In such a case, it would be a number of years before this person would even consider using their KiwiSaver. As a result, this person may be best off investing some or all of the KiwiSaver money in a more volatile fund, like a balanced or growth fund, to maximise the returns.

One should make sure they analyse their KiwiSaver comparison strategy as a part of your whole financial plan. By doing this, you can help yourself make the financial decisions that are best for you.

Read More: Why you shouldn’t ignore your investments outside of KiwiSaver.

2. Religious considerations

Some people also have religious concerns. Maybe they want their investments to align with their religious beliefs, for example.

The Christian KiwiSaver Scheme is a scheme made with Christians in mind. This provider allows active Christians, as well as a few other people, to invest in their fund.

Their choice of investments is influenced by a number of things. For example, the Bible is one area that they turn to in order to justify the areas they do not wish to invest in.

This scheme makes ethical judgements regarding what and what not to invest in. For example, they aim to avoid investments “in cases where animals are subject to unjust suffering” (source).

The scheme has three different types of funds as of writing – a growth fund, a balanced fund, and an income fund.

KiwiSaver Comparison - Employer Chosen Scheme

Who are they?

Some employers have arrangements in place with a particular provider to default all their employees into. This means, when joining KiwiSaver as an employee, the organisation will auto-enrol you without much chance to compare KiwiSavers.

Advantages of this might be that the scheme has agreed to give some additional benefits, such as financial advice. However, just because you get these benefits doesn’t necessarily mean you should stay. A KiwiSaver providers comparison can be crucial at this point.

In fact, there is no obligation to remain within the ‘default’ scheme chosen by employers. What if you find out they are charging higher than average fees after a KiwiSaver fee comparison? Employers cannot discriminate against employees by offering additional employer contributions towards one scheme as compared to others.

Furthermore, there is a chance that the employer-chosen default company is not the best for the employee’s situation. Everyone has their own unique financial situation, and it is not right to place all employees into the same fund. No one fund is suitable for everyone. That is why you should compare KiwiSavers before selecting one by default!

Our Advice

There are a bundle of factors that need to be considered before selecting a fund. This goes beyond just returns and KiwiSaver fee comparison. Choosing the wrong fund may impact your ability to retire comfortably. For example, being in the lowest-returning aggressive fund earning only 5.8% per annum as opposed to the highest at 9.6% can leave you with less than half the money 40 years later.

Ultimately it is your money, so do not rely on your employer to make a decision for you. Do your own homework with a KiwiSaver comparison or otherwise, seek financial advice.

Read More: Joining your employer-chosen KiwiSaver scheme – a mistake?

Compare KiwiSavers - Employment Restricted Schemes

What are they?

Employment-restricted KiwiSaver schemes are those that only allow people working in a certain organisation or industry to join them.

Some of these firms may offer incentives like extra contributions to your KiwiSaver account. However, just because an employment-restricted scheme offers incentives, it does not mean you should automatically join them. Only through research and a KiwiSaver providers comparison can you find out which solution is best for you.

This section will break down the three current employment-restricted schemes out there.

New Zealand Defence Force KiwiSaver Scheme (For NZDF Members)

The New Zealand Defence Force’s (NZDF) Scheme is open for past and present NZDF members and their immediate families. It is run by Mercer.

The NZDF Scheme offers some incentives for joining KiwiSaver. This includes the $50,000 they give out through participation reward raffles for their eligible members. You can read the NZ Defence Force KiwiSaver Scheme Booklet if you’d like more information regarding this.

However, as warned earlier, just because a scheme offers rewards to its members, does not mean that you should rush to join them immediately. Other factors, such as a KiwiSaver fee comparison, returns needed, and investment personality, should be taken into account.

Supereasy Scheme (For Local Government Workers)

The Supereasy scheme has been set up for people who work in local government and their immediate family members. Local government includes regional councils, district councils, and city councils.

This scheme is run by Civic Financial Services Ltd, a company which is owned by the local government. It is worth checking how it stacks up against other choices during a thorough KiwiSaver comparison.

Medical Assurance Society (MAS) Scheme (For Professional Services Workers)

The Medical Assurance Society (MAS) scheme is for professional service workers. The name of the scheme may imply that only medical professionals can join it. However, this is not the case.

The people who can join include architects, accountants, doctors, veterinarians, lawyers, engineers, and dentists. Immediate family members of these groups can join too. Even students studying to be doctors, veterinarians, or dentists can join.

The Medical Assurance Society’s Scheme has around 15,000 members and around $1.4 billiom under management. Therefore, they are the largest restricted scheme out there.

