Using the most recent returns from 30th September 2021, we’ll look at JUNO’s recent KiwiSaver Performance.

JUNO is a relatively new KiwiSaver Scheme, launched by Pie Funds Management Limited in 2018. JUNO has close to 80% of their KiwiSaver members in their Growth Fund. In addition, JUNO has members pay a monthly fee that increases based on the size of their KiwiSaver balance. The transparent monthly fee structure allows JUNO to have no other hidden fees.

During September, the share market and JUNO’s KiwiSaver Funds had a drop in returns. This could be because of Covid restrictions, the market settling down after last year’s significant returns or other external factors. However, if you are regularly checking in with a trusted financial advisor, you as a KiwiSaver investor shouldn’t worry as it’s natural for the market to fluctuate and doesn’t always indicate the performance of these funds long term.

Table Of Contents

Performance of JUNO’s KiwiSaver Funds

JUNO Conservative Fund

JUNO Balanced Fund

JUNO Growth Fund

Performance of JUNO’s KiwiSaver Funds

| 1 month | 3 months | 6 months | 1 year | 3 years (p.a) | Since inception | |

| JUNO Conservative Fund |

-1.07% |

-0.83% |

0.47% |

4.26% |

4.85% |

4.75% |

| Market index |

-0.81% |

-0.35% |

1.77% |

4.55% |

4.64% |

4.84% |

| JUNO Balanced Fund |

-2.34% |

-1.61% |

0.83% |

9.75% |

10.20% |

9.94% |

| Market index |

-1.29% |

-0.10% |

4.51% |

13.52% |

7.69% |

8.09% |

| JUNO Growth Fund |

-3.60% |

-2.48% |

1.55% |

16.19% |

16.93% |

16.91% |

| Market index |

-1.54% |

0.06% |

6.08% |

18.73% |

9.33% |

9.85% |

Note: As the Fund has not been in existence for five full years, it uses market index returns as well as actual returns. During times of extreme market volatility, the risk may be greater than indicated, particularly this fund as it invests in smaller companies; smaller companies can be more volatile when markets sell down. Past performance may not be a reliable indicator of future performance.

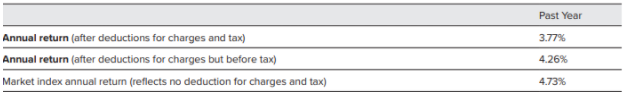

JUNO Conservative Fund

JUNO’s Conservative fund invests primarily in cash held on-call or term deposits with New Zealand registered banks and the JUNO Balanced fund. The Conservative fund is directed at KiwiSaver members with a short investment horizon or low comfort with volatility. The fund has a 1 month return of -1.07%. This return is lower than the market index average of -0.81%, meaning it could be more volatile than other providers conservative funds. The fund’s 1-year return of 4.26% is also slightly below the market index of 4.55%. This is normal as the return since inception of 4.75% is slightly below the market index of 4.84%. The Conservative fund is also JUNO’s fund with the highest annual fees of 0.49%.

Returns

*Source JUNO Fund Update

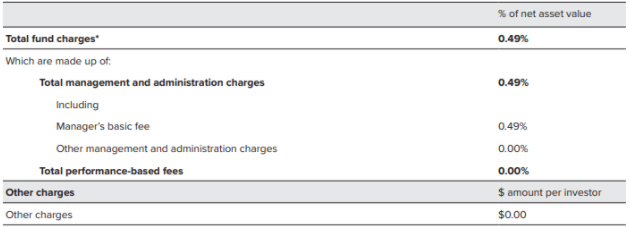

Fees

The total annual fees for investors in the JUNO Conservative fund are 0.49% per year, not including the 1 monthly membership fee.

*Source JUNO Fund Update

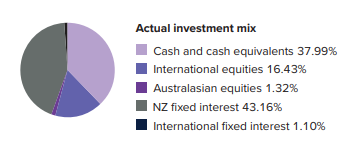

Investment Mix

This shows the type of assets that the fund invests in.

*Source JUNO Fund Update

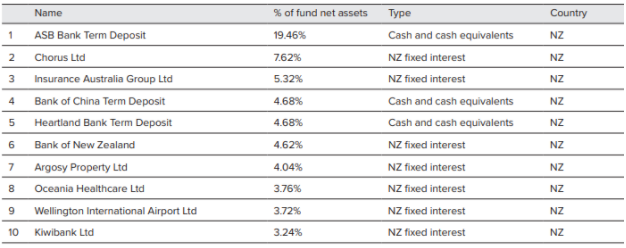

Top ten Investments

The following is JUNO’s top 10 investments in the Conservative fund, which make up 61.14% of the fund.

