*Past performance is not necessarily indicative of future performance.

*All returns are per annum after fees and tax (28% PIR) as of the quarter ended 31st August 2025.

*Source: National Capital Research

We’re here to help find the best KiwiSaver fund for you. Our team are financial advisers specialising in KiwiSaver & Investment research. We provide free KiwiSaver advice, with the goal of empowering Kiwis to become financially secure.

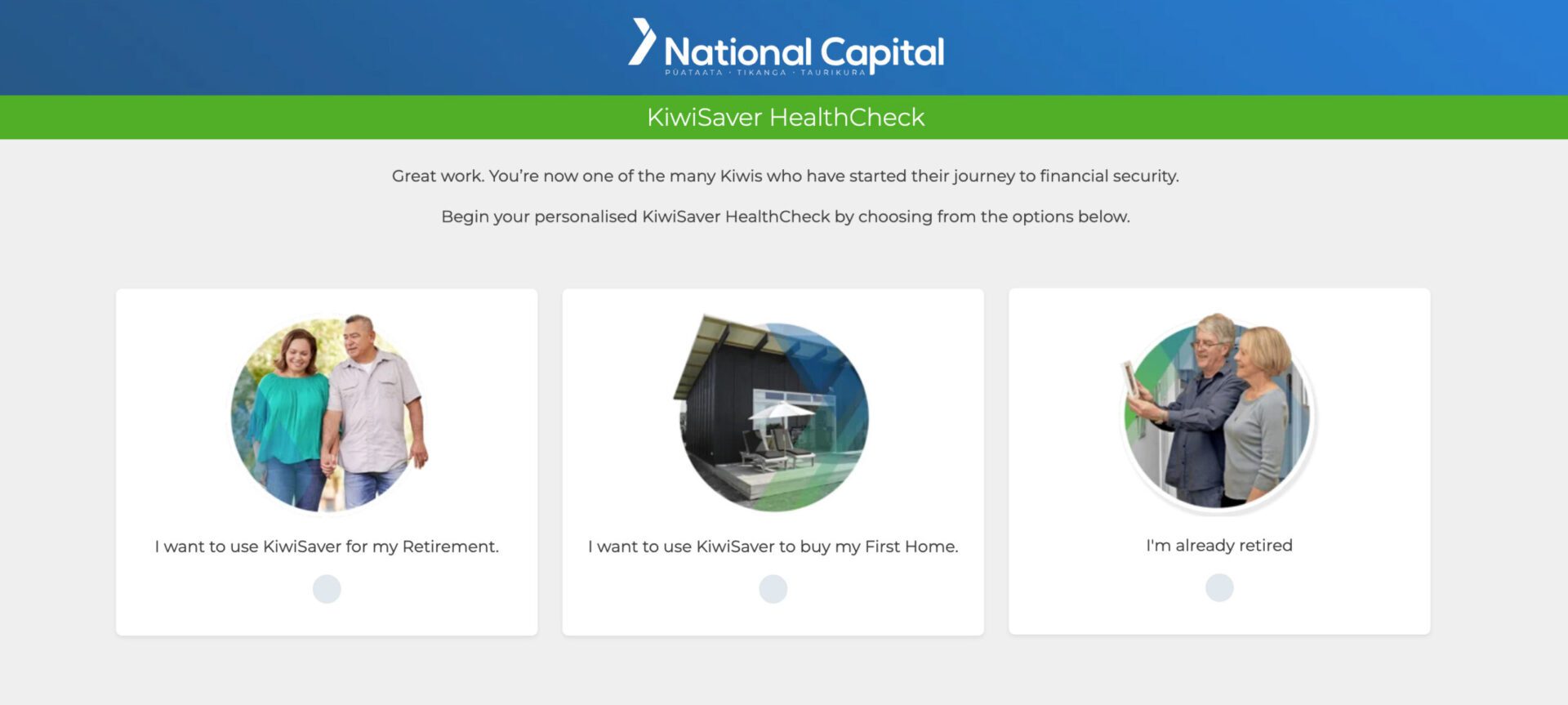

By taking a few minutes of your time to complete our KiwiSaver HealthCheck questionnaire, you will receive an instant recommendation tailored specifically to your goals and beliefs.

Our system combines the latest figures and technology to provide the most suited recommendations. Nonetheless, whether you take us up on the advice, is completely up to you.

There are many different ways you could interpret what a KiwiSaver calculator is used to find out, but one idea that may jump to the front of your mind is calculating what your KiwiSaver balance will be when you retire. Retirement can be a somewhat frightening topic for people to discuss and think about openly, and so it is very common to look for calculators that will paint a general picture of how financially secure their future is. Below are some of the different available calculators online, from several providers, that could help you paint your own retirement picture.