They offer seven funds as of writing: a Global Equities Fund, an Aggressive Fund, a Growth Fund, a Balanced Fund, a Moderate Fund, a Conservative Fund, and a Cash Fund. You can get in touch to compare KiwiSavers and see how MAS performs.

Read more: Employment restricted KiwiSaver schemes – are they worth joining?

List of Providers & Funds

AMA

Always Ethical (AE) KiwiSaver Scheme

Formerly known as Amanah KiwiSaver Plan, the AE KiwiSaver Plan rebranded recently to Always-Ethical Limited. This rebranding aimed to make the Strict Ethical Mandate, developed over centuries by Islamic scholars, accessible to all New Zealanders seeking ethical investment options. Always-Ethical Limited remains the only KiwiSaver provider that does not invest in pork products and strictly enforces the prohibition of Riba (interest-based earnings).

AMP

AMP KiwiSaver Scheme Details

AMP is a well-established financial services company in New Zealand, offering a variety of investment and insurance products. With a significant presence in the KiwiSaver market, AMP provides members with tools like the MyAMP app and online portal for easy account management. The company’s investment philosophy emphasises sustainable investing, aiming to deliver healthy fund performance while contributing positively to the environment and society.

ANZ

ANZ KiwiSaver Scheme

ANZ, or the Australia and New Zealand Banking Group, is a prominent banking institution in New Zealand, offering a comprehensive range of financial services, including the ANZ KiwiSaver Scheme. With a significant presence in the KiwiSaver market, ANZ provides various investment options to help New Zealanders achieve their retirement goals.

AON

Aon KiwiSaver Scheme

Aon KiwiSaver was a scheme offered by Aon New Zealand, providing members with a range of investment options managed by external investment managers. Following its acquisition, Fisher Funds now oversees these KiwiSaver accounts, integrating them into their broader suite of retirement and investment solutions.

ASB

ASB KiwiSaver Scheme

ASB Bank, established in 1847 as the Auckland Savings Bank, is one of New Zealand’s leading financial institutions. The ASB KiwiSaver Scheme offers a variety of funds designed to help New Zealanders achieve their retirement and savings goals.

BNZ

BNZ KiwiSaver Scheme

The BNZ KiwiSaver Scheme is managed by BNZ Investment Services Limited (BNZISL), a wholly-owned subsidiary of Harbour Asset Management Limited. BNZISL is responsible for the investment strategy and governance of the scheme’s funds. The scheme is part of the broader Bank of New Zealand (BNZ) group, which is ultimately owned by National Australia Bank (NAB).

BOO

Booster KiwiSaver Scheme

Booster is a New Zealand-based financial services company committed to enhancing the financial resilience of New Zealanders. Beyond KiwiSaver, they offer a suite of services, including investment funds, superannuation products, and insurance solutions. Booster’s mission centers on providing accessible financial products and fostering financial literacy among Kiwis.

CHR

Christian KiwiSaver Scheme

The Christian KiwiSaver Scheme is specifically designed for individuals within New Zealand’s Christian community, encompassing all denominations. It provides an opportunity for members to invest their KiwiSaver funds in a manner consistent with Christian ethics and values.

CRA

Craigs KiwiSaver Scheme

Craigs Investment Partners, a leading New Zealand investment advisory firm, manages the Craigs KiwiSaver Scheme. With a nationwide presence and a commitment to personalized wealth management, Craigs offers a range of investment services, including the KiwiSaver scheme, to help clients achieve their financial objectives.

FF

Fisher Funds KiwiSaver Scheme

Established in 1998, Fisher Funds has grown to become one of New Zealand’s largest specialist investment managers. Their mission is to make investing understandable and accessible, helping Kiwis achieve their financial aspirations. With a team of over 20 investment professionals, Fisher Funds combines local expertise with global insights to manage their investment portfolios.

FFTWO

Fisher Funds Two KiwiSaver Scheme

Fisher Funds TWO KiwiSaver Scheme was established to provide New Zealanders with a structured approach to retirement savings. Managed by Fisher Funds, one of New Zealand’s largest specialist investment managers, the scheme benefits from the firm’s extensive experience and expertise in fund management.

GEN

Generate KiwiSaver Scheme

Generate is New Zealand-owned and operated KiwiSaver provider, passionate about helping members save for a comfortable retirement. They have attracted over 160,000 members, reflecting their commitment to delivering quality service and investment options tailored to individual retirement goals.

Kōura

Kōura Wealth KiwiSaver Scheme

Kōura Wealth is a New Zealand-based KiwiSaver provider committed to simplifying the investment process and empowering individuals to make informed decisions about their retirement savings. Utilizing innovative digital tools and offering a variety of investment options, Kōura focuses on delivering tailored KiwiSaver solutions that cater to the diverse needs of New Zealanders.

