KiwiSaver Tax – Please click here for an updated version of this page.

Tax is not the most riveting subject in the world, nor is it something we like paying, but having the right information when it comes to tax can save you a lot of money. Instead of receiving a shock after viewing the tax cuts on our KiwiSaver funds this financial year, let’s try to be a step ahead and understand how our KiwiSaver investment get taxed. Being in the right tax bracket helps you to avoid owing large sums to the Inland Revenue Department. The first step in paying the right tax on your KiwiSaver scheme is to understand how KiwiSaver options are taxed in the first place.

KiwiSaver Tax

You pay tax only on your returns from KiwiSaver, not on the entire balance. The amount of tax you pay is based on your Prescribed Investor Rate (PIR) with a maximum of 28%. Your KiwiSaver scheme will collect your share of the payable tax and pay the IRD on your behalf, in most cases.

What rate of tax will I pay?

The amount of tax you pay is based on your Prescribed Investor Rate (PIR) with an upper ceiling of 28%. In most cases, your scheme will collect your share of the payable tax and pay the IRD on your behalf based on the PIR you provide them upon joining KiwiSaver.

Your PIR for the current tax year depends on how much you earned in the previous two tax years. It’s your responsibility to tell your provider the correct rate, so if you are still unsure, here is a simple tool to help you calculate your PIR.

Selecting and providing the right PIR is essential to ensure not underpaying or overpaying your tax. Upon KiwiSaver sign up, if you do not provide your KiwiSaver provider with a PIR, you will be charged tax at a default rate of 28%. However, the IRD has now put systems in place via which they will calculate your PIR themselves and ask you to correct your tax rate if you have entered an incorrect rate. You can also go and correct it via your KiwiSaver login.

Which part of my KiwiSaver money is taxed?

Your KiwiSaver account earns money for you by investing your contributions. However, you only pay tax on the amount of money your KiwiSaver investment earns for you. So you do not pay tax on your principal amount, only on returns.

For example, John has $10,000 balance in his KiwiSaver account earning 5% returns annually. For the current year, say John earns $500 on his investment. It is only this $500 that is subject to tax.

The tax you will pay on income earned is also determined by what kind of KiwiSaver investment options you are invested in.

How is the tax applied?