The Westpac KiwiSaver Scheme Calculator can be used to understand what your weekly retirement income might be at 65, based on several factors. It takes into account things like your age, employment status, yearly income before tax, and current KiwiSaver balance, to give you a general idea of what to expect in the future.

Other scenarios are also offered when you view your results, so that you can see how your retirement balance might be affected if you change things like your contributions, the type of KiwiSaver fund you are in, and the inclusion of NZ Superannuation.

However, as they say on their website, Westpac does not recommend taking this calculator as concrete proof of what your KiwiSaver balance will look like at retirement. It uses assumptions about the future and what returns we should expect, but it cannot accurately predict the future. Even though a KiwiSaver fortune-teller sounds ideal, it’s sadly not possible, and so the calculator should be treated as a guide, not a guarantee.

The BNZ KiwiSaver Scheme Calculator uses your personal details like age, current KiwiSaver balance, and income before tax, to estimate the amount of money you should have saved by retirement at 65. This value can be adjusted if you want to change your voluntary or employee contributions, and shows the retirement income you would have, based on these factors.

Your predicted retirement income can change a lot depending on what KiwiSaver fund you choose to be in, and this calculator takes that into account. If you want to see these changes in action, BNZ has provided an easy-to-use system, where you can slide between their different available funds and see their effects on your potential retirement income.

Once again, this calculator uses assumptions to estimate its results, and so BNZ recommends that you only use it as a tool for understanding how your choices could affect your retirement funds, and not as a guaranteed representation.

The Milford KiwiSaver Retirement Calculator helps provide an estimate of your retirement KiwiSaver balance, and what your future retirement income could look like as a result. It takes personal information such as your age, the type of fund you’re in, your gross annual salary, your current KiwiSaver balance, and any present contributions to your balance, to give you an estimated retirement balance amount when you are 65.

Sometimes it can be difficult to imagine what your retirement income looks like over the period of your retirement. This calculator has a handy feature where it creates a graph showing a timeline of your KiwiSaver balance savings during your working years, and retirement years. It also features a second graph that shows your estimated savings amounts over time, when you choose different contribution rates.

These visual graphs can be very helpful in understanding how your savings could be affected by your KiwiSaver choices, but again, they are estimated, and you should not use them as expectations. Milford uses assumptions, like inflation rates, to help create estimations, but returns can change in unexpected ways, so it is important to know where the line between fact and prediction is.

In summary, these are just a few of the calculators you can find online to estimate KiwiSaver retirement savings, and there are obviously many more available, such as the Generate Wealth calculator, or ASB’s KiwiSaver Scheme Calculator.

In the end, whichever retirement calculator you use online, you will get an estimated result that uses the provider’s own assumptions and information. It is important to remember that the result you are shown could sometimes be surprising or shocking if you were expecting something different. This is not a reason to panic.

National Capital can give you free KiwiSaver recommendations and advice tailored to your unique financial situation, so that you can feel comfortable and ready to make the important decisions for your retirement.

Life can be a twisting tunnel with unexpected turns, but one thing that we all want to be sure of is that we will have a roof over our heads. Something you might be wondering is how much money you will have to put towards your first home in the near or far future. With the New Zealand housing market being in the state that it currently is, people want to be sure of when they can enter the market themselves, especially younger KiwiSaver investors. Below are some of the first home KiwiSaver calculators that are available online, to help you get a better idea of when you might be able to enter the market.

At National Capital, we also offer a KiwiSaver First Home HealthCheck, using personal information to give you realistic recommendations towards buying your first home and entering the market, based on professional research and financial advisor experience.

The Live Sorted KiwiSaver Calculator helps give an estimate of the amount of money you could have to put towards your first home in a certain time period. Basically, it lets you know how close you are to affording your first home in the time that you want it in, and it uses information such as your fund type, age, income and KiwiSaver contributions to calculate this.

This calculator gives you the ability to alter details after seeing your results too, meaning you can see the graphs and numbers change for each unique scenario you may imagine in your future. Beyond being just a first home calculator, this page also links to a future mortgage calculator, so that you can find more information after you learn when this will be important.

As stated on their website, Live Sorted makes several assumptions in this calculator, such as inflation, and gradual contribution increases, among many others. This means that you should not use their first home calculator as a factual statement, but as more of a general idea of what could likely happen.

When it comes to making financial decisions in your life, there are lots of things that might cross your mind which could impact the decision you make. This could mean that you look for ways to ‘calculate’ different parts of your financial situation to make it easier to understand.

KiwiSaver is the same. There may come a time when you feel overwhelmed by the different factors affecting your decisions, and you might look for KiwiSaver calculators to answer your questions. However, it is important to understand that sometimes, what you are looking for when you think of the words ‘KiwiSaver calculator’, is not the same as the page that you will click on. For example, a young couple saving for their first home may search for a “KiwiSaver calculator” online, but click on a calculator that is meant for elderly couples wanting to retire. In the same way, elderly citizens may click on a calculator intended for first-home buyers. Both parties may have searched the same keywords, but what they are individually looking for might be very different.

