Using the most recent returns and fund update reports from April 2022, we will examine ASB’s recent KiwiSaver Performance.

Over the years, ASB has grown to be one of New Zealand’s largest banks, managing over $13.5b in assets under management and serving over 530,000 KiwiSaver members. With this pledge, ASB stated that it will give back to the community, grow, and support the endeavours of New Zealanders.

The inflation outlook, while highly uncertain over the medium term, is worryingly high at present. This month was all about interest rates, with the Reserve Bank of New Zealand hiking the OCR (Interest Rates) twice as much as expected, to 0.50% instead of 0.25% to combat inflation.

Table of Contents

Performance of ASB KiwiSaver Funds

ASB Cash Fund

ASB Conservative Fund

ASB Moderate Fund

ASB Balanced Fund

ASB Growth Fund

ASB Positive Impact Fund

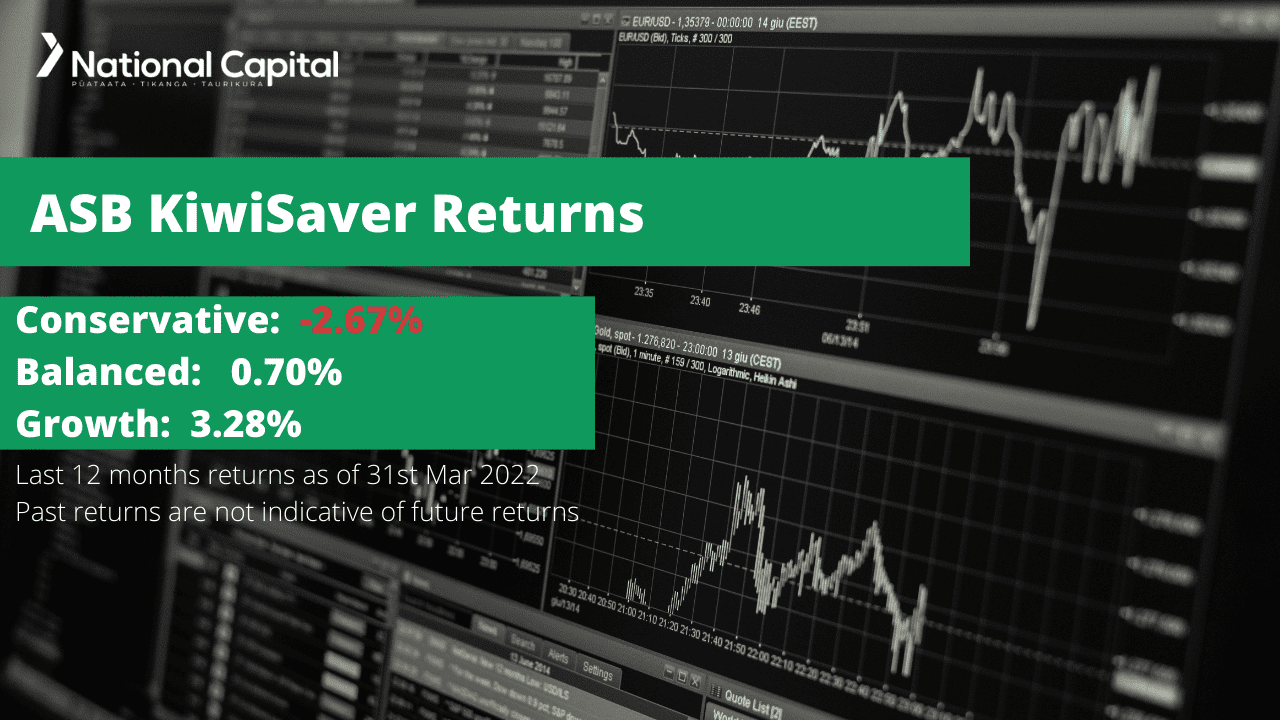

Performance of ASB KiwiSaver Funds

|

3 month |

6 months |

1 year |

5 years |

10 years |

Since Inception |

|

|

Cash |

0.21% |

0.33% |

0.47% |

1.28% |

2.09% |

2.76% |

|

Conservative |

-3.79% |

-3.67% |

-2.67% |

-3.26% |

4.58% |

4.63% |

|

Moderate |

-4.41% |

-3.35% |

-1.38% |

4.52% |

6.10% |

5.19% |

|

Balanced |

-5.04% |

2.84% |

0.70% |

6.67% |

8.15% |

5.97% |

|

Growth |

-5.32% |

-2.03% |

3.28% |

8.28% |

9.84% |

6.44% |

|

Positive Impact |

-7.55% |

-3.98% |

1.56% |

N/A |

N/A |

8.99% |

Sourced from ASB fund performance report

* These returns are to 31 March 2022 and are before tax and after fund management fees. Past performance is not necessarily an indicator of future performance, and return periods may differ.

Note: The following information is sourced from ASB Quarterly Fund updates published on 31 December 2021.

ASB Cash Fund

The ASB Cash Fund aims to provide exposure to a portfolio of investment-grade short term deposits, and fixed interest investments with New Zealand registered banks by investing in a target investment mix of 100% income assets. The Cash Fund has a 3-month return of 0.21% and a 1-year return of 0.47% lower than the since inception return of 2.76%.

*The following is Sourced from ASB Cash Fund Update

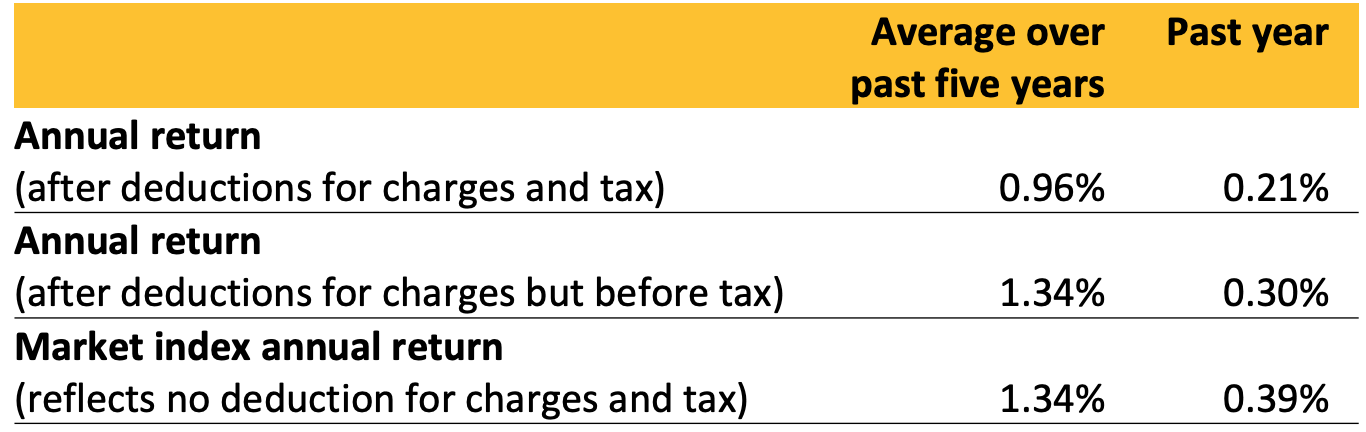

Returns

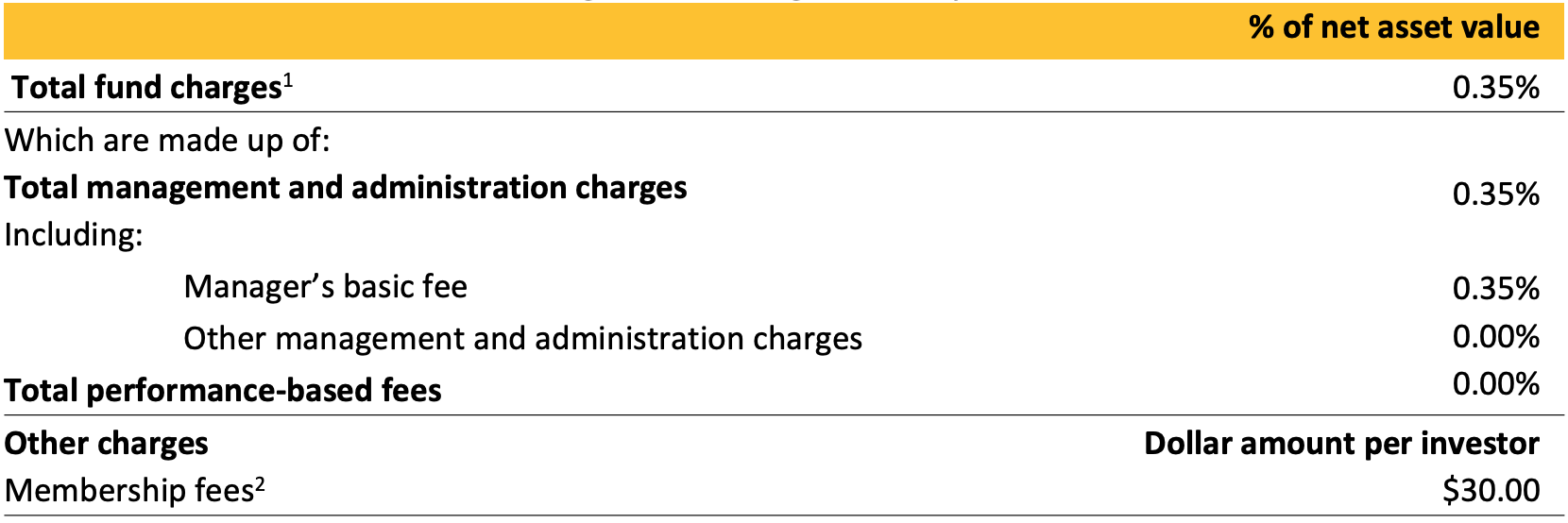

Fees

The total annual fees for investors in the ASB Cash Fund are 0.35% per year.

Investment mix

The investment mix is 100% cash and cash equivalents due to being a cash fund.

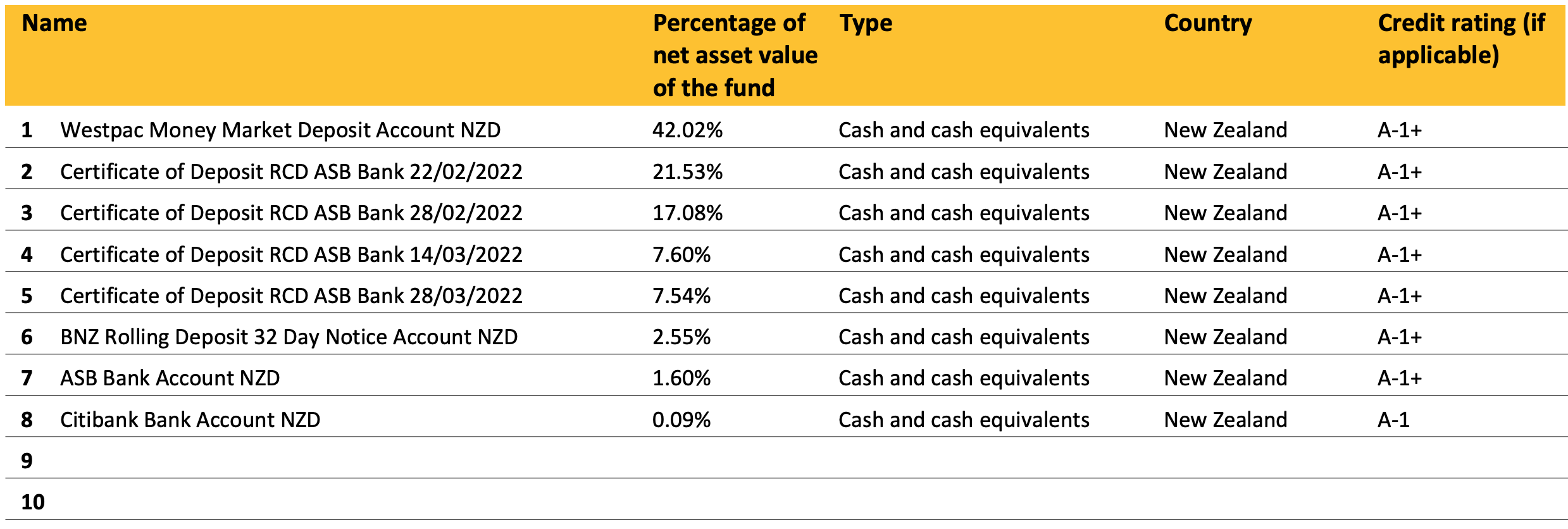

Top ten investments

This table shows ASB’s top 10 investments in the Cash KiwiSaver Fund, which make up 100% of the fund.

ASB Conservative Fund

The ASB Conservative Fund aims to provide modest total returns allowing for modest movements of value up and down by investing in a target investment mix of 80% income assets and 20% growth assets. The Conservative Fund has a 3-month return of -3.79% and a 1-year return of -2.67% lower than the since inception return of 4.63%.

