First home buyers and the new regulations

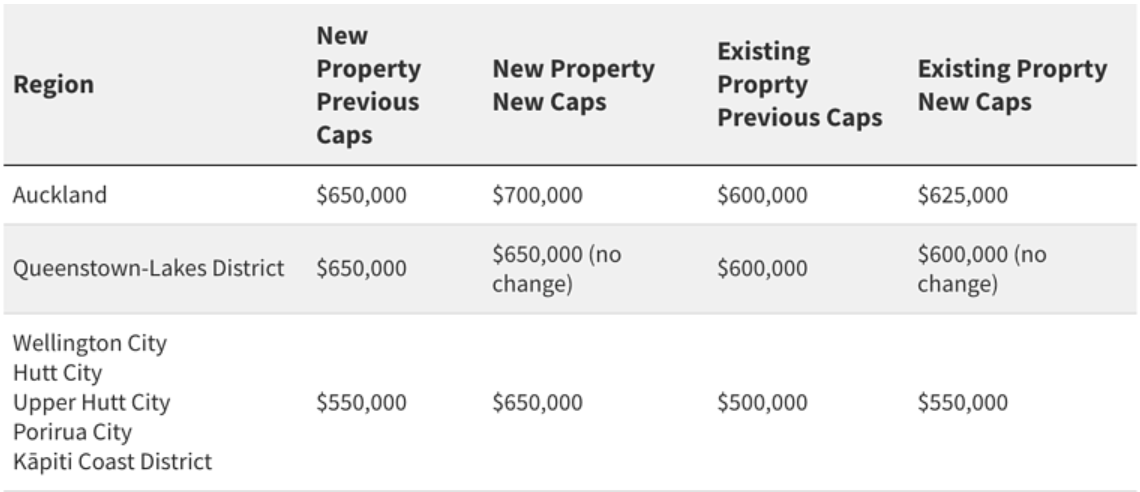

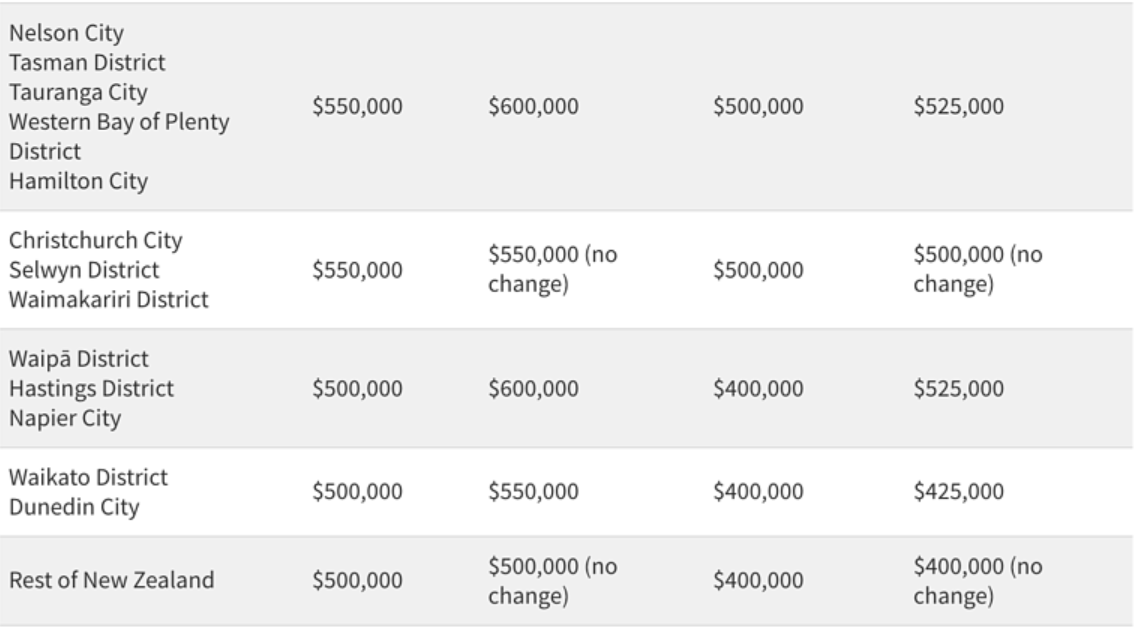

On March 23rd, 2021, the New Zealand government announced its new policy designed to rebalance the property market in favour of first home buyers. The government has now increased the income cap and the house price cap for people wishing to apply for a First Home Grant or First Home Loan as part of their deposit when buying their first home. While previously the maximum you could earn was $85,000 (before tax) for one person or $130,000 (before tax) for two people or more, things have now changed. The new income cap is $95,000 (before tax) for one person and $150,000 for two people or more while the minimum required deposit is at 5% of the house price.

Previously, most lenders needed at least a 20% deposit, now participating banks have dropped their required minimum to accommodate first time buyers. You do, however, need to be a KiwiSaver contributor to qualify for this type of loan, called a First Home Loan. The criteria to become eligible for a First Home Grant is the same as the criteria for the First Home Loan. The amount you receive in the grant will depend on the number of years you have contributed to your KiwiSaver Scheme. For example, for people buying existing homes, they can receive up to $1,000 for each year they have contributed for a maximum of five years, taking their grant up to $5,000 maximum. A person buying land or new homes can receive up to $2,000 per each year they have contributed for a maximum of up to five years, allowing their grant to potentially reach a maximum of $10,000. Two people buying together can combine their grants to put towards their purchase of a joint property for a maximum grant of $20,000.

Clive Fernandes, director of National Capital, said, “These new rules will really benefit first home buyers.” National Capital advises the public more than ever to pay more attention to their KiwiSaver, as it could significantly help improve their chances of getting first home loans and progressively, buying that dream first home.

Source: www.rnz.co.nz

How the government will regulate the supply

All these changes are good and well but they do not help much if houses are in short supply. What the government has promised to do is pay for the infrastructure that is needed to make more land available to build on. It has also created the Housing Acceleration Fund with $3.8 billion invested to make this plan a reality.

The National Policy Statement on Urban Development is what the government is using to implement the expectation that councils across New Zealand free up land fit for building on.

The projected number of homes built through this policy is expected to reach up to 130,000 but the real numbers will depend on a number of factors. How Iwi’s, councils, private developers and the not-for-profit sector implement this policy will determine the real number of houses built.

The Kāinga Ora Land programme which works at purchasing land on behalf of the government will also borrow an extra $2 billion with the goal of increasing the public housing supply.

How the government will regulate demand

In order to decrease the demand from those owning more than one home, the government is increasing what is known as the “bright line test”. What that means is that those owning more than one property will have to pay tax on its sale if it happens in under ten years from the date of purchase. The family home does not fall under this category, only properties owned on top of that. Newly built properties, however, remain under the old rule of five years. This new ruling came into effect on 27 March 2021.

The tax on it will be calculated as income tax taken from the profit made on the property.

The government is also attempting to close any known “loopholes” in the effort to sway people from speculation.

Under the current policies, buyers of multiple properties can claim interest on their loans as an expense when filing income tax, meaning they pay less tax. Under the new policy this will not be allowed anymore for residential property bought before the 27th of March 2021. For properties bought before 27 March 2021, the goal is to phase the policy out within the next four to five years, so people will still be able to claim tax deductions but the deductions will get smaller and smaller until they no longer exist. This is to be achieved by 2025-2026.

KiwiSaver Advice

Thinking about using your KiwiSaver to buy your first home? National Capital is a research-driven, independent KiwiSaver advice provider that can help you make it happen. Complete our KiwiSaver HealthCheck to get started.

Published on: