Quarterly Report as of the quarter ended June 2024 (Published 30th Aug 2024)

There is an overwhelming number of KiwiSaver providers and funds to choose from. Furthermore, we know reading about all the different KiwiSaver funds and how they differ is one of those chores you’re inclined to put off as it’s not the most exciting weekend task.

We noticed that no one was holding the individual providers to account. We’ve appointed ourselves as an industry watchdog. We want to provide transparency (one of our core values) to New Zealanders planning for their futures. Therefore, the following (quarterly) KiwiSaver Value for Money Report aims to contribute towards that transparency you are after.

*Past performance is not necessarily indicative of future performance.

*All returns are per annum after fees and tax (28% PIR) as of the quarter ended 31st August 2025.

*Source: National Capital Research

We’re here to help find the best KiwiSaver fund for you. Our team are financial advisers specialising in KiwiSaver & Investment research. We provide free KiwiSaver advice, with the goal of empowering Kiwis to become financially secure.

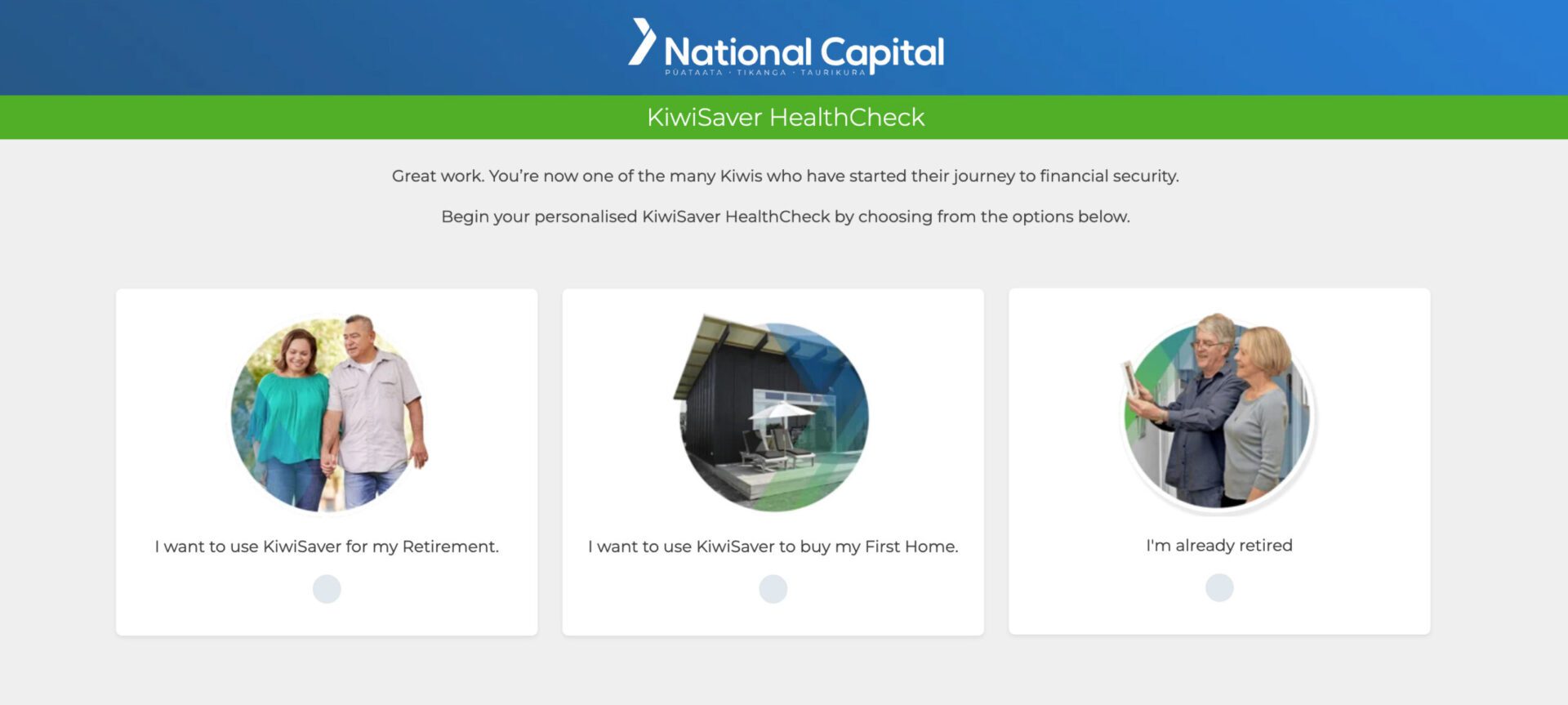

By taking a few minutes of your time to complete our KiwiSaver HealthCheck questionnaire, you will receive an instant recommendation tailored specifically to your goals and beliefs.

Our system combines the latest figures and technology to provide the most suited recommendations. Nonetheless, whether you take us up on the advice, is completely up to you.

You’ve had a read through the KiwiSaver Value for Money Report. Now what? The right fund will make a big difference to your KiwiSaver payout.