*The following is Sourced from ASB Conservative Fund Update

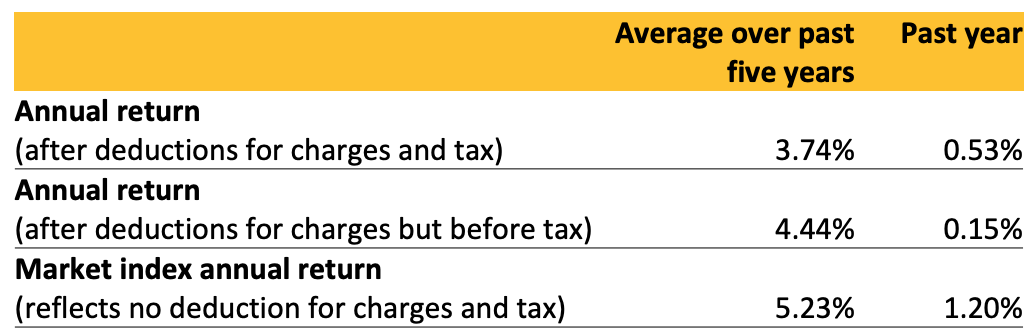

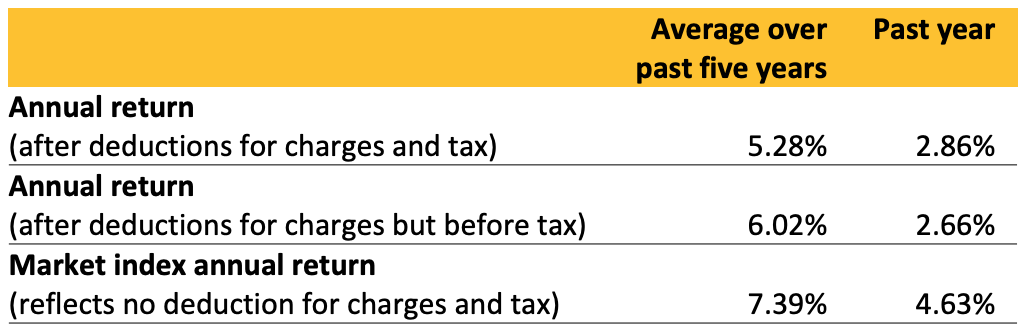

Returns

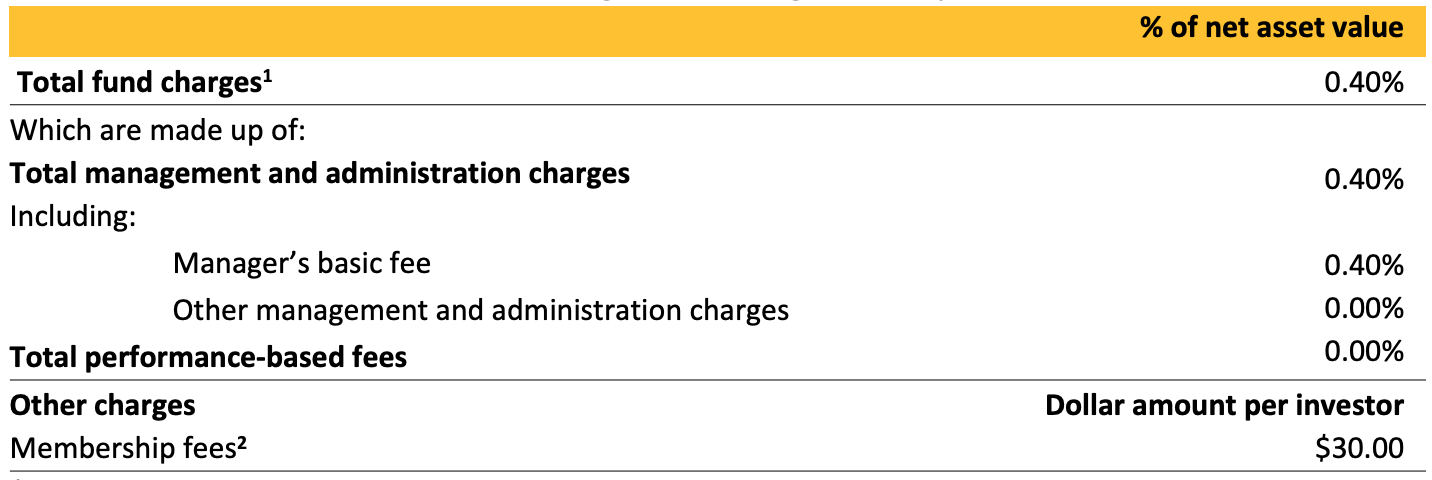

Fees

The total annual fees for investors in the ASB Conservative fund are 0.40% per year.

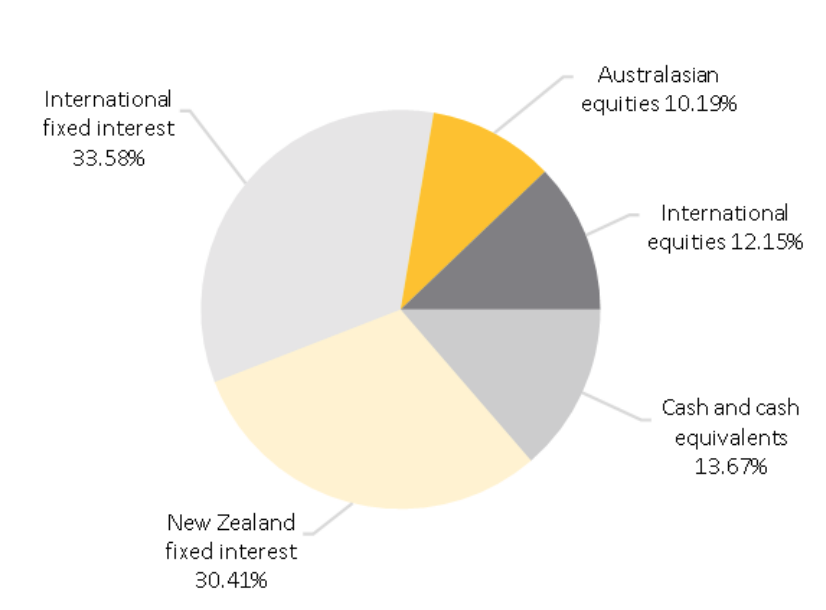

Investment mix

The investment mix shows the type of assets that the fund invests into.

