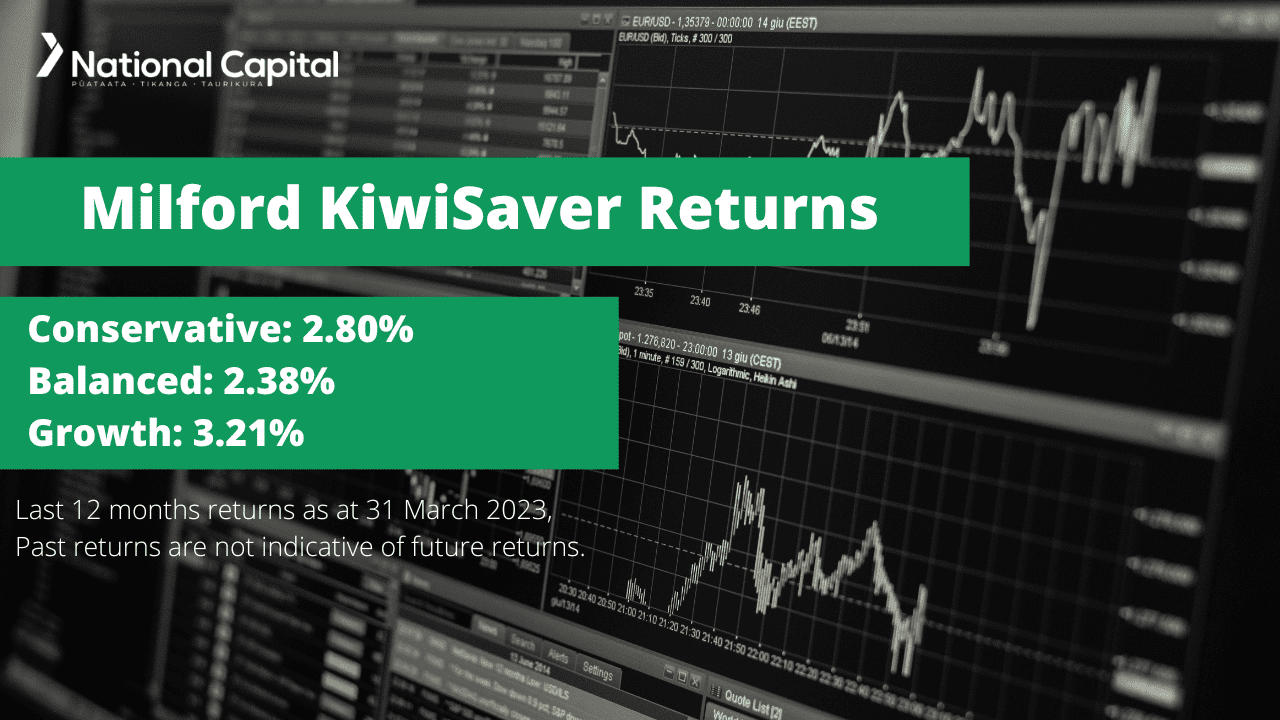

Using the most recent returns and fund update reports from 31 March 2023, we will examine Milford’s recent KiwiSaver performance.

Milford Asset Management is a majority New Zealand-owned company specialist investment firm founded in 2003 with the goal of generating wealth for investors. They operate across different locations with 180 employees. Currently, Milford manages over $15 billion of funds. They provide KiwiSaver Fund, managed investment fund, and wealth Management. Milford operates six KiwiSaver funds with different investor profiles.

Table of Contents

News about Milford

Performance of Milford KiwiSaver Funds

Milford Cash Fund

Milford Conservative Fund

Milford Moderate Fund

Milford Balanced Fund

Milford Growth Fund

Milford Aggressive Fund

News about Milford

In recent news, Milford has been named Morningstart´s Overall New Zealand Fund Manager of the Year 2023 and Fund Manager of the Year in KiwiSaver. This is the third year in a row that Milford won the title and the second year received the KiwiSaver Award. The annual Awards are selected by Morningstar’s Manager Research analysts who celebrate and recognise the best of the New Zealand Fund management.

Performance of Milford KiwiSaver Funds

|

3 Month |

1 Year |

3 Year |

5 Year |

Since Inception |

|

|

Cash |

1.13% |

3.53% |

1.52% |

N/A |

1.49% |

|

Conservative |

0.86% |

2.80% |

2.56% |

3.39% |

6.75% |

|

Moderate |

1.44% |

2.51% |

5.08% |

N/A |

6.19% |

|

Balanced |

1.70% |

2.38% |

8.59% |

7.18% |

9.22% |

|

Active Growth |

1.22% |

3.21% |

11.48% |

8.76% |

11.69% |

|

Aggressive |

2.96% |

4.12% |

12.10% |

N/A |

9.75% |

Sourced From Milford Fund Performance Report

These returns are to 31 March 2023 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from Milford Quarterly Fund published on 28 April 2023.