At National Capital, we have a goal of helping 1 million Kiwis become financially secure, and so we see it as our duty to help you better understand everything about KiwiSaver. Hopefully, after reading this blog, you will feel more informed about the different calculator options that are available out there, so that you can find the right one for your unique situation.

If you are feeling stuck, and looking for personalised KiwiSaver recommendations tailored to your own situation, take our KiwiSaver HealthCheck to start the journey to financial freedom. You’ll then be on track to a stable retirement or saving for your first home.

Note: The following information is general information and is not personalised advice. If you want personalised advice on which KiwiSaver fund is most appropriate for you, please submit the KiwiSaver HealthCheck.

The AMP KiwiSaver Calculator can help you to understand how likely it is for you to reach your first home aspirations in the time you want to. It gives you a result based on factors such as the first home deposit you need, the time you need it in, your KiwiSaver contributions, and your current fund type and balance.

This calculator displays three numbers: your projected deposit, which is estimated from your information; your target deposit that you entered; and your surplus/shortfall, which is the difference between your projected and target deposits. You can change details and see the direct impact on your predicted first home journey, until you have a positive surplus, meaning that you should reach your goal based on the information you gave the calculator.

Before you see your results from this calculator, it will remind you that it also uses assumptions, and will only give you an indication of how much your KiwiSaver account will help you to reach your first home goals. Again, these results should not be considered personalised advice, and if you want more detailed predictions, you should look for more tailored advice.

Besides being useful for retirement balance KiwiSaver estimations, the Westpac KiwiSaver Scheme Calculator can also be used to help create an idea of how much money you could likely withdraw to put towards your first home, in the time period you want. It uses the same information like your age, balance, KiwiSaver fund type, and income, to give you these estimated results.

This calculator lets you change things like additional weekly contributions and your fund type, so that you can test how different future scenarios might play out and impact your estimated first home withdrawal. It also lets you slide your withdrawal time to different years so that you can see the increase in withdrawal size overtime on a visualised graph.

As we already mentioned earlier, this calculator also uses assumptions to calculate and estimate your personal results, and so you should take them as guidance instead of fact.

In summary, these are only a few of the many calculators that you can find to estimate your first home’s financial requirements through, and give you an indication of when you can reach your goals toward entering the market with the help of KiwiSaver. Other calculators are available online to help with your KiwiSaver and first-home questions, including some that can predict loans you may need to borrow to afford a home in the future.

If you choose to use these online first-home calculators for guidance, it is important for you to understand that New Zealand’s housing market is highly competitive at this point. This may mean that you are surprised or shocked by the results that these calculators give you, but it does not mean your goals are out of reach. Seek professional KiwiSaver and property investment advice if you are feeling overwhelmed by the decisions you have to make.

If you feel as though your questions are about something that hasn’t been mentioned in this article so far, there are more specific calculators available too, besides retirement or first homes. A couple of these different options can be found below.

Your Prescribed Investor Rate (or PIR) is the rate that can be used to calculate how much tax you will pay on your KiwiSaver funds’ taxable income. The Inland Revenue Department (IRD) offer a PIR Calculator on their website that is simple to use, but other companies present options too. Superlife also offers a PIR Tax Rate Guide that you can use to calculate what PIR bracket you are in.

If you are wanting to find out the fees that apply to different types of funds and providers, and a basic explanation of services and fees between them, Live Sorted offer their Sorted KiwiSaver Fees Calculator. This can help you see what fees you are likely to be charged up until retirement, and see the comparisons between similar fund types.

Sometimes, you might look at all these available calculator options and still not find the answer you’re looking for. In all the hustle and bustle of everyday life, it can be hard to weigh your options effectively surrounding your KiwiSaver, while staying on top of everything else. That is why we ask you: “What is it that you are really trying to find out?”, because we understand that sometimes you just can’t afford to waste your time looking in the wrong place.

If you find yourself in this situation, looking for answers in KiwiSaver calculators without success, it may be time to look for advice elsewhere. These online resources can be very helpful, but they can’t answer some of the more complex KiwiSaver questions and issues you might have. That’s where National Capital can step in for you.

We can give you the personalised KiwiSaver financial advice that you need, which we create based on professional research and experience, so that you can keep on top of everything else in life while we find the answers. Just take our KiwiSaver HealthCheck, and get recommendations tailored to your situation, from our trusty financial advisors.

Utilising KiwiSaver calculators can provide more certainty with your goals and will enable you to understand where your heading.

Spending 10 minutes to complete our KiwiSaver HealthCheck form may be the most important thing you can do for your KiwiSaver account right now.