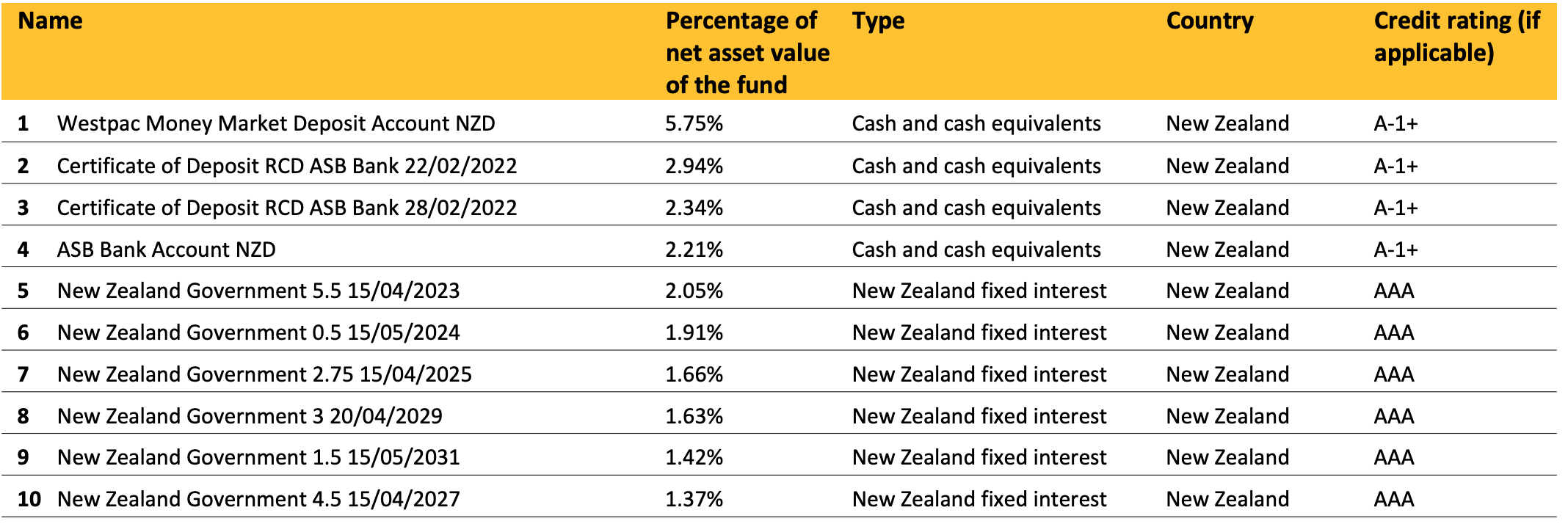

Top ten investments

This table shows ASB’s top 10 investments in the Conservative KiwiSaver Fund, which make up 23.28% of the fund.

ASB Moderate Fund

The ASB Moderate Fund aims to provide moderate total returns allowing for moderate movements of value up and down by investing in a target investment mix of 60% income assets and 40% growth assets. The Moderate Fund has a 3-month return of -4.41% and a 1-year return of -1.38% lower than the since inception return of 5.19%.

*The following is Sourced from ASB Moderate Fund Update

Returns

Fees

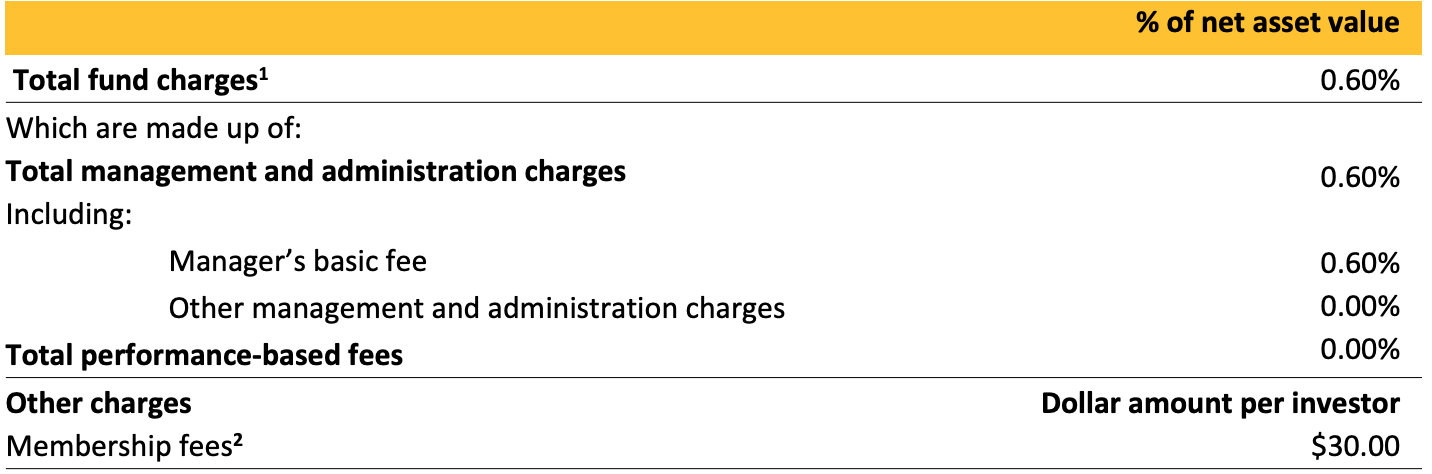

The total annual fees for investors in the ASB Moderate fund are 0.60% per year.

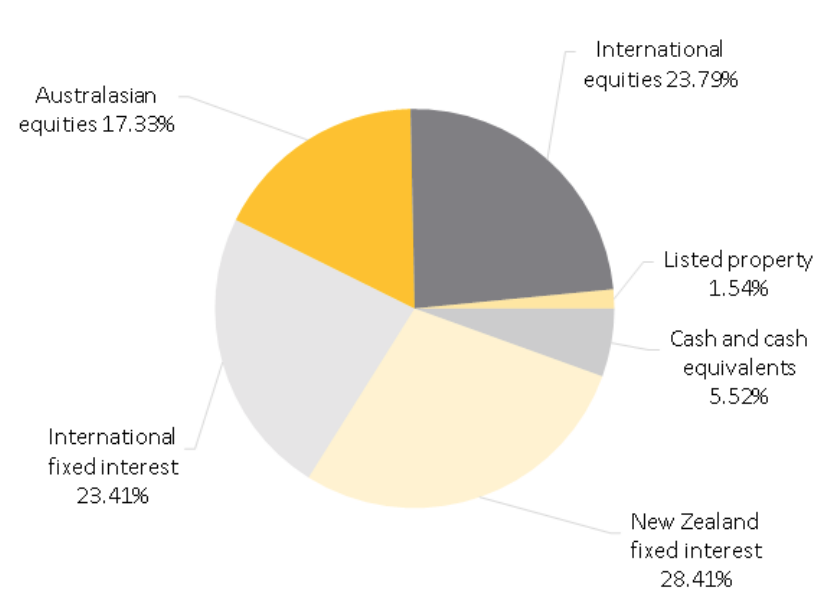

Investment mix

The investment mix shows the type of assets that the fund invests into.