Milford Cash Fund

After the base find fee but before tax, Milford´s Cash Fund aims to target returns above the New Zealand Official Cash Rate. It invests mainly in New Zealand cash, short-dated debt securities, and term deposits. The Cash Fund has a 3-month return of 1.13% and a 1-year return of 3.53%, which 1-year return is greater than the since inception return of 1.49%.

The following is sourced from Milford Cash Fund Update

Returns

Fees

The total annual fees for investors in the Milford Cash Fund are 0.20%

Investment mix

The investment mix shows the types of assets that the fund invests in.

Top ten investments

This table shows Milford´s top 10 investments in the Cash KiwiSaver Fund, which make up 64.02% of the fund.

Milford Conservative Fund

Over a minimum investment period of three years, Milford´s Conservative Fund aims to provide moderate returns while safeguarding capital after the base fund fee. It invests mainly in fixed-interest securities, but with a moderate portion allocated to equities. The Conservative Fund has a 3-month return of 0.86% and a 1-year return of 2.80%, which is lower than the since inception return of 6.75%.

The following is sourced from Milford Conservative Fund Update

Returns

Fees

The total annual fees for investors in the Milford Conservative Fund are 0.95%.

Investment mix

The investment mix shows the types of assets that the fund invests in.

Top ten investments

This table shows Milford´s top 10 investments in the Conservative KiwiSaver Fund, which make up 15.45% of the fund.

Milford Moderate Fund

Over a minimum investment period of four years, Milford´s Moderate Fund aims to provide moderate returns and capital growth, after the base fund fee but before taxes and performance fee. It invests mainly in fixed-interest securities, but with a moderate portion allocated to equities. The Moderate Fund has a 3-month return of 1.44% and a 1-year return of 2.51%, which is lower than the since inception return of 6.19%.

The following is sourced from Milford Moderate Fund Update

Returns

Fees

The total annual fees for investors in the Milford Moderate Fund are 0.95%.

Investment mix

The investment mix shows the type of assets that the fund invests in.

Top ten investments

This table shows Milford´s top 10 investments in the Moderate KiwiSaver Fund, which make up 15.92% of the fund.

Milford Balanced Fund

Over a minimum investment period of five years, Milford´s Balanced Fund aims to provide capital growth after deducting the base fund fee but before tax and performance fees. It invests mainly in equities but with a significant portion allocated to fixed interest. The Balanced Fund has a 3-month return of 1.70% and a 1-year return of 2.38%, which is lower than the since inception return of 9.22%.

The following is sourced from Milford Balanced Fund Update

Returns

Fees

The total annual fees for investors in the Milford Balanced Fund are 1.05%.

Investment mix

The investment mix shows the types of assets that the fund invests in.

Top ten investments

This table shows Milford´s top 10 investments in the Balanced KiwiSaver Fund, which make up 17.69% of the fund.

Milford Growth Fund

Over a minimum investment period of nine years, Milford´s Growth Fund aims to provide 10% of the annual return after deducting the base fund fee but before tax and performance fees. It invests mainly in equities but with a moderate portion allocated to fixed-interest securities. The Growth Fund has a 3-month return of 1.22% and a 1-year return of 3.21%, which is lower than the since inception return of 11.69%.

The following is sourced from Milford Growth Fund Update

Returns

Fees

The total annual fees for investors in the Milford Growth Fund are 1.05%.

Investment mix

The investment mix shows the types of assets that the fund invests in.

Top ten investments

This table shows Milford´s top 10 investments in the Growth KiwiSaver Fund, which make up 21.05% of the fund.

Milford Aggressive Fund

Over a minimum investment period of ten years, Milford´s Aggressive Fund goal is to maximise capital growth after deducting the base fund fee but before tax and performance fee. It invests mainly in international equities but with a moderate portion allocated to Australian equities. The Aggressive Fund has a 3-month return of 2.96% and a 1-year return of 4.12%, which is lower than the since inception return of 9.75%.

The following is sourced from Milford Aggressive Fund Update

Returns

Fees

The total annual fees for investors in the Milford Aggressive Fund are 1.15%.

Investment mix

The investment mix shows the types of assets that the fund invests in.

Top ten investments

This table shows Milford´s top 10 investments in the Aggressive KiwiSaver Fund, which make up 27.29% of the fund.

Data for Milford KiwiSaver funds have been sourced from Milford KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if Milford has the appropriate fund that aligns with your value, retirement goals, and situation, complete National Capital’s KiwiSaver HealthCheck.