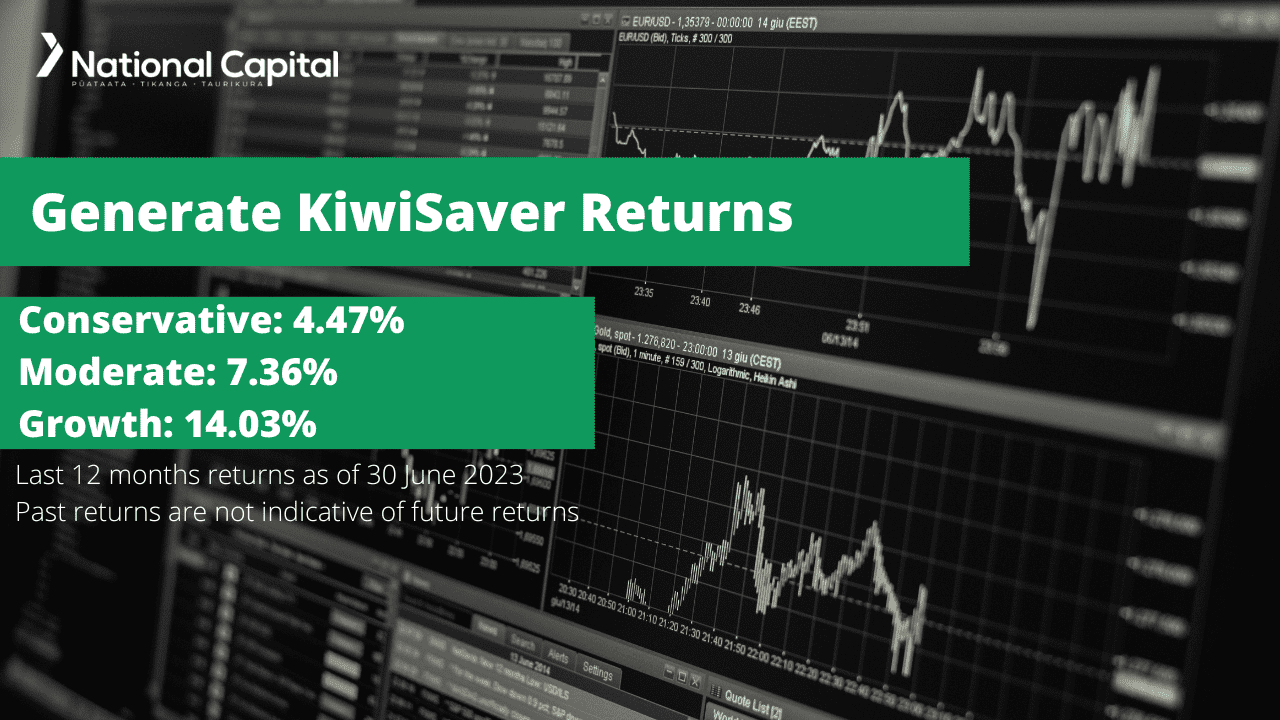

Using the most recent returns and fund update reports from 31st August 2023, we will examine Generate’s recent KiwiSaver Performance.

Generate KiwiSaver Scheme, established in 2012, offers six different KiwiSaver Funds with varying degrees of risk and potential return. Generates is an award-winning New Zealand-owned KiwiSaver and wealth manager. Generate’s investment decisions are commonly made by an investment committee that is made up of experienced investment professionals located around the world. Based on the latest annual report, Generate KiwiSaver scheme currently has more than 113,000 members and $3.2 billion under asset management.

Table of Contents

Performance of Generate KiwiSaver Funds

Generate Moderate Fund (Formerly Conservative)

News about Generate

Generate KiwiSaver scheme and Managed Fund suits, have been officially recognised as “Mindful Fund”. This recognition signifies that Generate’s investment funds meet the criteria set by Mindful Money for responsible investing, which includes avoiding harmful activities, practising stewardship, and supporting sustainable companies. It is a testament to Generate’s commitment to ethical investment and its dedication to incorporating environmental, social, and governance (ESG) factors into its decision-making process.