*Source JUNO Fund Update

JUNO Balanced Fund

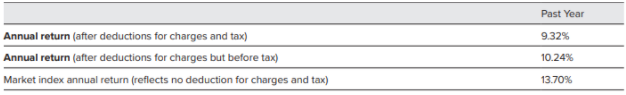

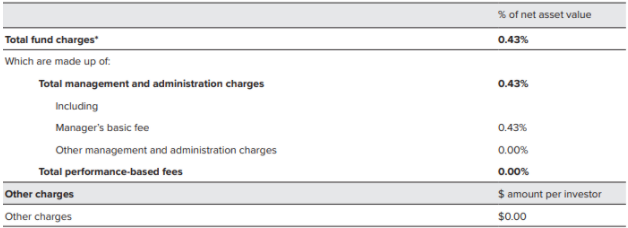

JUNO’s Balanced fund invests in equities and cash and fixed international interest and the JUNO Growth fund. The fund is targeted at KiwiSaver investors who have a medium-term investment horizon. The fund has a 1 month return of -2.34%, which is under the market index of -1.29. This could be due to the recent lockdown and its effect on the value of the fund. The 1-year return of the balanced fund was 9.75%, which is considerably smaller than the market index of 13.52% and slightly below the returns since inception of 9.94%. The Balanced Fund is also JUNO’s fund with the lowest annual fee of 0.43%.

Returns

*Source JUNO Fund Update

Fees

The total annual fees for investors in the JUNO Balanced fund are 0.43% per year, not including the 1 monthly membership fee.

*Source JUNO Fund Update

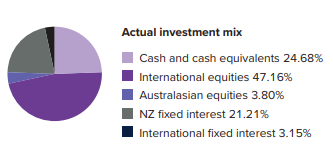

Investment Mix

This shows the type of assets that the fund invests in.

*Source JUNO Fund Update

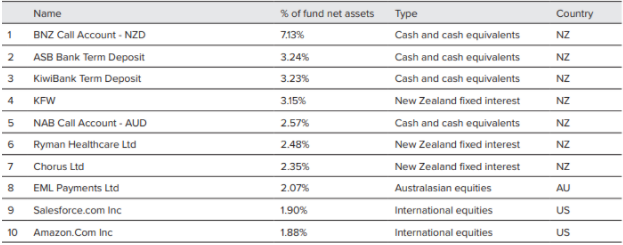

Top ten Investments

The following is JUNO’s top 10 investments in the Balanced fund, which make up 30.00% of the fund.

*Source JUNO Fund Update

JUNO Growth Fund

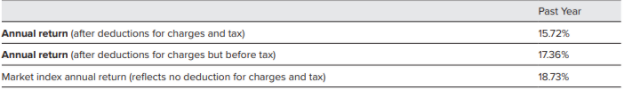

JUNO’s Growth fund invests primarily in international equities with a focus on globally-known brands, along with a cash exposure. The fund targets KiwiSaver investors who have a longer-term investment horizon and are comfortable with investing. The fund’s 1-month return of -3.60% is underneath the market index of -1.54%. This could again be due to the Covid restrictions as the fund invests primarily in growth assets. The Growth fund has also had a 1-year return of 16.19%, which is less than the market index of 18.73% but is close to the 16.91% returns since inception.

Returns

*Source JUNO Fund Update

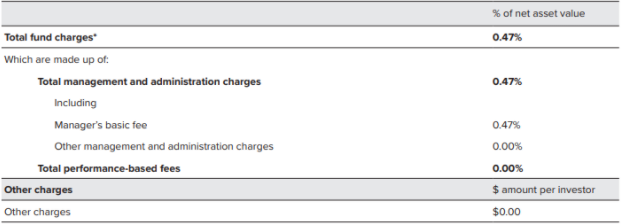

Fees

The total annual fees for investors in the JUNO Growth fund are 0.47% per year, not including the 1 monthly membership fee.

*Source JUNO Fund Update

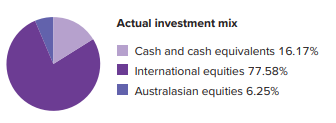

Investment Mix

This shows the type of assets that the fund invests in.

*Source JUNO Fund Update

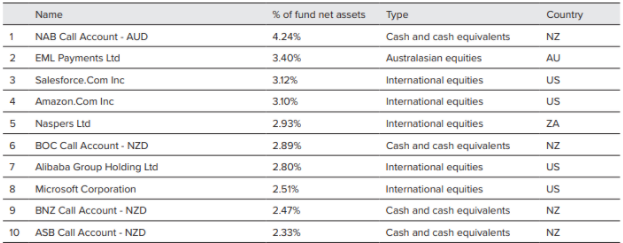

Top ten Investments

The following is JUNO’s top 10 investments in the Growth Fund, which make up 29.79% of the fund.

*Source JUNO Fund Update

Although the fund is functioning beneath expectations compared to the market index, the past returns do not indicate future performance.

To see if JUNO has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver HealthCheck.