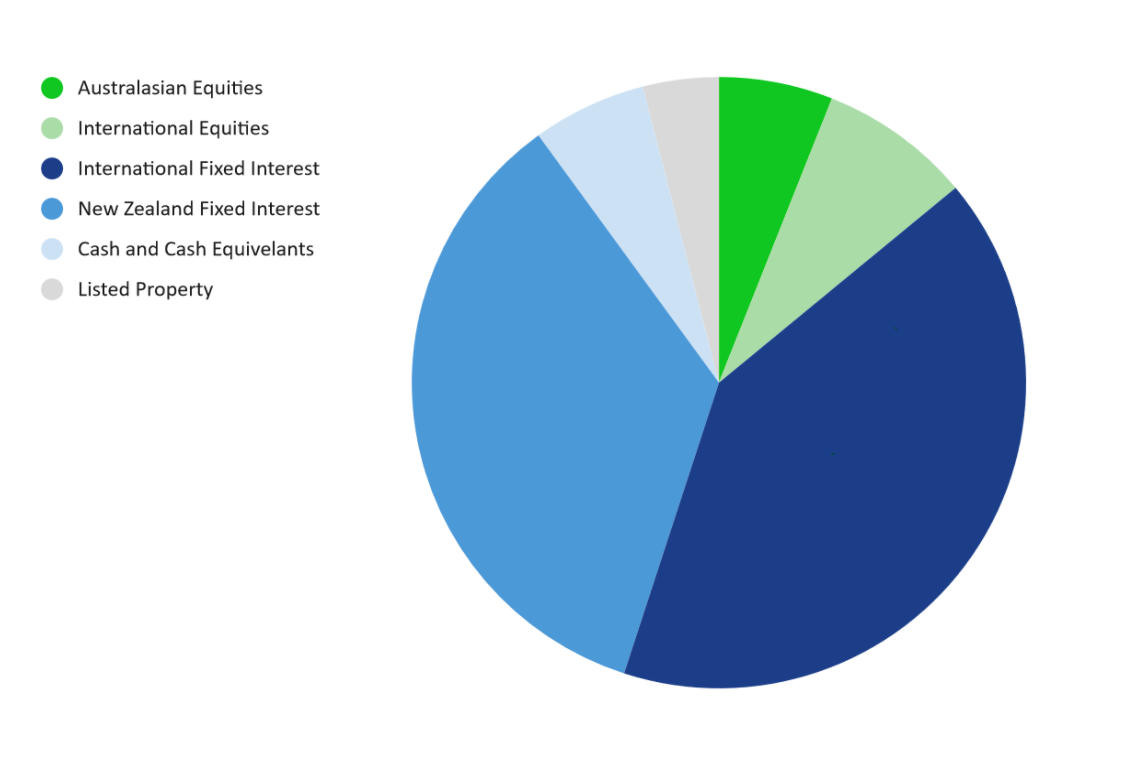

In most cases, your KiwiSaver scheme is a Portfolio Investment Entity. A PIE is a type of entity (such as managed funds) that invests your contributions in different types of investments as shown in the figure below;

Note: For more information on other types of schemes read the additional reading section below.

The PIE rules allow investment funds to pay tax on your share of investment earnings at your specific Prescribed Investor Rate (PIR) with an upper ceiling tax rate of 28%.

The amount of your share of taxable income you have to pay on the scheme’s earnings is calculated daily and attributed to you every quarter. Remember earnings here simply mean the $500 that John earned on his principal KiwiSaver account balance amount of $10,000.

Your share of taxable income changes depending on what kind of fund you are in as well as the asset allocation it has.

Domestic shares vs International Shares.

As most KiwiSaver schemes are PIE schemes, investments in some Australasian shares are exempted from tax by the Foreign Investment Fund rule, and gains on New Zealand shares are currently tax-free. The set of rules for companies that meet the ASX-listed Australian company share exemption criteria can be found here.

The value of this tax-free status is very valuable, particularly for younger investors who may be in KiwiSaver for 30-40 years and so get the compounding benefit of tax-free gains for a long period. However, tax on other international shares is paid on the income you derive from those shares.

For example, let’s assume John’s KiwiSaver scheme has a total balance of $10,000, of which $4,000 are invested in Australasian equities or shares, while the other $6000 are invested in international shares. According to the current taxation rules, the ‘income’ on the $4000 which are invested in Australasian shares are tax-free. However, John will have to pay tax on the ‘income’ he earns from $6000 from the international shares at his PIR rate.