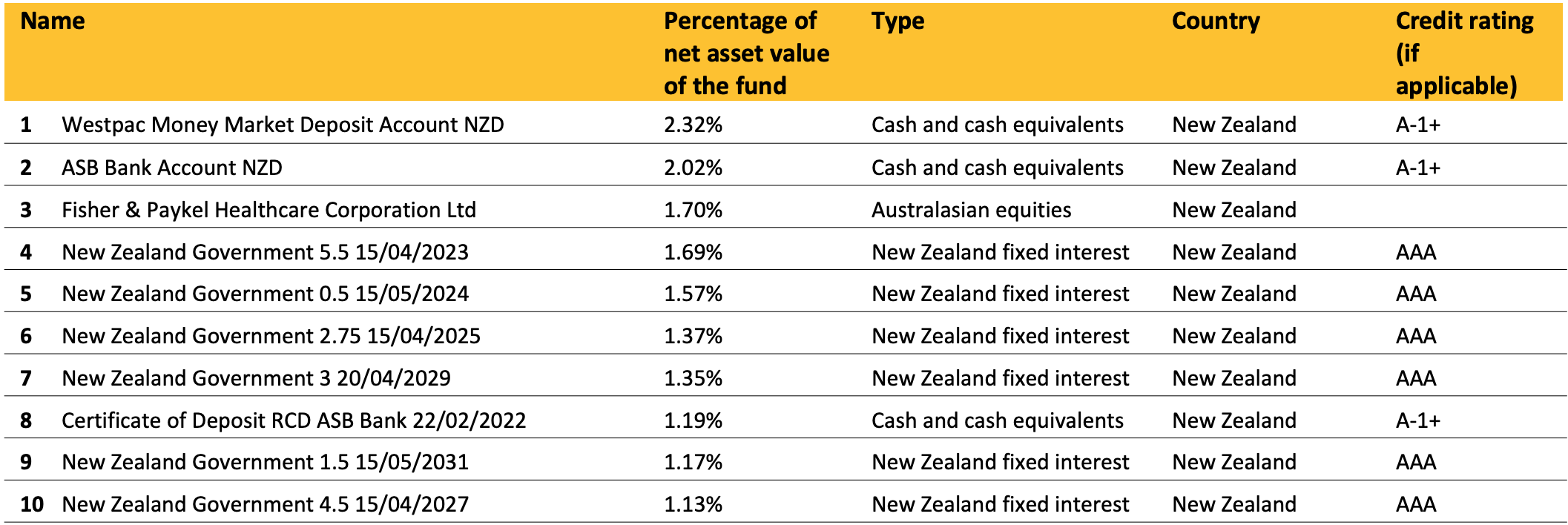

Top ten investments

This table shows ASB’s top 10 investments in the Moderate KiwiSaver Fund, which make up 15.51% of the fund.

ASB Balanced Fund

The ASB Balanced Fund aims to provide moderate to high total returns allowing for moderate to high movements of value up and down by investing in a target investment mix of 40% income assets and 60% growth assets. The Balanced Fund has a 3-month return of -5.04% and a 1-year return of 0.70% lower than the since inception return of 5.97%.

*The following is Sourced from ASB Balanced Fund Update

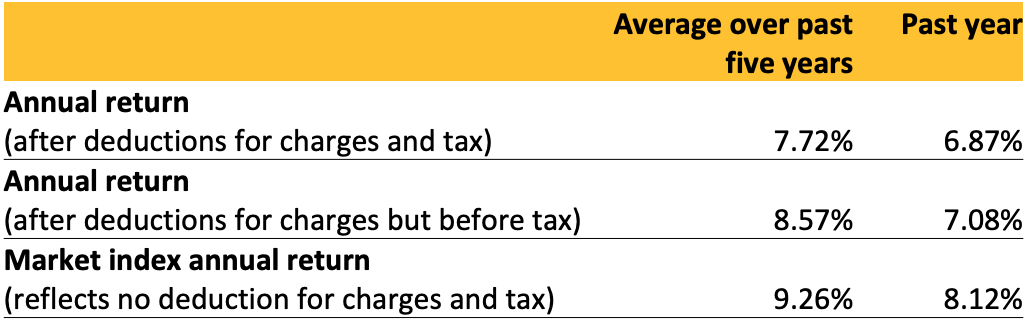

Returns

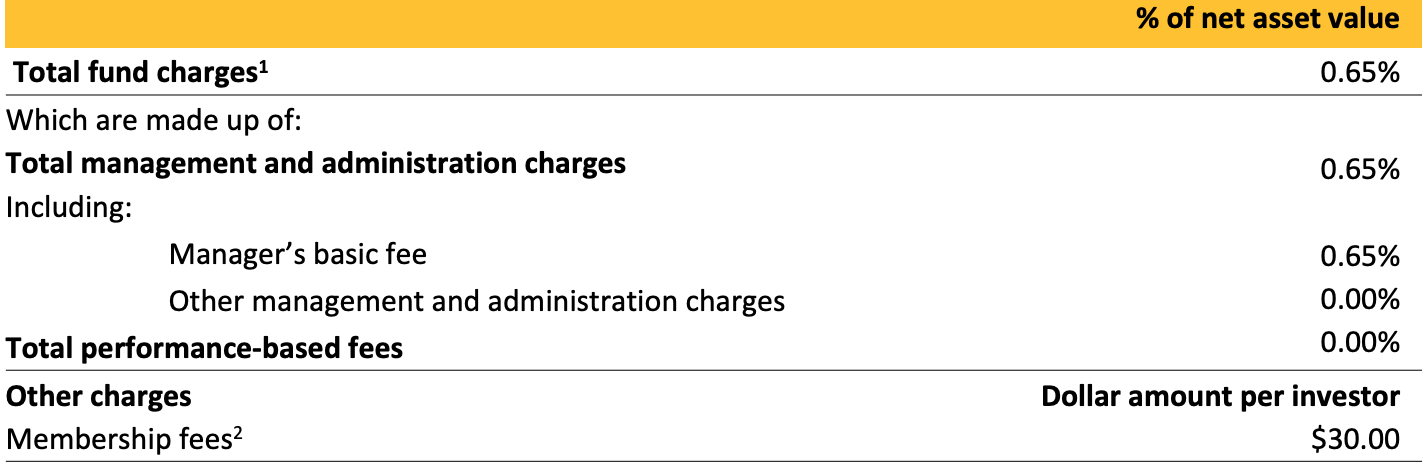

Fees

The total annual fees for investors in the ASB Balanced Fund are 0.65% per year.

