During every financial bubble, we will come across ‘experts’ in the media who are utterly convinced and try to convince the rest of us, that in terms of our economic future, “this time is different.”

These loud voices get even louder (though now saying the exact opposite) when the market starts falling. There will be stories of why the world economy is going to end this time, why this time the bear market will not reverse its trend like others before it, and why this time… is different.

But, the truth is, it’s actually not.

Bear Markets

We’re in a bear market right now, one that is defined as a drop in the share market of 20% or more from recent highs. There are a few things we should know about bear markets…

1. If you miss one, the next will come along pretty soon

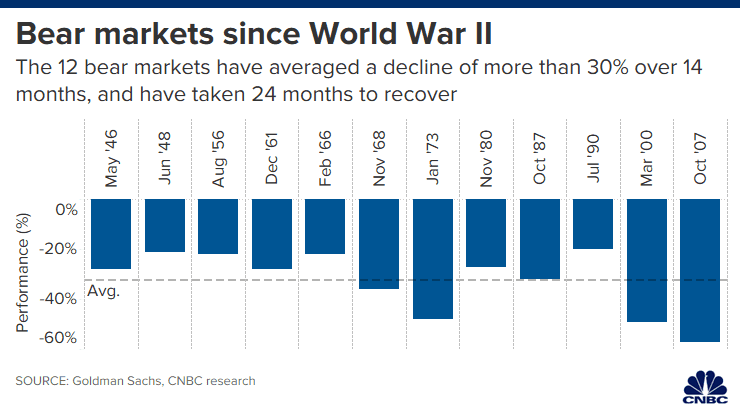

In the last 74 years, there have been 13 bear markets ( this one included) – that is an average of one every 5.69 years. The cricket world cup is played once every 4 years, so a bear market takes place only slightly less regularly than that. If you are an investor, get used to them.

2. Bear Markets are temporary, even though they might not seem so

Every bear market eventually comes to an end. When we are in the midst of one, it’s hard to see the other side, but, there is always an other side. The longest bear market lasted a little over 3 years which is a long time, but when seen in the context of an investors lifetime it is no more than a blip.

3. It’s Bear Markets where money is made

There is a reason why the long term average of equities is 9-10% while your local bank offers you a term deposit with an interest rate of 2%-3%. You are being paid for enduring volatility and bear markets.

(image courtesy CNBC.com)

But this is an unprecedented event…

That is for sure. Never before have world leaders taken steps such as these in response to a virus outbreak. This is definitely an unprecedented event.

But so was World War 2, the Dot com bubble and the Global Financial Crisis where stock markets fell more than 50%. We need to remember that every such major world event had a sense of doom and finality for the people who lived through it. Very much the same to what most of us are feeling right now. However, the world and our economy moved past these events and got stronger, which will happen again. Lets learn from history.

So what does this mean for us?

Bear markets are scary for anyone who has a major chunk of their life savings invested in the stock market. There is no denying that. We are human. As investors its OK feeling uneasy.

What we need to remember is that we will always have problems and crises. But as a species we will always find answers for them. The world will feel like it’s coming to end from time to time, but it won’t. Businesses will get back to their feet, and your Investment fund or KiwiSaver account will start growing again.

Use historical facts and context to guide your decision making, and remember, this time is never different.