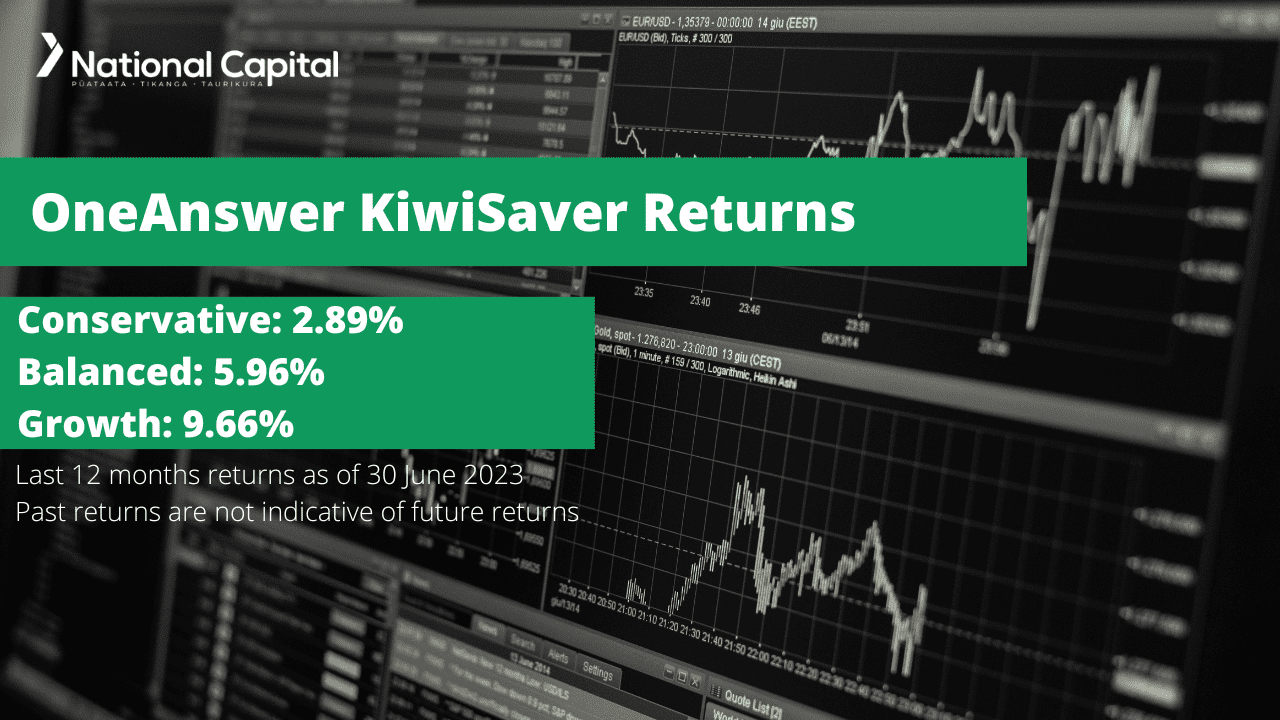

Using the most recent returns and fund update reports as of September 2023, we will examine OneAnswer’s recent KiwiSaver performance.

OneAnswer is a KiwiSaver scheme run by ANZ bank. It is run by ANZ Investments. The bank of ANZ itself was established in Sydney, Australia under the Royal Charter. It was established in New Zealand in 1840, making it New Zealand’s oldest bank. It has a strong heritage in Business Banking and offers a full range of banking options, including Personal, Rural, Corporate, Commercial, Institutional and Private Banking. In 1951, UBA and the Bank of Australasia merged to become Australia and New Zealand Bank (ANZ Bank).

ANZ moved its corporate headquarters to Melbourne, Australia in 1976, and three years later an Act of Parliament permitted ANZ to incorporate its branches in New Zealand as ANZ Banking Group (New Zealand) Ltd. ANZ sold 25% of the shares to the public.

Table of Contents

News about OneAnswer

Performance of OneAnswer KiwiSaver Funds

OneAnswer Conservative Fund

OneAnswer Balanced Fund

OneAnswer Growth Fund

News about OneAnswer

At ANZ, they’re always looking for ways to help customers get the most out of their investments. That’s why they recently introduced a new High Growth Fund across their OneAnswer KiwiSaver Scheme and OneAnswer Multi-Asset-Class Funds, providing customers with more choice.