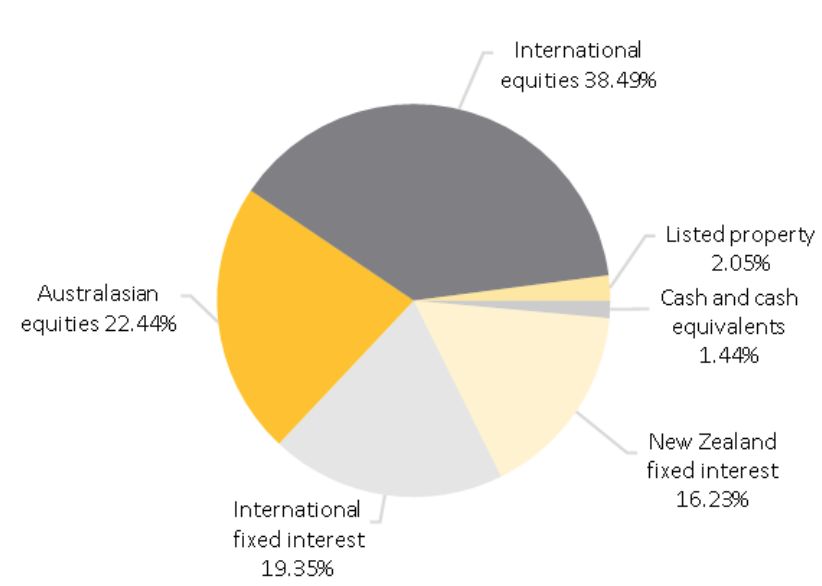

Investment mix

The investment mix shows the type of assets that the fund invests into.

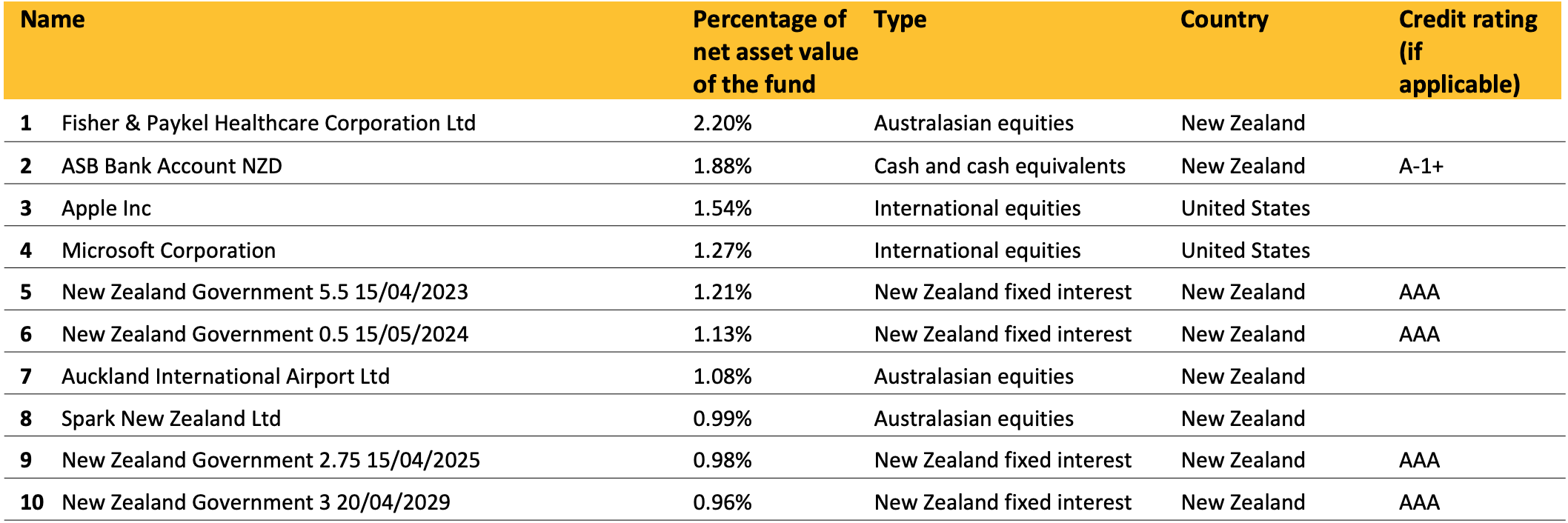

Top ten investments

This table shows ASB’s top 10 investments in the Balanced KiwiSaver Fund, which make up 13.24% of the fund.

ASB Growth Fund

The ASB Growth Fund aims to provide high total returns allowing for large movements of value up and down by investing in a target investment mix of 20% income assets and 80% growth assets. The Growth Fund has a 3-month return of -5.32% and a 1-year return of 3.28% lower than the since inception return of 6.44%.

*The following is Sourced from ASB Growth Fund Update

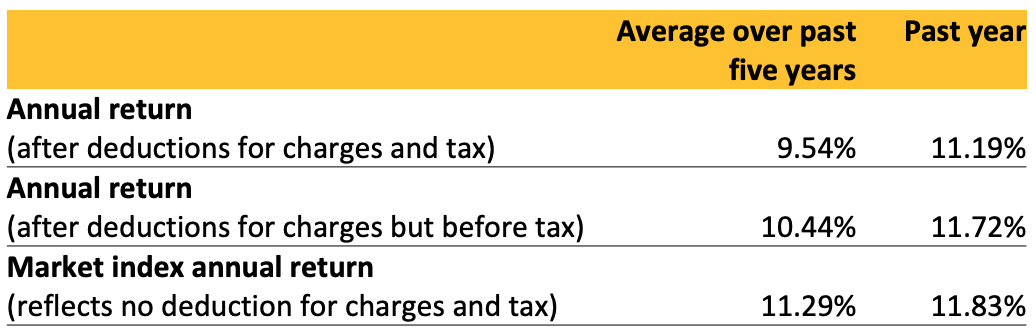

Returns

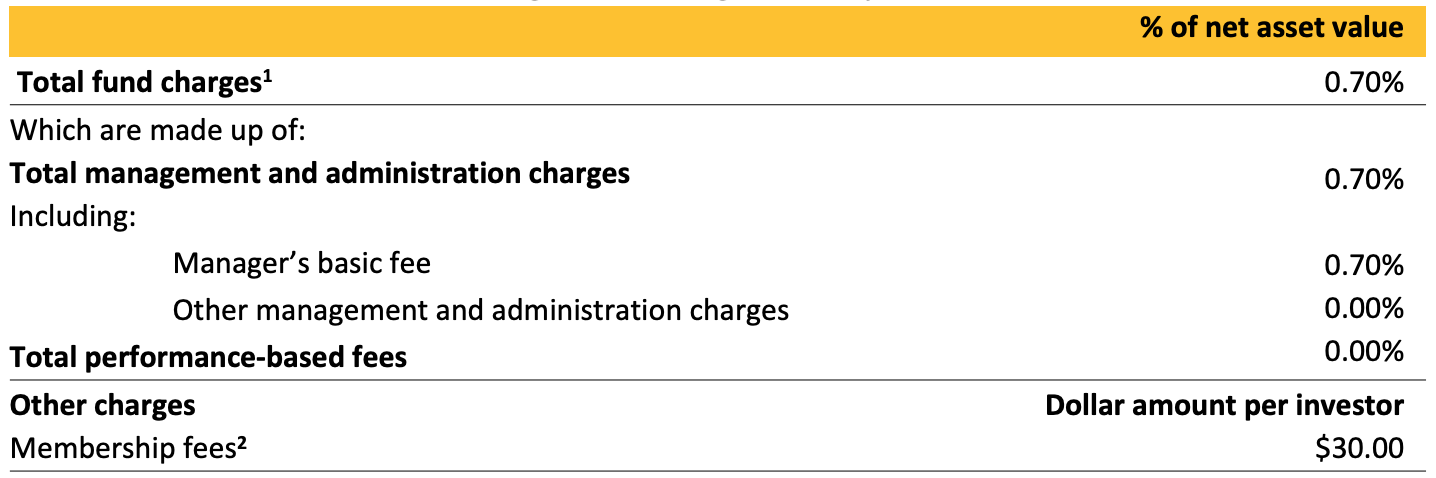

Fees

The total annual fees for investors in the ASB Growth Fund are 0.70% per year.

