Using the most recent returns and fund update reports, we will examine Juno’s recent KiwiSaver performance.

Juno is a KiwiSaver provider that offers growing returns over the long term. with low monthly fees and an active investment strategy, Juno aims to maximise your KiwiSaver returns. Juno is actively managed by experts at Pie Fund. With over 15 years of experience, Pie Funds has successfully created over $400 million in wealth for its clients.

Table of Contents

News about Juno

Performance of Juno KiwiSaver Funds

Juno Conservative Fund

Juno Balanced Fund

Juno Growth Fund

News about Juno

In recent news (March, 2023), Pie Funds achieved a 5-star Morningstar Rating for Australasian Dividend Growth Fund, outperforming 28 regional funds for 3 consecutive years.

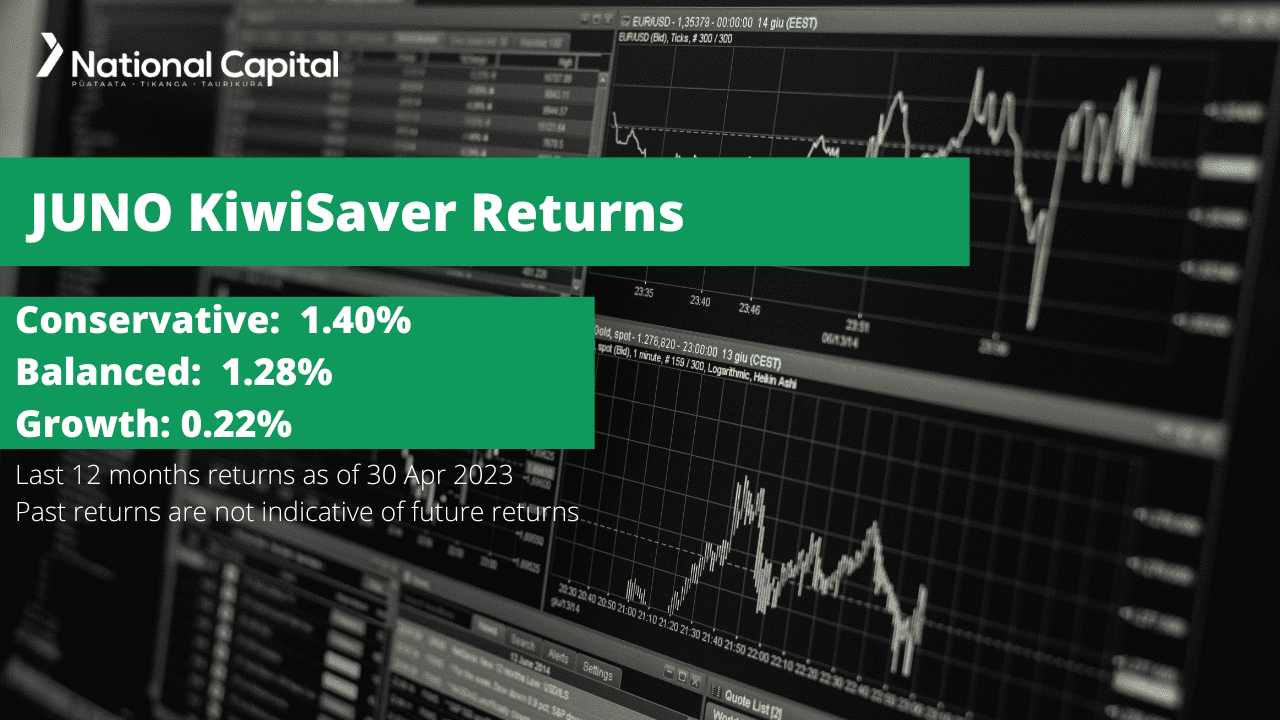

Performance of JUNO KiwiSaver Funds

|

3 Month |

1 Year |

3 Year |

Since Inception |

|

|

Conservative |

1.34% |

1.40% |

1.32% |

1.81% |

|

Balanced |

2.74% |

1.28% |

2.74% |

3.53% |

|

Growth |

3.50% |

0.22% |

4.27% |

6.05% |

Sourced From Juno Fund Performance Report

These returns are to 30 April 2023 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from Juno Quarterly Fund ended on 31 March 2023

JUNO Conservative Fund

Juno Conservative Fund aims to achieve modest capital growth over a period of three to five years. It invests mainly in fixed interest and cash, with an allocation to equities, either directly or through the Juno Balanced Fund. Juno Conservative Fund has a 3-month return of 1.34%, and a 1-year return of 1.40%, which is lower than the since inception return of 1.81%.

The following is sourced from Juno Conservative Fund Update

Returns

Fees

The total annual fees for investors in the Juno Conservative Fund are 0.69%.

Investment mix

The investment mix shows the types of assets that the fund invests in.

Top ten investments

This table shows Juno´s top 10 investments in the Conservative KiwiSaver Fund, which make up 47.10% of the fund.

JUNO Balanced Fund

Juno Balanced Fund aims to achieve stable capital growth over a period of five years to 10 years. It invests mainly in equities, either directly or through the Juno Growth Fund, while also maintaining a reasonable allocation towards fixed interest. Juno Balanced Fund has a 3-month return of 2.74%, and a 1-year return of 1.28%, which is lower than the since inception return of 3.53%.

The following is sourced from Juno Balanced Fund Update

Returns

Fees

The total annual fees for investors in the Juno Balanced Fund are 0.69%.

Investment mix

The investment mix shows the type of assets that the fund invests in.

Top ten investments

This table shows Juno´s top 10 investments in the Balanced KiwiSaver Fund, which make up 24.45% of the fund.

JUNO Growth Fund

Juno Growth Fund aims to maximise capital growth over a period of 10 years or more. It invests mainly in international and Australasian equities, with a specific focus on globally-known brands, along with a cash and fixed interest exposure. Juno Growth Fund has a 3-month return of 3.50%, and a 1-year return of 0.22%, which is lower than the since inception return of 6.05%.

The following is sourced from Juno Growth Fund Update

Returns

Fees

The total annual fees for investors in the Juno Growth Fund are 0.67%.

Investment mix

The investment mix shows the types of assets that the fund invests in.

Top ten investments

This table shows Juno´s top 10 investments in the Growth KiwiSaver Fund, which make up 23.80% of the fund.

Data for Juno KiwiSaver funds have been sourced from Juno KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if Juno has the appropriate fund that aligns with your value, retirement goals, and situation, complete National Capital’s KiwiSaver HealthCheck.