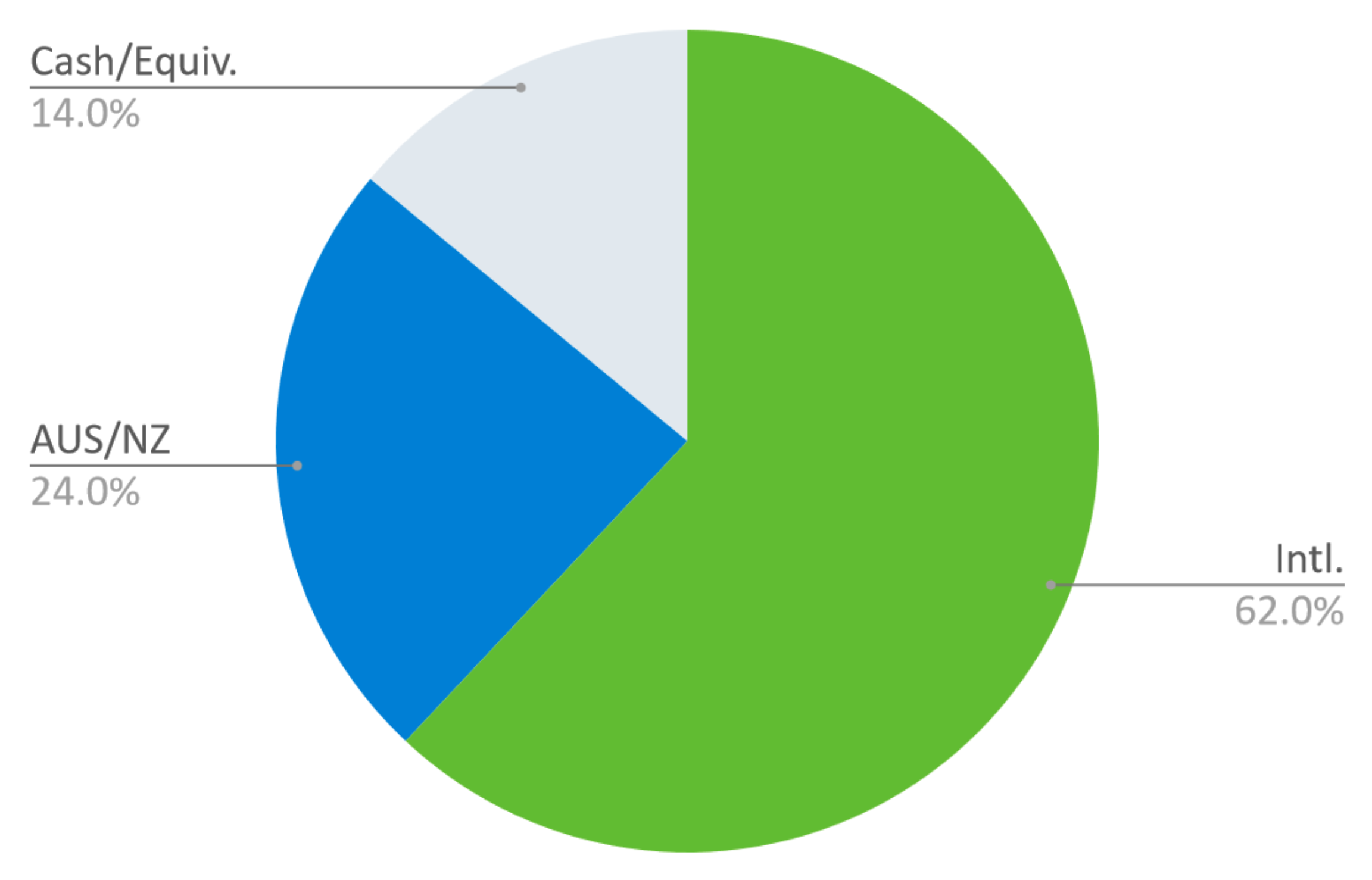

Below is an example of a fund with a percentage of the total assets invested in cash, Australasian, and international assets to better understand the distribution of assets in KiwiSaver fund investments.