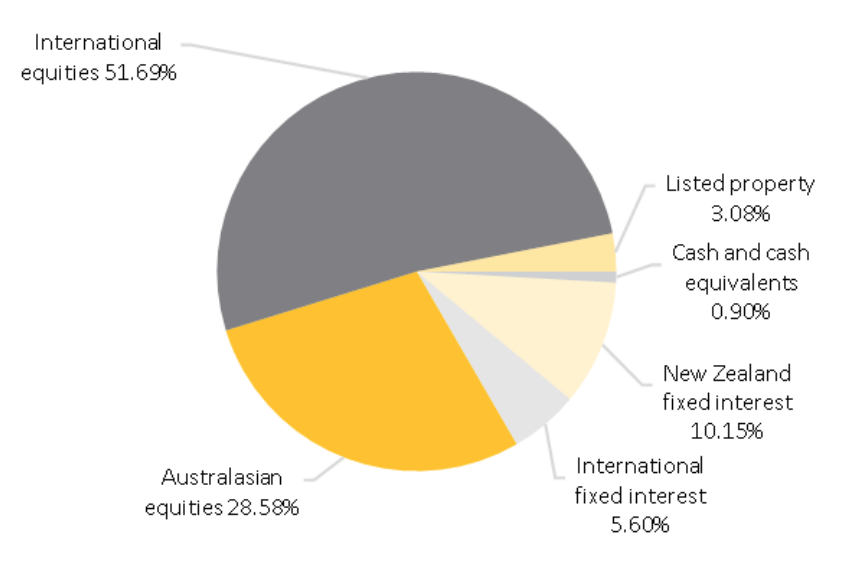

Investment mix

The investment mix shows the type of assets that the fund invests into.

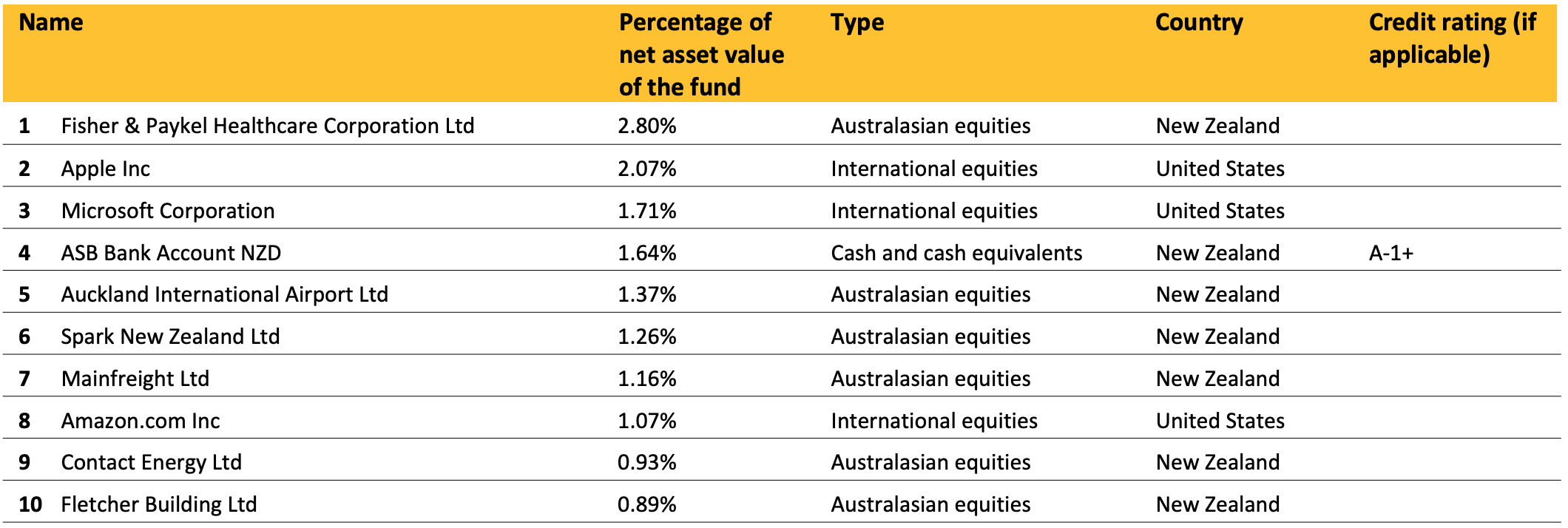

Top ten investments

This table shows ASB’s top 10 investments in the Growth KiwiSaver Fund, which make up 14.90% of the fund.

ASB Positive Impact Fund

The ASB Positive Impact Fund aims to provide moderate to high returns allowing for large movements of value up and down, from exposure to a portfolio of investments with a preference for those that make a positive impact on society or the environment. In order to achieve this, the target investment mix is 40% income assets and 60% growth assets. The Positive Impact Fund has a 3-month return of –7.55% and a 1-year return of 1.56% lower than the since inception return of 5.77%.