Performance of OneAnswer KiwiSaver Funds

| Funds |

1 Year |

5 Year |

Since Inception |

|

Conservative |

2.07% |

1.99% |

4.47% |

|

Balanced |

4.01% |

3.78% |

5.79% |

|

Growth |

6.61% |

5.57% |

6.83% |

Sourced From OneAnswer Fund Performance Report

These returns are to 31 August 2023 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from OneAnswer’s Quarterly Fund Updates published on 30 June 2023.

OneAnswer Conservative Fund

The Conservative Fund invests mainly in income assets (cash and cash equivalents and fixed interest), with a smaller exposure to growth assets (equities, listed property and listed infrastructure). The fund may also invest in alternative assets.

The following is sourced from OneAnswer Conservative Fund Update

Returns

Fees

The total annual fees for investors in the OneAnswer Conservative Fund are 0.61%

Investment mix

The investment mix shows the types of assets that the fund invests in.

Top ten investments

This table shows OneAnswer´s top 10 investments in the Conservative KiwiSaver Fund, which make up 11.30% of the fund.

OneAnswer Balanced Fund

The Balanced Fund invests in similar amounts of income assets (cash and cash equivalents and fixed interest) and growth assets (equities, listed property and listed infrastructure). The fund may also invest in alternative assets.

The following is sourced from OneAnswer Balanced Fund Update

Returns

Fees

The total annual fees for investors in the OneAnswer Balanced Fund are 0.95%.

Investment mix

The investment mix shows the types of assets that the fund invests in.

Top ten investments

This table shows OneAnswer´s top 10 investments in the Balanced KiwiSaver Fund, which make up 8.71% of the fund.

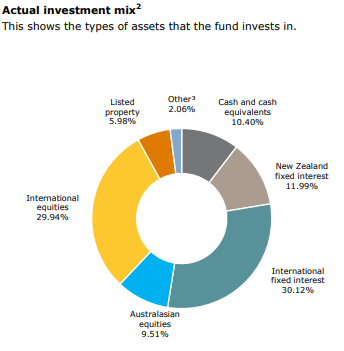

OneAnswer Growth Fund

The Growth Fund invests mainly in growth assets (equities, listed property and listed infrastructure), with a smaller exposure to income assets (cash and cash equivalents and fixed interest). The fund may also invest in alternative assets.

The following is sourced from OneAnswer Growth Fund Update

Returns

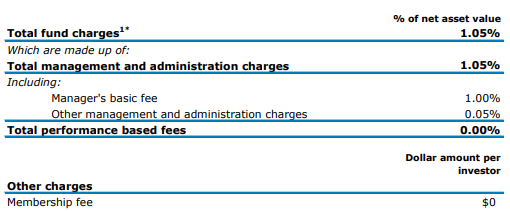

Fees

The total annual fees for investors in the OneAnswer Growth Fund are 1.05%.

Investment mix

The investment mix shows the types of assets that the fund invests in.

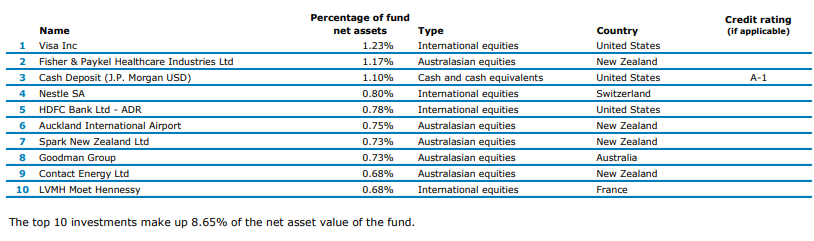

Top ten investments

This table shows OneAnswer´s top 10 investments in the Growth KiwiSaver Fund, which make up 8.65% of the fund.

Data for OneAnswer KiwiSaver funds have been sourced from OneAnswer KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if OneAnswer has the appropriate fund that aligns with your value, retirement goals, and situation, complete National Capital’s KiwiSaver HealthCheck.