MAS

Medical Assurance Society(MAS) KiwiSaver Scheme

The MAS KiwiSaver Scheme is managed by Medical Funds Management Limited, a wholly-owned subsidiary of the Medical Assurance Society (MAS). MAS is a New Zealand-owned mutual organization that has been serving its members for over 100 years. As a mutual, MAS is owned by its members, meaning profits are reinvested to benefit members and support initiatives like the MAS Foundation, which focuses on health and wellbeing equity in Aotearoa.

MER

Mercer KiwiSaver Scheme

Mercer is a subsidiary of Marsh & McLennan Companies, a global professional services firm specializing in risk, strategy, and human capital. With a presence in over 40 countries, Mercer leverages its extensive expertise to offer retirement, superannuation, and KiwiSaver solutions to individuals and institutions in New Zealand.

MIL

Milford KiwiSaver Plan

Milford is a New Zealand-based investment firm known for its active management style and commitment to delivering strong investment returns. They offer a range of investment products, including the Milford KiwiSaver Plan, which is designed to help New Zealanders achieve their retirement goals.

PAT

Pathfinder KiwiSaver Scheme

Pathfinder Asset Management Limited is a New Zealand-based investment firm specializing in ethical investing. With a history dating back to 2010 in ethical fund management, Pathfinder launched its KiwiSaver Plan in 2019 to provide investors with a values-aligned retirement savings option. The firm is a Certified B Corporation, reflecting its commitment to high standards of social and environmental performance, accountability, and transparency.

JNO

Pie KiwiSaver Scheme (Juno)

The Pie KiwiSaver Scheme is managed by Pie Funds Management Limited, a boutique investment manager based in New Zealand. Established in 2007, Pie Funds launched the JUNO KiwiSaver Scheme in 2018, which was rebranded to Pie KiwiSaver Scheme on 5 December 2023. The firm is known for its active investment approach and has a global presence with teams in New Zealand, Australia, and the UK.

QS

Quaystreet KiwiSaver Scheme

QuayStreet Asset Management is a specialist funds management firm based in New Zealand. The QuayStreet KiwiSaver Scheme is managed and issued by Smartshares Limited, a subsidiary of NZX Limited. With a focus on active management and a commitment to delivering value to investors, QuayStreet combines local expertise with a global perspective to navigate the complexities of financial markets.

SBS

SBS KiwiSaver Scheme

SBS Wealth Limited is a New Zealand-based financial services provider, operating under the umbrella of SBS Bank, which is owned by its members. This structure ensures that the organization remains focused on serving the local community. The SBS Wealth KiwiSaver Scheme is designed to help New Zealanders achieve their retirement goals by offering a variety of investment options and personalized financial advice. The scheme’s management emphasizes transparency, client-focused service, and a commitment to responsible investing.

SIM

Simplicity KiwiSaver Scheme

Simplicity NZ Limited is the issuer of the Simplicity KiwiSaver Scheme and the Simplicity Investment Funds. Founded by former Tower Investments CEO Sam Stubbs, Simplicity operates as a nonprofit organization, reinvesting profits to benefit members. The organization is based in Auckland, New Zealand, and is committed to providing low-cost, ethical investment options to its members.

SUM

Summer KiwiSaver Scheme

The Summer KiwiSaver Scheme is managed by Forsyth Barr Investment Management Limited, a licensed manager of registered schemes and part of the Forsyth Barr group of companies. Forsyth Barr is a New Zealand-owned investment firm with a history dating back to 1936. The scheme is structured as a trust, with Trustees Executors Limited acting as the Supervisor and custodian, ensuring that members’ investments are held separately from Forsyth Barr for their benefit.

SUP

Superlife KiwiSaver Scheme

SuperLife is managed by Smartshares Limited, a wholly-owned subsidiary of NZX Limited. They have been assisting New Zealanders with their investments for over 15 years and are one of six government-appointed default KiwiSaver providers. SuperLife’s offerings include KiwiSaver, superannuation, insurance, and investment products, catering to a wide range of financial needs.

WES

Westpac KiwiSaver Scheme

The Westpac KiwiSaver Scheme is managed by BT Funds Management (NZ) Limited, the investment arm of Westpac in New Zealand. Westpac New Zealand Limited acts as a distributor of the scheme. With a strong presence in the New Zealand financial sector, Westpac offers a comprehensive suite of banking and investment services, aiming to support Kiwis in achieving their financial goals.

Prefer speaking to an Adviser?

Make a Video appointment with one of our Financial Advisers.

National Capital has helped thousands of Kiwi’s in comparing KiwiSaver solutions. Click the button below to set a 30-minute video call appointment.