Performance of Generate KiwiSaver Funds

| Funds |

1 Year |

5 Year |

Since Inception |

|

Defensive |

2.29% |

N/A |

1.65% |

|

Conservative |

3.29% |

N/A |

2.69% |

|

Moderate |

5.37% |

4.00% |

5.05% |

|

Growth |

11.13% |

6.24% |

8.29% |

|

Focused Growth |

14.78% |

6.44% |

8.97% |

Sourced from Generate fund performance report.

* These returns are to 31st August 2023 and are before tax and after fund management fees. Past performance does not necessarily indicate future performance and return periods may differ.

Note: The following information is sourced from Generate Quarterly Fund updates ended on 30 June 2023.

Generate Defensive Fund

The objective of the Defensive Fund is to provide stable investment returns over the short term. This Fund is useful if one plans to withdraw their KiwiSaver funds within the next 12 months and needs certainty of the amount they intend to withdraw, like for a deposit on a first home.

*The following is Sourced from Generate Defensive Fund Update.

Returns

Fees

The total annual fees for investors in the Generate Defensive Fund are 0.79% per year.

Investment Mix

The investment mix shows the type of assets that the fund invests in.

Top ten investments

This table shows Generate’s top 10 investments in the Defensive KiwiSaver Fund, which comprise 36.33% of the fund.

Generate Conservative Fund

The objective of the Conservative Fund is to provide a conservative investment return through investment in a portfolio of actively managed cash, fixed interest, property and infrastructure assets, Australasian equities and international equities.

*The following is Sourced from Generate Conservative Fund Update.

Returns

Fees

The total annual fees for investors in the Generate Defensive Fund are 1.09% per year.

Investment Mix

The investment mix shows the type of assets that the fund invests in.

Top ten investments

This table shows Generate’s top 10 investments in the Defensive KiwiSaver Fund, which comprise 25.38% of the fund.

Generate Moderate Fund (Formerly Conservative)

The objective of the Moderate Fund is to provide a conservative investment return through investment in a portfolio of actively managed cash, fixed interest, property (including aged care) and infrastructure assets, Australasian equities, and international equities. The fund has a low to medium level of volatility.

*The following is Sourced from Generate Moderate Fund Update.

Returns

Fees

The total annual fees for investors in the Generate Moderate Fund are 1.14% per year.

Investment mix

The investment mix shows the type of assets that the fund invests in.

Top ten investments

This table shows Generate’s top 10 investments in the Moderate KiwiSaver Fund, which comprises 24.65% of the fund.

Generate Growth Fund

The objective of the Growth Fund is to provide a growth investment return over the long term through investment in a portfolio of actively managed cash, fixed interest, property (including aged care) and infrastructure assets, Australasian equities, and international equities. The fund has a medium to high level of volatility. The fund has one year return of -12.85% and a five-year return of 6.05%.

*The following is Sourced from Generate Growth Fund Update.

Returns

Fees

The total annual fees for investors in the Generate Growth Fund are 1.29% per year.

Investment mix

The investment mix shows the type of assets that the fund invests in.

Top ten investments

This table shows Generate’s top 10 investments in the Growth KiwiSaver Fund, which comprise 33.14% of the fund.

Generate Focused Growth Fund

The objective of the Focused Growth Fund is to provide a growth investment return over the long term through investment in a portfolio of actively managed cash, fixed interest, property (including aged care) and infrastructure assets, Australasian equities, and international equities. The fund has a medium to high level of volatility.

*The following is Sourced from Generate Focused Growth Fund Update.

Returns

Fees

The total annual fees for investors in the Generate Focused Growth Fund are 1.33% per year.

Investment mix

The investment mix shows the type of assets that the fund invests in.

Top ten investments

This table shows Generate’s top 10 investments in the Focused Growth KiwiSaver Fund, which comprise 35.66% of the fund.

Data for Generate KiwiSaver funds have been sourced from Generate KiwiSaver Funds. Past performance does not necessarily indicate future performance and return periods may differ.

To see if Generate has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.