*The following is Sourced from ASB Positive Impact Fund Update

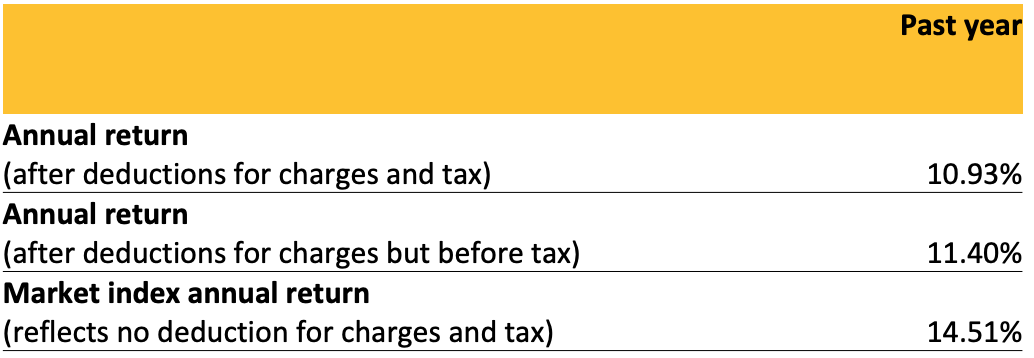

Returns

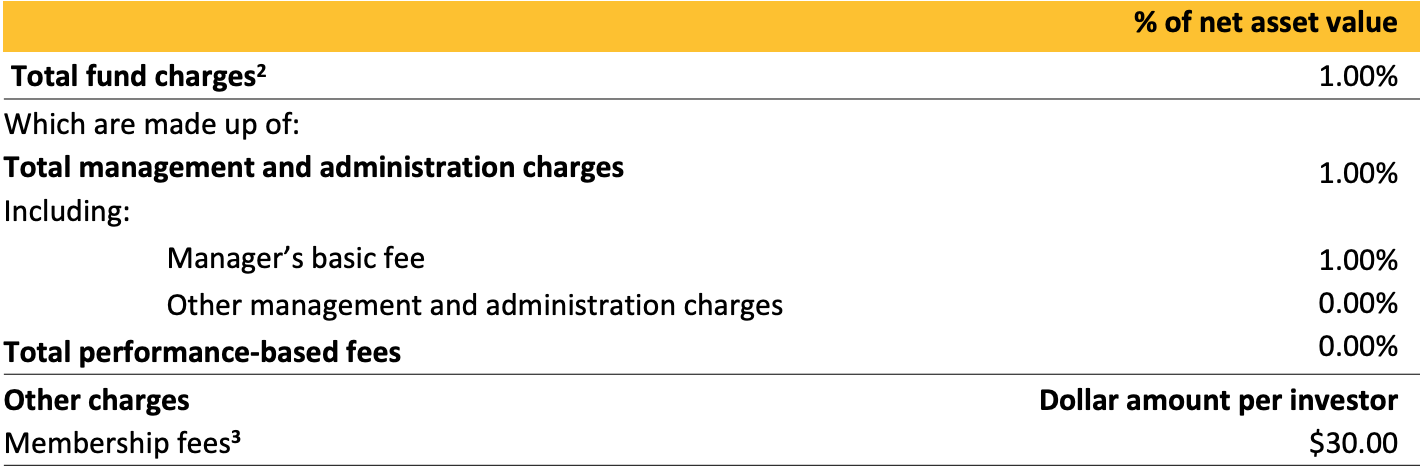

Fees

The total annual fees for investors in the ASB Positive Impact Fund are 1% per year.

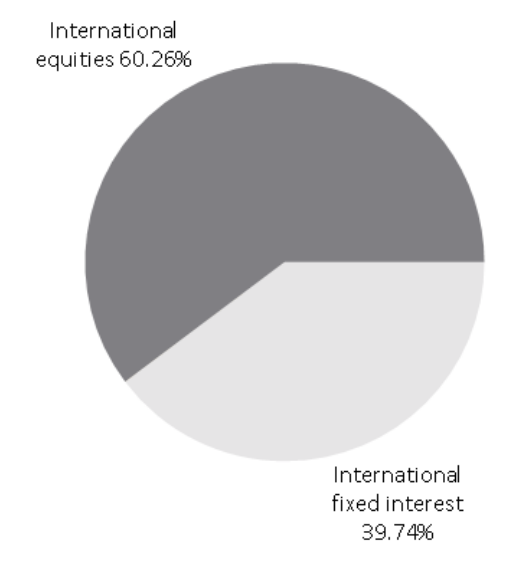

Investment mix

The investment mix shows the type of assets that the fund invests into.

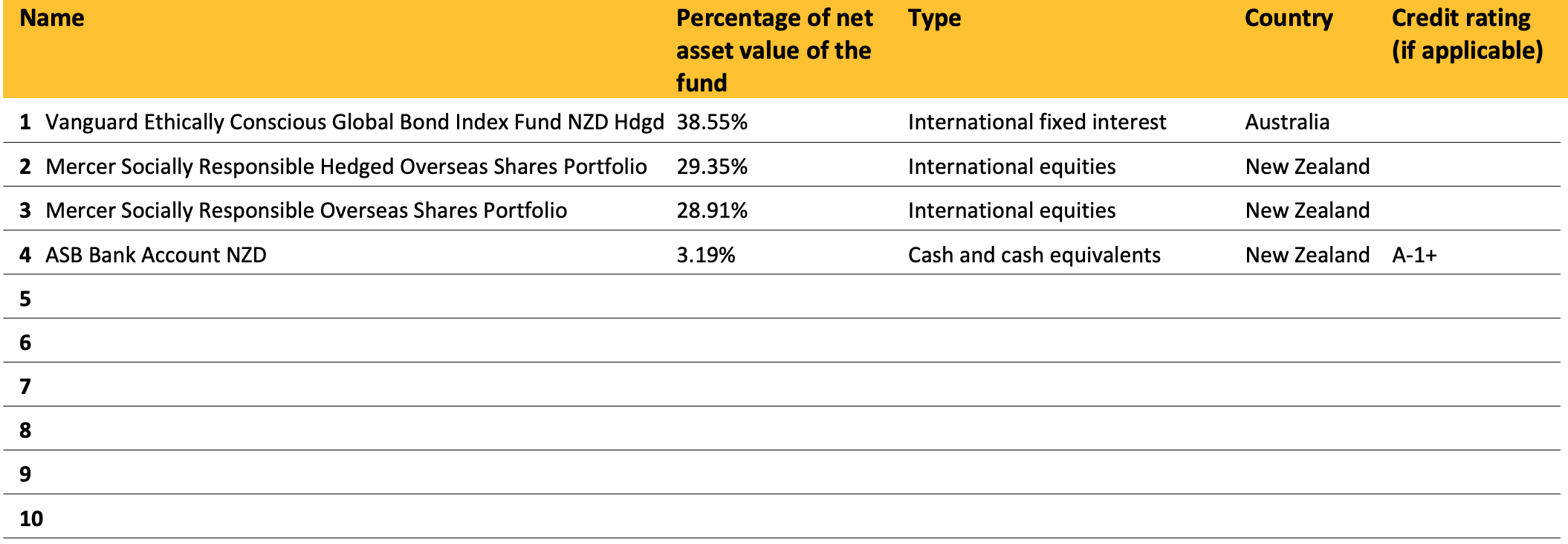

Top ten investments

This table shows ASB’s top 10 investments in the Positive Impact KiwiSaver Fund, which make up 100% of the fund.

Data for ASB KiwiSaver funds have been sourced from ASB KiwiSaver Funds. Past performance is not necessarily an indicator of future performance, and return periods may differ.

To see if ASB has the appropriate fund that aligns with your values, retirement goals and situation, complete National Capital’s KiwiSaver HealthCheck.