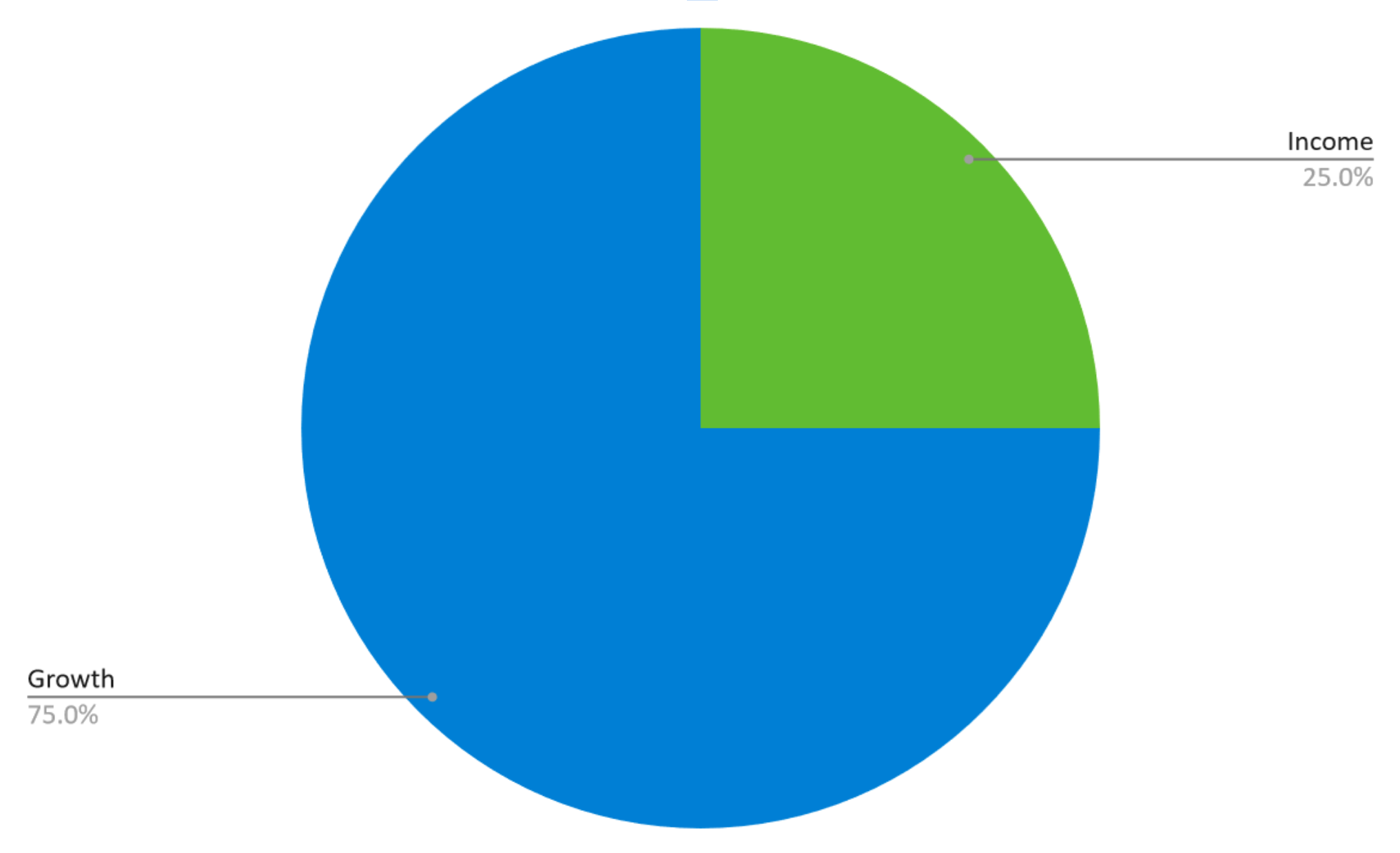

Below figures are an example of how a scheme’s allocation with respect to growth and income assets look like.

In most cases, growth assets such as shares, generate more taxable returns as compared to investments in bonds, fixed interest bonds etc. Thus a KiwiSaver scheme with a higher asset allocation to growth assets is likely to incur more tax as compared to a KiwiSaver scheme with more allocation to income investments. The amount of tax you will be charged thus will not just depend upon how much of your assets are invested in growth funds but also what proportion of your KiwiSaver funds have asset allocation in international shares.

Additional Reading

Types of KiwiSaver Schemes

There are two types of schemes:

- Widely held superannuation schemes

- Portfolio Investment Entities (PIE) schemes.

Having a quick look at your KiwiSaver provider’s Product Disclosure Statement can provide you with this information (All default funds are PIE schemes). If you are in a widely held superannuation scheme, your investment earnings will be taxed at 28%.

When is the PIE tax collected?

The PIE tax is collected from you at the end of each tax year and at the time of full withdrawal, based on year-to-year date accrual. When your PIE tax position is finalised, the tax will be collected or rebated based on set debit ordering rules.

The debit order rules will vary between products but what this generally means is the tax is collected or rebated from the most liquid investment (the most easily converted into cash) and, if exhausted, deducted from other investments in a prescribed order. You can speak with your KiwiSaver provider to understand what your debit ordering rules are.