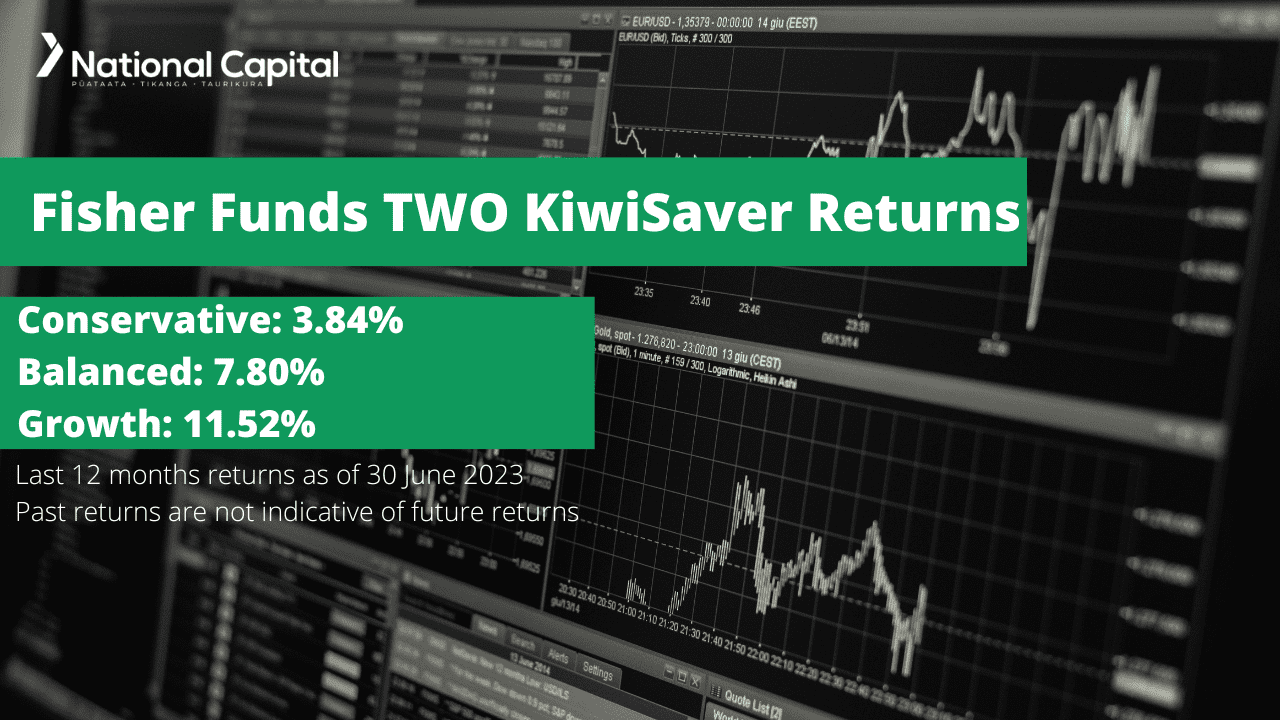

Using the most recent returns and fund update reports from September 2023, we will examine Fisher Funds TWO’s recent KiwiSaver Performance.

Fisher Funds TWO is issued by Fisher Funds, which is the fourth largest KiwiSaver provider in New Zealand. Fisher Funds TWO currently have over 230,000 KiwiSaver members. They offer five different KiwiSaver Funds, ranging from a lower-risk preservation fund to a higher-risk equity fund.

Table of Contents

Performance of Fisher Funds TWO KiwiSaver Funds

Fisher Funds TWO Preservation Fund

Fisher Funds TWO Conservative Fund

Fisher Funds TWO Balanced Fund

News about Fisher Funds TWO

Fisher Funds TWO was named as the Canstar Outstanding Value KiwiSaver Schemes again in 2023. This is the second year Fisher Funds TWO KiwiSaver Scheme has received this award. The award is given to schemes that demonstrate outstanding value across all three Conservative, Balanced and Growth profiles.

Performance of Fisher Funds TWO KiwiSaver Funds

| Funds |

1 Year |

5 Year |

Since Inception |

|

Preservation |

4.2% |

1.6% |

3.0% |

|

Conservative |

2.7% |

2.4% |

4.4% |

|

Balanced |

5.2% |

4.7% |

6.9% |

|

Growth |

8.2% |

6.2% |

5.9% |

|

Equity |

10.1% |

8.1% |

5.9% |

Sourced from Fisher Funds TWO fund performance report

*These returns are to 31 August 2023 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from Fisher Funds TWO Quarterly Fund updates published on 30 June 2023.

Fisher Funds TWO Preservation Fund

The Preservation fund aims to provide stable returns and reduce the potential of capital loss over the short to medium term by investing in New Zealand cash and New Zealand short-term fixed interest assets.

*The following is Sourced from Fisher Funds TWO Preservation Fund Update

Returns

Fees

The total annual fees for investors in the Fisher Funds Preservation Fund are 0.61% per year.

Investment mix

Top ten investments

This table shows Fisher Funds’ top 10 investments in the Preservation KiwiSaver Fund, which comprise 45.47% of the fund.

Fisher Funds TWO Conservative Fund

The Conservative Fund aims to provide stable returns over the long term with income assets as its main investment allocation and modest allocation to growth assets.

*The following is Sourced from Fisher Funds TWO Conservative Fund Update

Returns

Fees

The total annual fees for investors in the Fisher Funds TWO Conservative Fund are 0.89% per year

Investment mix

Top ten investments

This table shows Fisher Funds TWO’s top 10 investments in the Conservative KiwiSaver Fund, which make up 13.71% of the fund.

Fisher Funds TWO Balanced Fund

The Balanced Fund aims to provide a balance between the stability of returns and growing the investment over the long term by investing in both income and growth assets.

*The following is Sourced from Fisher Funds TWO Balanced Fund Update

Returns

Fees

The total annual fees for investors in the Fisher Funds TWO Balanced Fund are 0.94% per year.

Investment mix

Top ten investments

This table shows Fisher Funds TWO’s top 10 investments in the Balanced KiwiSaver Fund, which make up 15.74% of the fund.

Fisher Funds TWO Growth Fund

The Growth Fund aims to grow investment over the long term by investing mainly in growth stocks.

*The following is Sourced from Fisher Funds TWO Growth Fund Update

Returns

Fees

The total annual fees for investors in the Fisher Funds TWO Growth Fund are 1.04% per year.

Investment mix

Top ten investments

This table shows Fisher Funds TWO’s top 10 investments in the Growth KiwiSaver Fund, which make up 20.92% of the fund.

Fisher Funds TWO Equity Fund

The Equity fund focuses on the growth of your investment over the long term by investing in New Zealand and international shares.

*The following is Sourced from Fisher Funds TWO Equity Fund Update

Returns

Fees

The total annual fees for investors in the Fisher Funds TWO Equity Fund are 1.14% per year.

Investment mix

Top ten investments

This table shows Fisher Funds TWO’s top 10 investments in the Equity KiwiSaver Fund, which make up 26.33% of the fund.

Data for Fisher Funds TWO KiwiSaver funds has been sourced from Fisher Funds TWO KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if Fisher Funds TWO has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver Healthcheck.