How often do you ask yourself what would happen to your KiwiSaver account after you pass away? We bet not very often.

Inland Revenue states that around 60% of New Zealanders have a KiwiSaver account and more than NZD$5 million are withdrawn annually due to death. Despite such statistics, the majority of Kiwis do not pay significant attention to the protection of their assets including their account after their death.

We have come across a few misconceptions related to the discussion on ‘What will happen to my KiwiSaver money if I die’ and would like to debunk the myths below right off the bat.

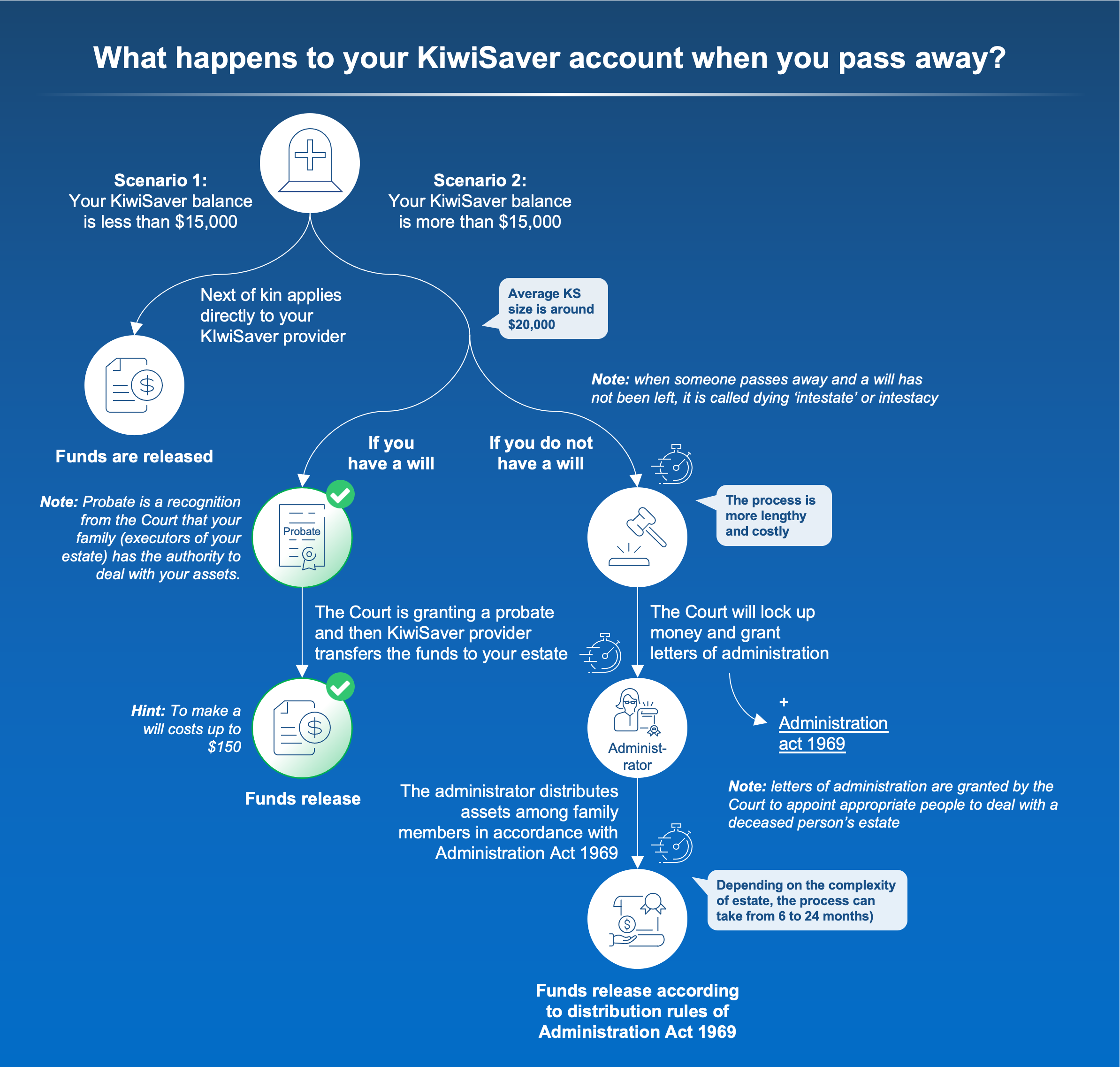

You’re probably pretty curious as to what really happens. The good news is that according to Inland Revenue, the savings will be paid to your estate once you pass away. However, the time and convenience of such a transfer to your closest relatives will depend on your KiwiSaver Balance and the presence of your last will. Without a will, accessing KiwiSaver balances can be a lengthy process.

Let’s look at the two scenarios you might encounter:

Scenario 1: Your KiwiSaver account balance does not exceed NZD$15,000.

In this scenario, your next of kin is not required to apply for the court’s approval for the management of your estate (also known as ‘Probate for a will’ or Letters of Administration if there is no will).

Instead, your KiwiSaver provider can release the funds to your close relatives after a direct application from them. Your administrator or beneficiary will usually need to provide a copy of the death certificate. In this scenario, the process of accessing KiwiSaver is easy!

However, according to the KiwiSaver Annual Report released by Financial Market Authority (2019), the average member’s balance was around NZD$20,000 above the given benchmark. Hence, it’s important to have a look at the second scenario.

Scenario 2: Your KiwiSaver account exceeds NZD$15,000.

Given your KiwiSaver investment is above NZD$15,000, your loved ones have two potential cases. In case A where you have a will. Your close relatives would be required to make an application to the court which will grant them ‘probate’. Once probate is granted, your KiwiSaver provider will transfer the money to your estate. Your accumulated funds will then be distributed as specified in the relevant will.

Important note: make sure that your relatives are aware of your scheme provider and they know who to contact for a withdrawal of your KiwiSaver funds. There are numerous providers in the KiwiSaver market, and thus, without this information it can be rather challenging and expensive for an executor to track down the funds.

In the case of intestacy (case B), when you pass away without a will, the process of transferring KiwiSaver balances can be costly, complicated, and quite stressful. At first, your family would be required to make an application to the court – specifically, for the appointment of an administrator, a person who is given the authority to deal with the estate assets on your behalf.

Once “Letters of Administration” are granted, the administrator can start dealing with your estate, however, you need to be aware that the estate will not be distributed as per your will, but as prescribed by the Administration Act 1969. Overall, the whole process can take anywhere between 6 and 24 months depending on the complexity of the estate.

As you can see, increasing your KiwiSaver account balance is rather important, however, it is also crucial to ensure that your savings stay protected and that your loved ones can successfully receive your assets in the unfortunate event of your death.

If you already have a will, National Capital advises you to review it regularly every few years or as your circumstances change. If you do not have a will, we recommend seeking advice from certified professionals. Preparation today can save your family from financial hardship and legal battles in the future.